Swiss Franc Collapses Against the Dollar and Gold as Central Bank Plans to Debase Currency

Commodities / Gold and Silver 2011 Sep 06, 2011 - 08:40 AM GMTBy: GoldCore

Currency markets have seen massive volatility this morning after the Swiss National Bank decision to fix the Swiss franc to the euro.

Currency markets have seen massive volatility this morning after the Swiss National Bank decision to fix the Swiss franc to the euro.

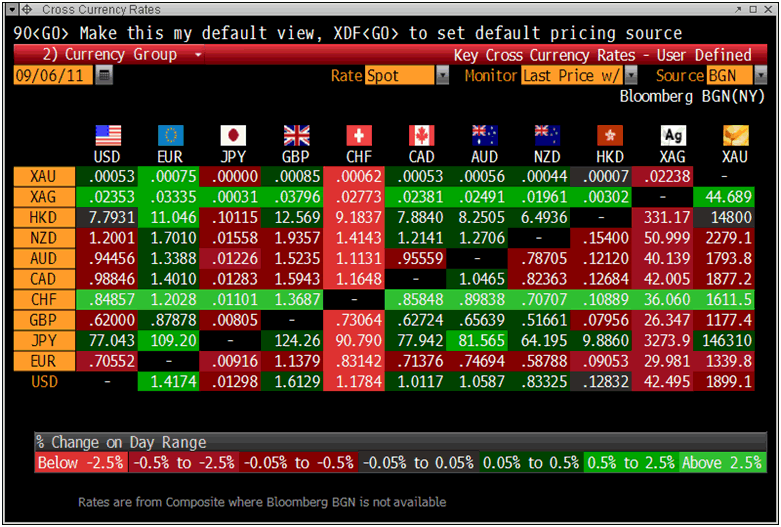

Gold is trading at USD 1,899.50, EUR 1,339.10, GBP 1,177.30, CHF 1,611.10 (up from CHF 1,486.50 yesterday) and JPY 146,350 per ounce. Gold is down 0.18% in dollar terms and strong physical demand continues at these levels.

Just prior to the announcement, spot gold for immediate delivery had risen to a new record nominal high of $1,921.15/oz in early morning trading in Europe.

Cross Currency Table

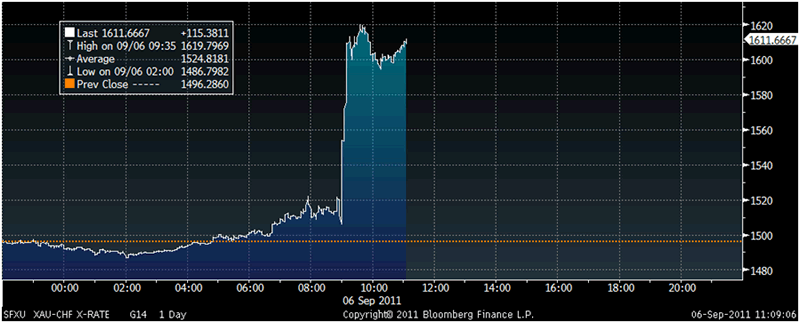

Then just before 0900 hours GMT came the news that the Swiss National Bank has decided to fix the country's exchange rate at 1.20 Swiss francs per euro. The SNB indicated it would buy an unlimited amount of euros regardless of the risk to maintain that value.

In a matter of minutes, gold fell 3% from the high of $1,921.15 to an inter day low of $1,862.72. It then recovered as quickly and surged back to over $1,912/oz.

Gold’s London AM fix this morning was USD 1,891.00, EUR 1,330.75, GBP 1,172.86 per ounce. Gold fixed lower in all currencies (USD 1,896.50, EUR 1,341.13, GBP 1,174.67 per ounce).

The SNB announced the currency fix because of what it called "the current massive overvaluation of the Swiss franc."

It said it will "no longer tolerate" an exchange rate below the minimum rate of 1.20 francs, which it said is still high.

Gold in Swiss francs – 1 Day (Tick)

The euro, which had been trading at close to 1.10 Swiss francs before the announcement, surged 9% to 1.2024 in the minutes afterwards.

Given the inherent frailties of the euro, it is more apt to say that the Swiss franc plunged 9% against the euro.

The SNB said in a statement that it "is prepared to buy foreign currency in unlimited quantities."

The SNB has once again clearly indicated that the so called safe haven currency that is the Swiss franc is set to be debased alongside the dollar, the euro, the pound and all fiat currencies.

Gold’s volatility is often overstated and the moves this morning are purely a function of massive volatility being seen in the international currency markets.

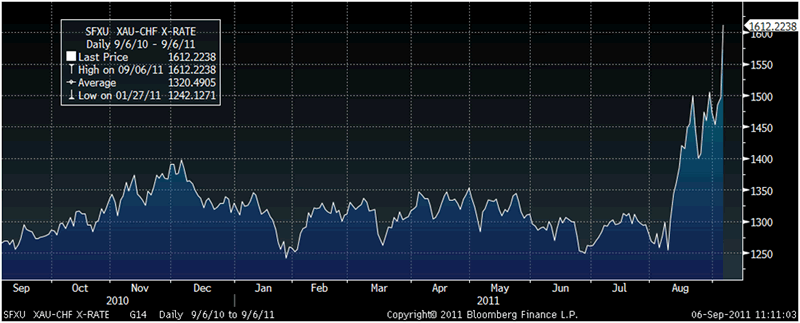

Gold in Swiss francs – 1 Year (Daily)

This volatility is set to continue and increase in coming months as the ramifications of QE1, QE2, further quantitative easing and injections of trillions of dollars, euros, pounds, yen and Swiss francs into the global financial system are felt.

Such volatility will of course be beneficial to gold as it will lead to further diversification into gold as store of wealth buyers, including central banks, seeking to protect themselves from currency volatility and the debasement of currencies internationally.

While the SNB news has provided a short term boost to the euro, the outlook for the ‘single’ currency is uncertain to say the least, despite massive denial amongst decision makers.

While all the markets are focusing on the SNB announcement today, its timing is interesting as it comes a day before a critical decision regarding the future of the European project, the European Union and the euro itself.

The Federal Constitutional Court will issue a ruling on the legality of last year's bail-out packages tomorrow at 10:00.

The court is expected to demand that the German government does more to ensure "democratic legitimacy" for its support for European wide bail-outs and to set conditions on continuing German support for the policy.

It is also possible that the court could throw the euro into chaos. Many analysts warn that the judges are likely to impose restrictions on the German government that could make decision making in the zone even more cumbersome than it already is.

It is also possible that the panel of judges ban Germany from taking part altogether, a drastic step that would deprive the EU rescue fund of its biggest contributor and undermine the very integrity of the euro.

Given these and the myriad of other macroeconomic, geopolitical and systemic issues facing the global financial and economic system today, it is amusing that some can confidently assert that gold is a bubble.

Unfortunately, this leads to people again being lulled into a false sense of security and to a lack of real diversification.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $41.77/oz, €29.49/oz and £25.97/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,860.00/oz, palladium at $762/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.