Gold, is Safe Haven, Not Francs as Switzerland to Buy Foreign Currency in Unlimited Quantities

Commodities / Gold and Silver 2011 Sep 07, 2011 - 01:29 AM GMTBy: Mike_Shedlock

In a stunning morning press release, Swiss National Bank sets minimum exchange rate at CHF 1.20 per euro

In a stunning morning press release, Swiss National Bank sets minimum exchange rate at CHF 1.20 per euro

The current massive overvaluation of the Swiss franc poses an acute threat to the Swiss economy and carries the risk of a deflationary development.

The Swiss National Bank (SNB) is therefore aiming for a substantial and sustained weakening of the Swiss franc. With immediate effect, it will no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20. The SNB will enforce this minimum rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities.

Even at a rate of CHF 1.20 per euro, the Swiss franc is still high and should continue to weaken over time. If the economic outlook and deflationary risks so require, the SNB will take further measures.

Line in the Sand

Reuters Reports Swiss draw line in the sand to weaken franc

Using some of the strongest language from a central bank in the modern era, the SNB said it would no longer tolerate an exchange rate below 1.20 francs to the euro and would defend the target by buying other currencies in unlimited quantities.

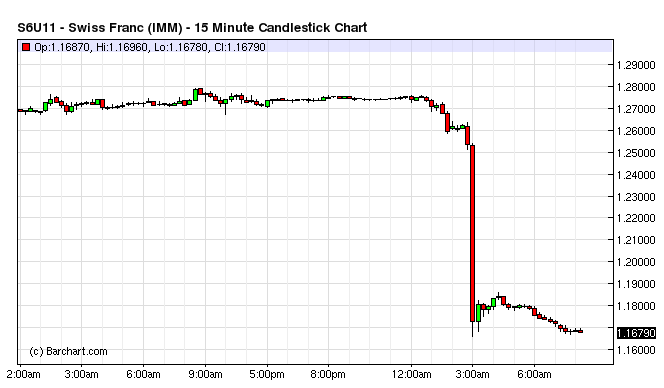

The move immediately knocked about 8 percent off the value of the franc, which had soared by a third since the collapse of Lehman Brothers in 2008 as investors used it as a safe haven from the euro zone's debt crisis and stock market turmoil.

The move was seen as a new shot in the currency wars, with Japan expected to try to weaken the yen if the Swiss action diverts more safe-haven inflows into the currency. Gold, which hit a record higher earlier on Tuesday, is also seen gaining.

"That was the single largest foreign exchange move I have ever seen," said World First chief economist Jeremy Cook. "This dwarfs moves seen post Lehman Brothers, 7/7, and other major geopolitical events in the past decade."Gold, is Safe Haven, Not Francs

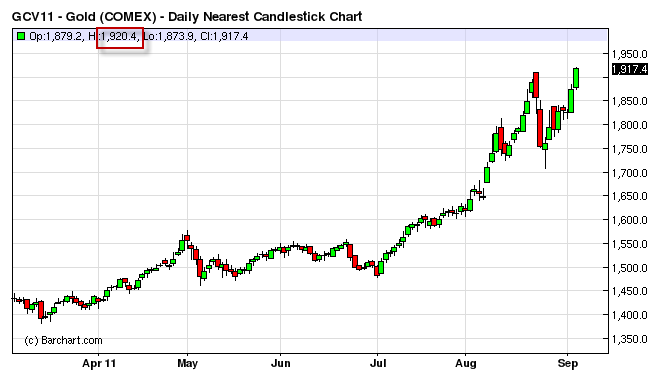

At 1:25 AM today I wrote Gold Hits New High of $1920; Miners Should Follow.

When I wrote that, I had no idea fireworks would hit about an hour later. First, take a look at what I said:

It only took 7 sessions to take back a sharp $200 plunge about a week ago.

In 2008, gold sold off with everything else but treasuries. Miners were crushed. This time I expect gold and miners to do much better in a big market decline, perhaps even rise.

Other Currencies Look Sick

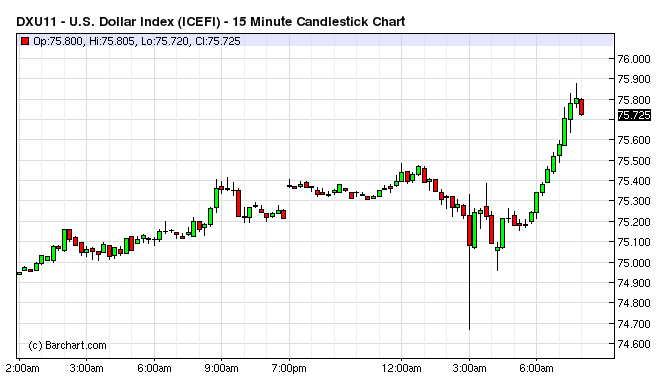

The Euro, the US dollar, the Yen, and the Yuan all look sick for differing reasons. The Eurozone may break apart, Bernanke is likely to double up on QE and the US deficit is out of control, Japan has a horrendous debt problem, and inflation is out of control in china as is China's infrastructure spending and housing bubble.

The one thing the Euro, the US dollar, the Yen, and the Yuan all have in common is competitive currency debasement by central bankers hoping to increase export to everyone else. Mathematically that is impossible.

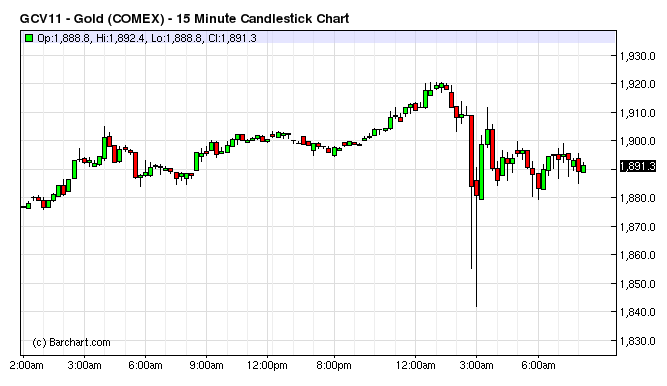

Once currency stands out (and it's not the Swiss Franc). It's gold.

The fireworks started an hour or so later. Here are some charts to consider.

Swiss Franc 15-Minute Chart

US$ Index 15-Minute Chart

Gold 15-Minute Chart

Unlike the Swiss Franc, Gold continued on its merry way in the face of competitive currency debasement

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.