Central Banks Monetary Policy Rocked by Global Financial Markets Turmoil

Interest-Rates / Credit Crisis 2011 Aug 14, 2011 - 06:51 AM GMTBy: CentralBankNews

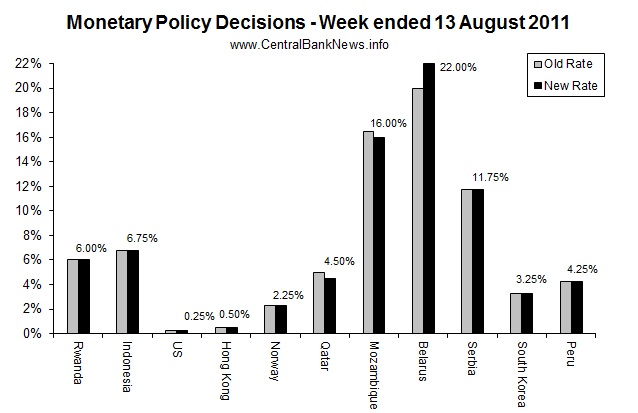

The past week in monetary policy was rocked by the turmoil in global sentiment in the wake of the US sovereign credit rating downgrade, and heightened concerns about contagion in the European sovereign debt crisis. In all, 11 central banks reviewed monetary policy rates, with the following banks adjusting rates: Qatar -50bps to 4.50%, Mozambique -50bps to 16.00%, and Belarus +200bps to 22.00%. Meanwhile the following central banks held interest rates unchanged: Rwanda 6.00%, Indonesia 6.75%, US 0.25%, Hong Kong 0.50%, Norway 2.25%, Serbia 11.75%, South Korea 3.25%, and Peru 4.25%.

The past week in monetary policy was rocked by the turmoil in global sentiment in the wake of the US sovereign credit rating downgrade, and heightened concerns about contagion in the European sovereign debt crisis. In all, 11 central banks reviewed monetary policy rates, with the following banks adjusting rates: Qatar -50bps to 4.50%, Mozambique -50bps to 16.00%, and Belarus +200bps to 22.00%. Meanwhile the following central banks held interest rates unchanged: Rwanda 6.00%, Indonesia 6.75%, US 0.25%, Hong Kong 0.50%, Norway 2.25%, Serbia 11.75%, South Korea 3.25%, and Peru 4.25%.

Aside from interest rate adjustments the week saw further moves from the Swiss National Bank to attempt to cap gains in the Swiss franc, which saw heavy safe-haven buying earlier in the week as panic gripped the market. Similarly the Central Bank of Turkey also announced a set of moves to support the Turkish Lira. Elsewhere, the US Federal Reserve issued a statement following the Standard & Poor's credit rating downgrade, and the European Central Bank issued a statement following disruptive activity in the European bond markets, essentially saying that it would expand its SMP to include Spanish and Italian bonds.

Indeed, the US sovereign rating downgrade and ensuing financial market panic was mentioned in virtually all of the central bank monetary policy statements through the week, causing central banks to act with caution, and take a more reserved stance. While largely a symbolic move, the credit rating downgrade was seen largely as a rebuke of US politicians, rather than capacity to meet debt obligations. Aside from Standard & Poor's, Moody's affirmed it's AAA rating for the US, and Fitch Ratings said it expects to finish its review of US sovereign credit ratings by the end of August.

Even though the downgrade was largely symbolic, the immediate flow-on effects were a widespread, yet short-lived panic; however that panic was largely limited to equities, as US treasuries actually rallied during the week due to investor flight-to-safety. The European sovereign debt crisis developments were perhaps the greater, and more tangible risk area that was highlighted during the week. For now, it appears the ECB has the capacity and the willingness to help prevent any further contagion of the sovereign debt crisis, and should prove instrumental in the transition to the implementation of the EFSF, as countries prepare and implement longer-term fiscal sustainability plans.

Aside from those two key risk areas, central banks were also worried about the usual things such as inflation and economic growth. Some of the key quotes and sound-bites from the central banks that made announcements over the past week are listed below:

US FOMC (held rate at 0 to 0.25%): "The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013."

HKMA (held rate at 0.50%): "I don't think the ratings downgrade should impact the US government bond interest rate. International investors will continue to view US government debt as the safest and the most liquid tool for investment and risk-averse purposes,"... and "growth momentum in the US will be slow in the second half, but the risk of a double dip recession is not very high."

Norges Bank (held rate at 2.25%): "The decision must especially be seen against the background of the recent flare-up in financial market turbulence and clear signs of weaker growth internationally,"... and "An overall assessment of the outlook and the balance of risk suggests that the key policy rate be left unchanged at this meeting,"

Bank of Mozambique (increased rate 50bps to 16.00%): "The deliberations of the board took into consideration the objectives of economic growth, inflation forecasts for short and medium term and the important challenges that persist in some sectors, with significant weight in the growth of GDP".

National Bank of Belarus (increased rate 200bps to 22.00%): "Along with general economic measures undertaken by the government, this tightening will help stabilize the external economic situation and limit inflation,"... "as positive trends in the economy and financial markets develop, the Natsionalnyi Bank will return to its policy of gradually lowering the refinancing rate".

Bank Indonesia (held rate at 6.75%): "Bank Indonesia views that the current BI rate level is still consistent with efforts to maintain macroeconomic and financial stability as well as to support stronger economic growth. Bank Indonesia is confident that the impact of the recent turmoil in the global financial markets because of the U.S. credit rating downgrade to the domestic financial market is limited, and can be contained with continuous monitoring of market development and coordination with the government"

Central Reserve Bank of Peru (held rate at 4.25%): "Some current and advanced indicators of activity show lower growth than in previous months. Moreover, indicators of global activity show signs of weakness and increased uncertainty due to the downgrade of the U.S. debt and the persistence of risks associated with the fiscal situation of some industrialized countries."

Looking to the central bank calendar, next week is set to be relatively quiet on the monetary policy front, with just Iceland and Chile scheduled to review monetary policy settings. Also on the radar is the Reserve Bank of Australia's August board meeting minutes, due for release on the 16th of August, and the Bank of England monetary policy committee meeting minutes due out on the 17th of August.

ISK - Iceland (Central Bank of Iceland) - expected to hold at 4.25% on the 17th of August

CLP - Chile (Central Bank of Chile) - expected to hold at 5.25% on the 18th of August

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/08/monetary-policy-week-in-review-13.html

© 2011 Copyright centralbanknews - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.