The Silver Siren: Reversion To Reality

Commodities / Gold and Silver 2011 Sep 07, 2011 - 03:16 PM GMTBy: Rob_Kirby

According to the World Gold Council – the overall level of global mine production is relatively stable. Supply has averaged approximately 2,497 tonnes per year over the last several years. 2500 tonnes is equal to 80.4 million troy ozs.

According to the World Gold Council – the overall level of global mine production is relatively stable. Supply has averaged approximately 2,497 tonnes per year over the last several years. 2500 tonnes is equal to 80.4 million troy ozs.

The Silver Institute tells us there were 735 million ozs. of Ag mined from the earth’s crust in 2010. Simple math [735 / 80.4] tells us that “nature” is implying that the gold / silver ratio should be 9.14: 1.

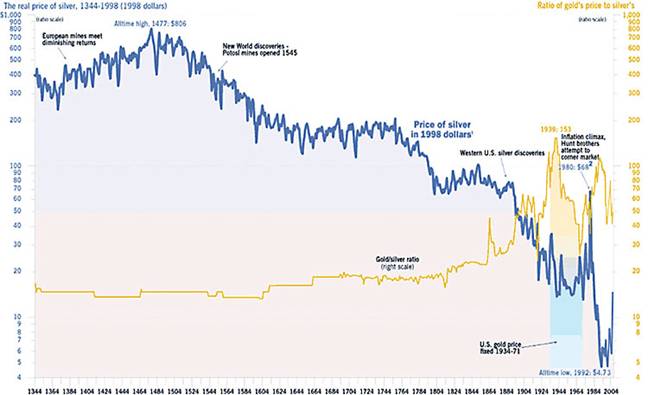

Historic Gold/Silver Ratio – 650 Years

This is a 650 year graph of silver prices and silver/gold ratio from 1344 to 2004.

Source: http://goldinfo.net/silver600.html

From 1300 to the mid 1800’s – the gold silver ratio never went above 20 and gravitated to 15 – that’s 500+ years worth of equilibrium. It’s really only been in the past 140 years [while the private Rothschild controlled Bank of England centric debt based monetary system has been in force] that we’ve seen such strange “aberrations” in the gold/silver ratio.

Only a “CHERRY PICKING HACK” would show 140 yrs. worth of PERVERTED data and make the “insinuation” with this data and by naming the piece, ‘140 Years of Silver Volatility’ - that 15: 1 is “LOW” for the gold / silver ratio.

What this 140 Years of Volatility better reflects is the political nature of the monetary metals – and how free markets in them stand between spend-thrift megalomaniacs who have increasingly occupied political offices over that time frame. Take this account explaining the “end of bi-metalism” – which explains silver’s fall-from-grace. The fall created artificial gluts of Ag [artificial because, unlike gold, silver is consumed] – which have been sold-off or generally disgorged for more-or-less the past 100 years. Well guess what folks? The very real glut which was synthetically created in silver by ‘de-monetizing’ it – has now been consumed:

II. The end of bi-metalism.

The 19th century is the period when the very long-established ratio of 15 between the price of gold and silver is displaced. Throughout the previous three centuries, this ratio of 15 - or less - had prevailed globally. I shall examine this period in more detail in the next article on the same subject.

The ratio of 15 seems to be a sort of natural balance between the price of gold and silver. This balance was broken at the end of the 20th (19th???) century, with the depreciation of silver.

This depreciation resulted from several factors:

- The end of bi-metalism - silver was no longer a specie metal. This factor seemed to lead all the others

- The increase in production of silver in the United States.

- The sales of silver by Germany, which had furthermore a very strong psychological impact. Germany was in a different situation from the other countries, because it went from a silver mono-metalism to a gold mono-metalism. This was unique, because other countries went from bi metalism to the gold standard. It thus had large inventories to be sold – and the threat of the sales depressed prices more than the sales themselves.

- The sales of silver by the Scandinavian countries.

The volatility we’ve experienced in the past 140, or so, years “IS” the aberration. The profligate political factors which created the aberration [glut] have now been removed from the landscape.

With above ground stockpiles now gone, along with the re-emergence of investment demand for silver – we WILL return to the historic 15: 1 at a MINIMUM.

This is math and – when it happens - represents nothing more than a reversion to a mean.

As for silver [or gold] trading at a “premium” to the paper COMEX price – we should all take a deep breath and remember that Eric Sprott is trusted and believed by the public to posses the REAL silver which backs the fund he markets in his name. Sprott PSLV actually publishes their NAV and share price daily – so, like it or not, there is transparency. Don’t forget, Sprott PSLV shares are readily convertible / exchangeable into physical silver.

COMEX, on the other hand – is widely – if not universally - understood to possess a “tiny” fraction [perhaps as little as 1/100th] of physical metal for each paper contract they sell. Getting physical delivery from COMEX is extremely cumbersome and – according to reliable market participants who have been through the process - reportedly inexplicable [if they really have the metal] fraught with delays. Promoters / adherents of this scheme get around the transparency aspect of the fractional fraud with the semantics of “allocated” and “unallocated” accounts – verbiage which has been developed / adopted to obfuscate the difference between REAL and imaginary.

At the time of writing - Kitco is charging $ US 45.77 per oz. [9.11 % premium] for a Cad. Maple and $ US 4,382.00 for a 100 oz bar [4.46 % premium] of silver basis spot $ US 41.95 spot for silver. BMG Bullion Bars [shamelessly and promotionally which are available through myself] are still available at spot plus 3 %.

This brings us to another unfortunate but logical conclusion: we are very likely fast approaching the day when REAL gold and silver will not be obtainable with fiat money – period.

In order to procure these stores of wealth in the future one will likely be required to trade other REAL ‘tangibles’. Hurt feelings, vendettas and foul language will not prevent this from happening – and by the way, our “paper markets” are much worse than a joke – they’re criminally hallucinogenic and an insult to free markets and humanity.

Got physical precious metal yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2011 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.