Swiss Franc Safe Haven Becoming Dangerous?

Currencies / Forex Trading Aug 10, 2011 - 01:51 AM GMTBy: Willem_Weytjens

You have probably read it many times the last couple of days: People are rushing into safe havens such as Gold, the Swiss Franc and the Japanese Yen. When the mass is doing something, we pay attention. We get cautious. We know that if you follow the mass, you will burn your hands. Therefore, we analyzed those so-called safe havens in this article.

You have probably read it many times the last couple of days: People are rushing into safe havens such as Gold, the Swiss Franc and the Japanese Yen. When the mass is doing something, we pay attention. We get cautious. We know that if you follow the mass, you will burn your hands. Therefore, we analyzed those so-called safe havens in this article.

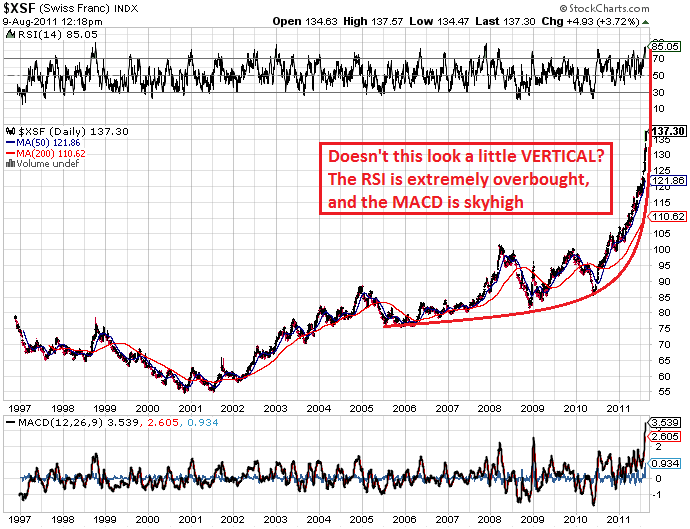

Below you will find a chart of the Swiss Franc index. We can see that it is going nearly vertically the last couple of days.

The RSI is extremely oversold, and the MACD is sky high. This is going to end very, very badly.

If this parabola bursts, expect similar moves to silver in the beginning of may, and to any bubble when they burst.

Chart courtesy stockcharts.com

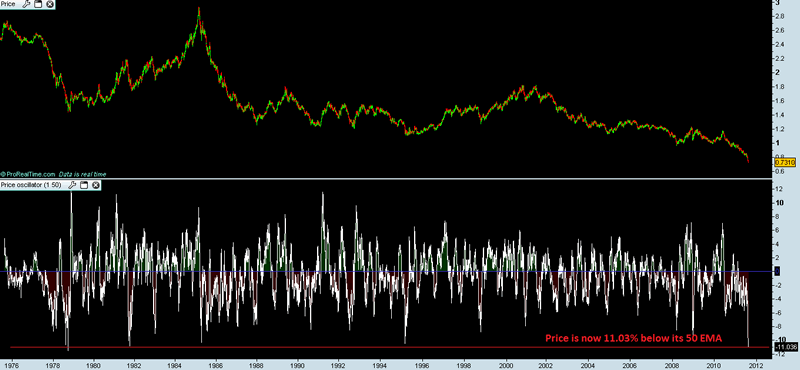

The following chart shows the USD/CHF since 1975.

We can see that price is now 11.03% below the 50 days Exponential Moving Average, as the Price Oscilator indicator shows us.

Only in September 1978, it was a bit lower. That was the only time. You know what happened afterwards? Price rose from 1.45 to over 2.90 over the next 7 years.

Chart created with Prorealtime Charting Software

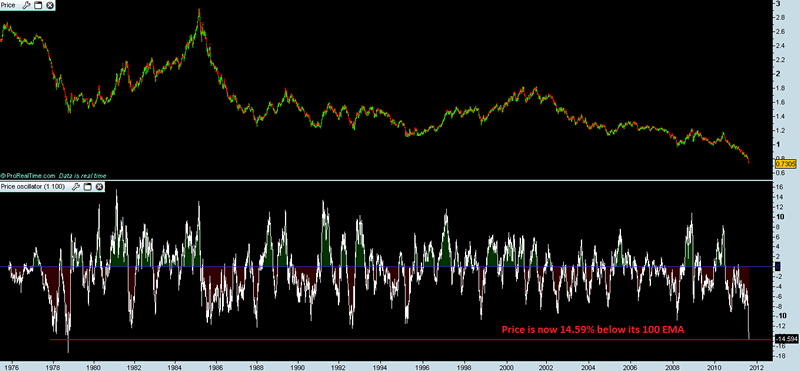

The following chart also shows the USD/CHF exchange rate, but now with the PPO(1,100), which shows us that price is now 14.59% below its 100 days Exponential Moving Average. Again, the only time this happened, was in September 1978.

Chart created with Prorealtime Charting Software

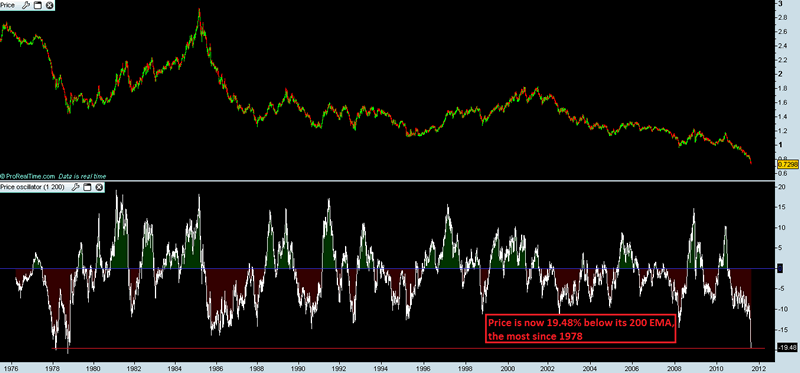

The following chart also shows the USD/CHF exchange rate, but now with the PPO(1,200), which shows us that price is now 19.48% below its 200 days Exponential Moving Average. This happened only twice before (in February 1978 and in September 1978).

Chart created with Prorealtime Charting Software

The Swiss Franc is EXTREMELY overbought, based on the charts above. This so-called safe haven is thus becoming a “Dangerous safe haven” in my opinion.

We could make similar charts for the Japanese Yen.

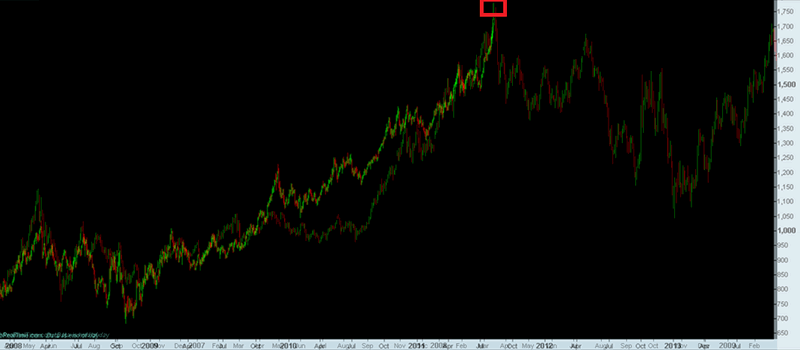

Last but not least, please have a look at the following chart, which compares the price action of gold from early 2008 until today with the price action of gold from early 2006 until early 2008. Do you see the similarities?

Chart created with Prorealtime Charting Software

If the Swiss Franc Bubble bursts, keep an eye on gold…

For more analyses and updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.