Ongoing Silver Bear Market Means Investors Should Diversify Into Rhodium

Commodities / Rhodium Sep 16, 2011 - 11:55 AM GMTBy: Ned_W_Schmidt

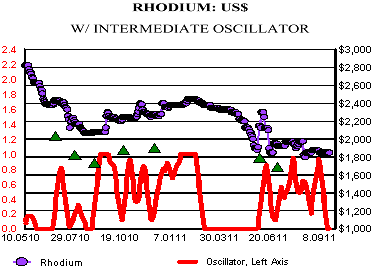

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done. Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

RHODIUM TRADING THOUGHTS is about timely and profitable trading of precious metals. We do not believe every turn in the market can be called. Our goal is that our recommendations should be profitable. Profits are the goals, not trades. Do not expect all recommendations to be profitable. No system can achieve that lofty goal. Our goal is simply to state whether conditions for a metal are favorable or not. Buy signals are issued when appropriate. These signals are generally speaking for day they are issued. If price remains below signal price, buying can be done. Do Not Buy signals are given when market is over bought, and buying is unwise. Blue triangles indicate an over bought condition. These would not be good times to buy, so they are labeled Do Not Buy. Software is not showing complete legend, for some reason.

World seems poised to move to a new level when it comes to understanding and using many metals, from Rhodium to rare earths. A reason for that is researchers now have far sophisticated tools than ever to study them. Rhodium may be one of those metals to benefit from this research. From "UIC Researchers Study Alternate Routes to Alternate Fuels" from newswise.com, 6 September,

"Ethanol as a fuel additive -- often touted as a domestic solution to curbing oil imports -- has been suggested by some researchers to be an expensive answer to an ongoing problem. Corn . . .is ethanol's usual raw material here in the United States. Creating ethanol through fermentation is slow and inefficient. Acid catalyzed processes generate significant waste byproducts."

"But a method using the rare metal rhodium as a catalyst could make ethanol production cheaper, generate less waste, and use non-food biomass such as switchgrass -- rather than corn kernels -- as the source material. The key is gaining a greater nderstanding of how rhodium can do the job at maximum efficiency, and that involves studying interactions at the atomic level between the catalyst metal and promoter elements like manganese or vanadium."

"Two University of Illinois at Chicago researchers hope their use of a sophisticated new electron microscope will lead to new chemical production models . . .received a $300,000 grant from the National Science Foundation to create models that explain what happens when individual atoms and atom clusters of these elements combine."

(Note: Ethanol from switchgrass is a concept similar to perpetual motion machines and alchemy.)

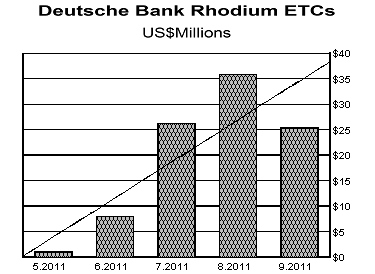

Chart above is of the combined size of the Rhodium ETCs, European ETFs, which trade in London. One is denominated in Euros and the other in dollars.

Given the turmoil in Europe in recent times that the size of these two investment vehicles shrank since last month should not be a surprise. Seems like everything of value is shrinking. However, over time these ETCs should remove a significant amount of Rhodium from the trading market.

OPINION:

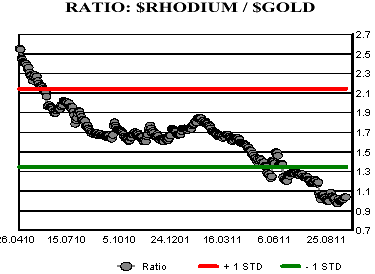

With the ongoing bear market in Silver, now in fourth month, the argument for diversification has been again validated. Given the continued over valuation of Silver, see below, and the increasing probability, ~85%, of lower prices, Silver investors would be advised to sell Silver and place the proceeds in Rhodium. Investors with heavy exposure to Gold may be advised to add Rhodium to their portfolio for diversification and valuation reasons.

Your Eternal Optimist;

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.