U.S. Dollar’s On the Verge of a Relief Rally Look Out Gold, Oil and Stocks!

Commodities / Gold and Silver 2011 Sep 01, 2011 - 02:01 AM GMTBy: Chris_Vermeulen

Let’s talk about the dollar for a moment… The US Dollar has been stuck in a very large trading range during the past 4 months. But when the dollar actually breaks out of this pattern in either direction we should see some big price movements across the board in stocks and commodities.

Let’s talk about the dollar for a moment… The US Dollar has been stuck in a very large trading range during the past 4 months. But when the dollar actually breaks out of this pattern in either direction we should see some big price movements across the board in stocks and commodities.

From July through mid-August I was bearish on the dollar. But over the past 2 weeks the price action has become more neutral/bullish in my opinion. Its clear there is still indecision with the dollar value because every surge in price either up or down is quickly followed by a surge in the opposite direction. The key here is that the support level down at the 73.50 area has held more than three times and now I think the downward momentum is about to shift. The UUP bullish dollar etf is a good option.

Dollar Index Chart

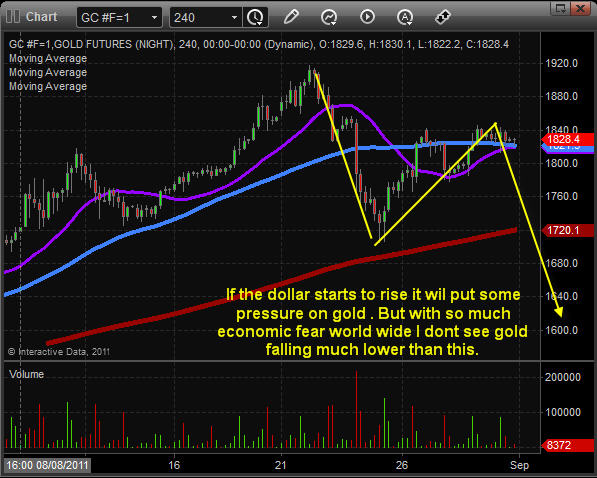

Gold Chart:

Looking at the gold chart I see potential for another sharp drop to the low $1600’s. While I like the look of this chart for lower prices there is still a wild card which is the Euro-Land issues… I’m not willing to bet on lower prices because we could wake up any day to some poor news which instantly sends gold higher. Rather I am waiting for things to unfold then look to buy again for another 10-20% gain on the next rally.

Crude Oil Chart:

This chart is straight forward… The trend is down and at this time all bounces are to be looked at as shorting opportunities.

SP500 Index:

The equities market has broken down sharply over the past couple months and now we are seeing a rebound and small cap stocks are making big gains. With the dollar looking bullish and stocks trading up at resistance I have a feeling we may see another downward move within the next week or so to test the lows or make a new low before putting in a real bottom.

Mid-Week Trend Trading Conclusion:

In short, I feel the market overall is leaning towards lower prices in the coming week or two. After that we will have to re-analyze because it may be a fantastic buying opportunity for stocks and commodities.

Consider subscribing so that you will be consistently informed, have 24/7 Email access to me with questions, and also get Gold, Silver, SP500 and Oil Trend Analysis on a regular basis. Subscribe now http://www.thegoldandoilguy.com/trade-money-emotions.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.