Can Revulsion with the Federal Reserve Note be Sustained over the Weeks and Months Ahead?

Currencies / US Dollar Aug 12, 2011 - 12:12 PM GMTBy: Aftab_Singh

We seem to have reached an intermediate-term extreme in revulsion for the Federal Reserve note. It seems to us that the status quo of the currency markets is highly dependent on the Federal Reserve accommodating the market’s perception of it. Here, I present the usual Federal Reserve balance sheet charts and briefly outline why we continue to anticipate a short-term rally in the dollar.

We seem to have reached an intermediate-term extreme in revulsion for the Federal Reserve note. It seems to us that the status quo of the currency markets is highly dependent on the Federal Reserve accommodating the market’s perception of it. Here, I present the usual Federal Reserve balance sheet charts and briefly outline why we continue to anticipate a short-term rally in the dollar.

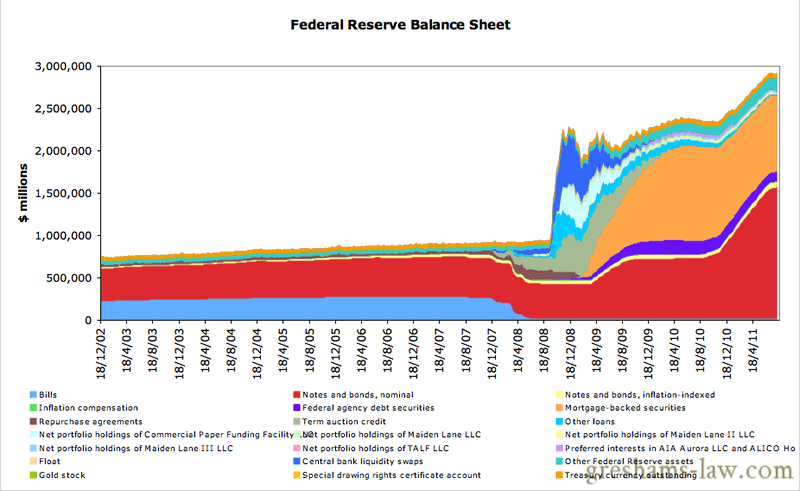

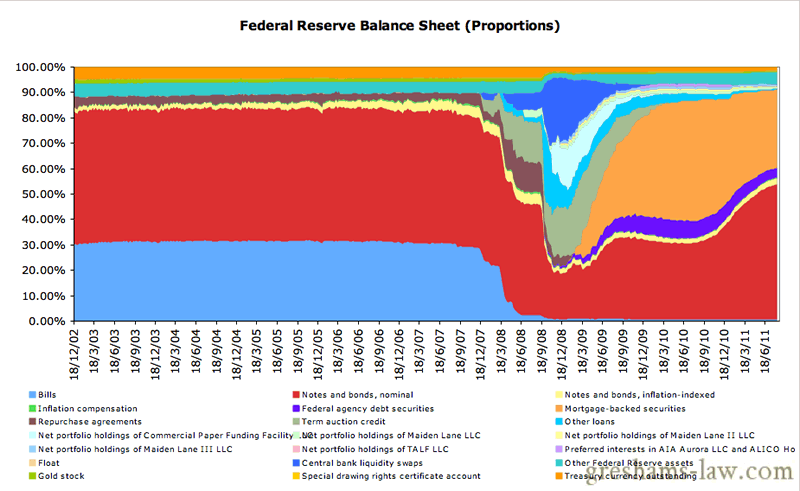

[The first chart shows the Federal Reserve's assets as recorded on the 'factors affecting reserve balances' statistical release. The second chart shows those assets on a proportional basis. That is, the latter chart shows the Fed's various assets as a percentage of its total assets.]

As we suspected, the recent weekly declines in the total size of the Federal Reserve’s balance sheet were to be cherished as a rare and peculiar happening. This week, the Federal Reserve’s balance sheet expanded by around $5 billion. Surprise, surprise, the majority of this expansion was in favor of US Treasury notes & bonds and ‘Other Assets’.

With that said, it should be clear (from the first chart above) that the momentum of the increases in the Fed’s balance sheet size has slowed lately. Moreover, as we have stressed for months on end; the Fed’s assets have improved qualitatively over the past year or so (at least by consensual standards). [The movement away from Mortgage-backed securities and towards US Government bonds & notes should be clear from the second chart above.]

The major problem that the West faces is an enormous legacy of debt. Since debt can be viewed as a ‘short on federal reserve notes‘, we concluded that this improvement (in the quality of the Federal Reserve note) would eventually invoke another drastic ‘short squeeze in money’ (i.e. a drastic decrease in the money prices of things aka an appreciation of federal reserve notes against ‘risk’). This, it would seem, is coming to pass. However, when we look at the currency markets these days, we cannot help but recall the wise words of Humphrey B. Neill in ‘The Art of Contrary Thinking‘:

The problem of “money” is far too complex for us to examine in this report. It is a study in itself and one which still confuses the great minds of the world. It would be presumptuous for me to attempt a learned discussion of monetary economics.

However, I do wish to leave with you the thought that, because monetary problems are not comprehended by the public or by the average businessman, “money management” will continually cross up public opinions concerning economic trends.

Monetary manipulation is a crafty and tricky tool within a system of bootstrap economics. If you make it a point to become posted on some of the more common practices of monetary management you will occasionally be able to discern trends that are opposite to those commonly discussed in public pronouncements and business stories.

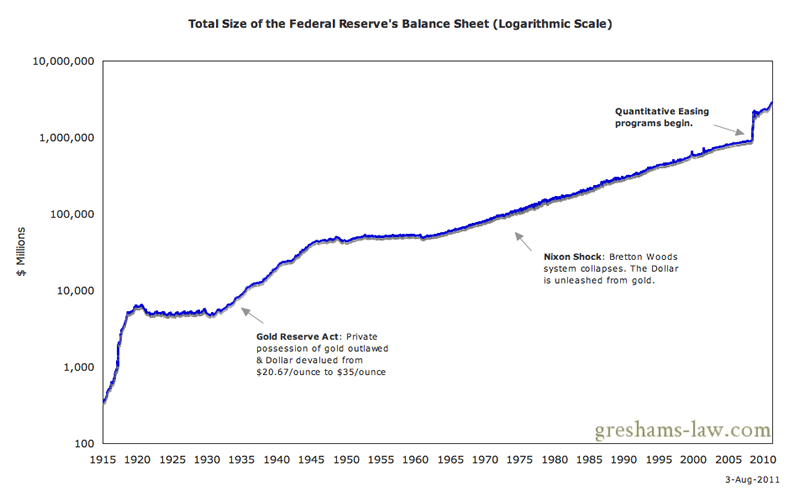

When looking at the dollar these days, we cannot help but suspect that; “money management” is crossing up public opinions concerning economic trends and that the intermediate-term trends in the dollar are in opposition to those commonly discussed in public pronouncements and business stories! The world has got quantitative easing on the brain, and people seem to hold conviction that ‘the authorities will do whatever is required’ because ‘otherwise the world will end’. We have great sympathy with the view that the monetary authorities will be outlandishly profligate in the future, after all, the Fed’s balance sheet has expanded continually over the past 100 years:

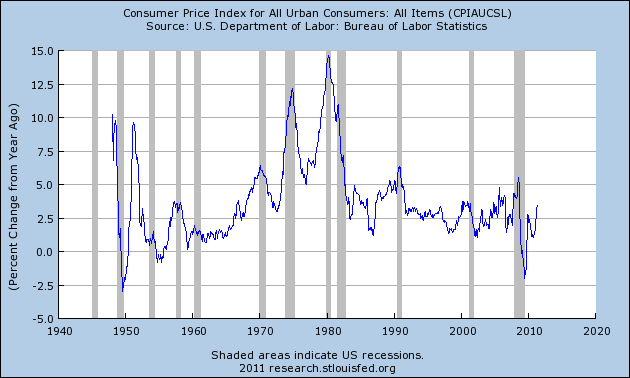

However, remember that the monetary authorities are proponents of statist economic dogmas. With glazed-over eyes, they say; ‘INFLATION = CPI GROWTH. INFLATION ≠ CPI GROWTH DOES NOT COMPUTE!‘. So, despite mild modernizations of their theories (like perhaps the inclusion of US equities into their blackbox models of the economy) we must realize that these guys are part of a long, dogmatic legacy of money producers who make decisions based on changes in the growth of a basket of consumer goods. This is essentially the reason why we pay so much attention to movements in the real money supply in our newsletters. Right now, the textbook is saying; ‘don’t debase’:

Indeed, this view has been corroborated by the recent ‘no QE3′ announcement. And yet, with the spikes in US Treasury securities and gold, the market is discounting enormous and imminent balance sheet expansions by the Fed! In fact, the reverse seems to be occurring (after all, we recently witnessed the rare occurrences of weekly contractions in the size of the Fed’s balance sheet). So, although we believe in the long-term bearish case for the dollar, we find it hard to believe that the market will maintain this level revulsion all the way to the end. That is, we find it difficult to believe that this level of revulsion for the Federal Reserve note can be meaningfully sustained over the weeks and months ahead. Naturally, then, we’ve been anticipating a rally in the dollar.

Just to be clear, we don’t anticipate this by saying; ‘the dollar is good and the US is awesome yada yada yada’ but rather by saying; ‘consensual traders are going to get messed around as usual’. In our minds, anything that throws the current perceptions of monetary policies off course could invoke a swift repositioning by consensual market participants. There is no guarantee that this will come to pass, but we believe that current (consensual) perceptions of the future are too dependent on a specific course of events – so the long dollar trade seems to have a favorable risk/reward profile. That is, the long dollar trade may contain a high degree of contrarian asymmetry.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.