Stocks Bear Market Begins

Stock-Markets / Stocks Bear Market Aug 21, 2011 - 11:14 AM GMTBy: Donald_W_Dony

World markets have broken important support levels over the past three weeks. Global equity indexes have now fallen into a new bear market.

World markets have broken important support levels over the past three weeks. Global equity indexes have now fallen into a new bear market.

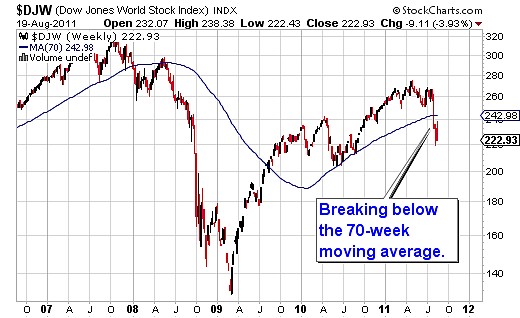

Fears about the spiraling European debt crises and a stalling US economy is largely the cause for the decline (Chart 1). Most indexes have already dropped 10% to 14% in August as investors run to safe havens. An additional 10% to 12% is expected by year end.

However, this bear is likely to be short lived.

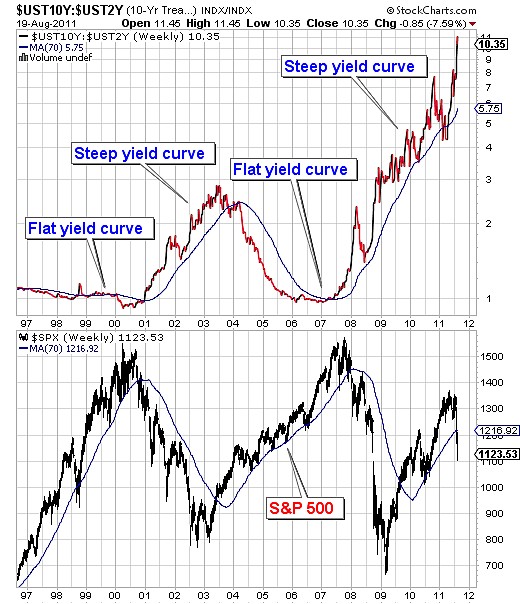

Market tops are normally associated with flat yield curves. Short term rates gradually climb as an economy expands. 1999 and 2006 were two examples of recent flat yields before significant equity declines developed (Chart 2). The present yield curve is very steep.

Another positive factor is the low interest rate environment. This is beneficial to corporations and eventually creates growth.

The current equity decline has more of the characteristics of a correction within a longer term bull advance rather than a prolonged descent.

From a short term perspective, models are still indicating a low can be expected in late September followed by a likely bounce in October.

Bottom line: The bear market is anticipated to continue into year-end. The first downside target for the Dow Jones World Stock Index is 205.

Investment approach: At present, there is no technical evidence to indicate the duration or depth the bear market. As indexes continue to trade on a 14-16 week cycle, the expected low in early January should provide some important information to the extent of the new decline.

Investors may wish to increase their cash positions in their portfolios in October and hold off on any new buys until evidence of a bottom develops.

More research will be available in the upcoming September newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.