Global Systemic Crisis: Implosive Fusion of Global Financial Assets, Worst Ahead

Economics / Credit Crisis 2011 Sep 18, 2011 - 09:55 AM GMTBy: LEAP

As anticipated by LEAP/E2020 since November 2010, and often repeated up to June 2011, the second half of 2011 has started with a sudden and major relapse of the crisis. Nearly USD 10 trillion of the USD 15 trillion in ghost assets announced in GEAB N°56 have already gone up in smoke. The rest (and probably much more) will vanish in the fourth quarter of 2011, which will be marked by what our team calls "the implosive fusion of global financial assets". It’s the two major global financial centers, Wall Street in New York and the City of London, which will be the "preferred reactors" of this fusion. And, as predicted by LEAP/E2020 for several months, it’s the solution to the public debt problems in some Euroland countries which will enable this reaction to reach critical mass, after which nothing is controllable; but the bulk of the fuel that will drive the reaction and turn it into a real global shock (1) is found in the United States. Since July 2011 we have only started on the process that led to this situation: the worst is ahead of us and very close!

As anticipated by LEAP/E2020 since November 2010, and often repeated up to June 2011, the second half of 2011 has started with a sudden and major relapse of the crisis. Nearly USD 10 trillion of the USD 15 trillion in ghost assets announced in GEAB N°56 have already gone up in smoke. The rest (and probably much more) will vanish in the fourth quarter of 2011, which will be marked by what our team calls "the implosive fusion of global financial assets". It’s the two major global financial centers, Wall Street in New York and the City of London, which will be the "preferred reactors" of this fusion. And, as predicted by LEAP/E2020 for several months, it’s the solution to the public debt problems in some Euroland countries which will enable this reaction to reach critical mass, after which nothing is controllable; but the bulk of the fuel that will drive the reaction and turn it into a real global shock (1) is found in the United States. Since July 2011 we have only started on the process that led to this situation: the worst is ahead of us and very close!

In this issue N°57, we have chosen to address, very directly, the great manipulation organized around the Greek crisis and the Euro (2), whilst describing its direct link with the implosive fusion process of financial assets worldwide. Also in this issue, LEAP/E2020 presents its anticipations for the gold market for the period 2012-2014 as well as its analyses on neo-protectionism which will be introduced from the end of 2012. In addition to our monthly recommendations on Switzerland and the Swiss Franc, currencies, real estate and financial markets, we also present our strategic advice to the G20 leaders less than two months from the G20 summit to be held in Cannes.

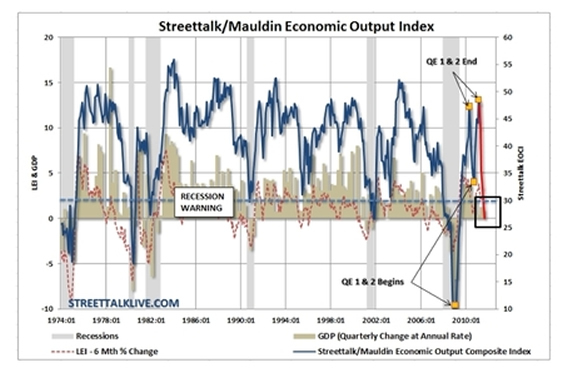

US economic output index (1974-2011) (grey shading: recessions; broken blue line: recession warning; blue: economic output index and in red, forecast for the 3rd and 4th quarters 2011) - Source: Streetalk/Mauldin, 08/2011

Greek crisis and the Euro: Itemizing the huge manipulation in progress

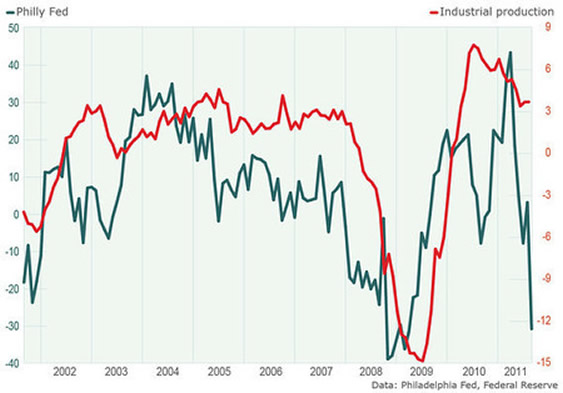

But let’s come back to Greece and what is beginning to be a "very repetitive old story (3)" which, as we have already explained, returns to the front of the media stage every time Washington and London are in serious difficulties (4). Moreover, coincidentally, the summer has been disastrous for the United States which is now in recession (5), which has seen their credit rating cut (an event deemed unthinkable by all the "experts" only six months ago) and exposed their political system’s state of widespread paralysis (6) to an astonished world, all whilst being incapable of putting any serious measure in place to reduce their deficits (7). At the same time, the United Kingdom is sinking into depression (8) with riots of uncommon violence, an austerity policy that fails to control budget deficits (9) whilst plunging the country into an unprecedented social crisis (10), and a ruling coalition that doesn’t even know why it governs together against the backdrop of the scandal of collusion between political leaders and the Murdoch empire. No doubt, in such a context, everything was ripe for a media relaunch of the Greek crisis and its corollary, the end of the Euro!

If LEAP/E2020 had to summarize the "Hollywood style" or "Fox News" (11) scenario, we would have the following synopsis: "While the US iceberg is ramming the Titanic, the crew leads the passengers in search of dangerous Greek terrorists who may have planted bombs on board!" In propaganda terms, it’s a known recipe: it’s a diversion to allow, first of all, the rescue of the passengers one wants to save (the informed elite who know very well that there are no Greek terrorists on board) since everyone can’t be saved; and then, hide the problem’s true nature for as long as possible to avoid a revolt on board (including some of the crew who sincerely believe that there really are bombs on board).

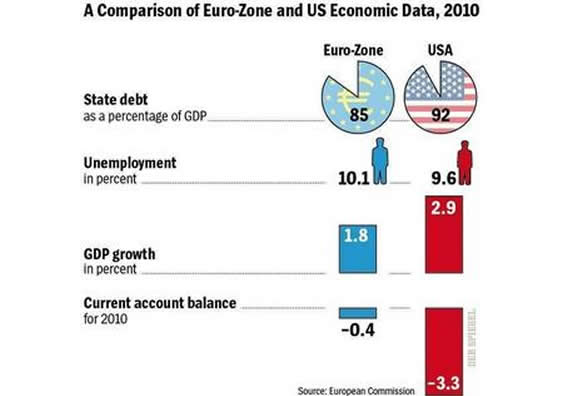

Focusing on the background, we must emphasize that the "promoters" of a Greek crisis presented as a fatal crisis for the Euro have spent their time repeating it for almost two years without any of their forecasts coming to pass in any shape or form (12) (except to continue talking about it). Facts are stubborn: despite the media outcry that should have seen off many economies or currencies (13), the Euro is stable, Euroland has come on in leaps and bounds in terms of integration (14) and is about to break even more spectacular new ground (15), the emerging countries continue to diversify out of US Treasury Bonds and buy Euroland debt, and Greece’s exit from the Euro zone is still completely beyond consideration except in the Anglo-Saxon media articles whose writers generally have no idea of how the EU functions and even less of the strong trends that drive it.

Comparison of economic data Euroland-USA (2010) (State debt, unemployment, GDP growth, current account balance) - Source: Spiegel, 07/2011

Now our team can do nothing for those who want to continue to lose money by betting on a Euro collapse (16), Euro-Dollar parity, or Greece’s Euroland exit (17). These same people spent lot of money to protect themselves against the so-called "H1N1global epidemic" that experts, politicians and the media of all kinds "sold" for months to people worldwide and proved to be a huge farce fueled in part by pharmaceutical companies and cliques of experts under their orders (18). The rest, as always, is self-propelled by the lack of thought (19), sensationalism and mainstream media conformity. In the case of Euro-Greek crisis, the scenario is similar, with Wall Street and the City in the role of the pharmaceutical companies (20).

When Wall Street and the City panic before the solutions in the course of forging Euroland

In fact we recall that what terrifies Wall Street and the City are the lessons that Euroland’s leaders and its people have been in the process of learning from these three years of crisis and the ineffective solutions that have been applied. The nature of Euroland creates a unique forum for discussion among the elite and American and British public opinion. And this is what disturbs Wall Street and the City, which is systematically trying to kill this forum, either by trying to plunge it into a panic by announcing the end of the Euro for example; or by reducing it to a waste of time and evidencing Euroland’s ineffectiveness, an inability to resolve the crisis. Which is the limit given the complete paralysis prevailing in Washington!

However, it’s really this discussion forum that allows Eurolanders to move forward on the path to a lasting solution to the current crisis. This discussion forum is an integral part of European construction where opposing views of the methods and solutions confront each other before ultimately agreeing on a compromise (and it’s still the case as the very important decisions taken since May 2010 prove). Thus it broadens the debate to a whole raft of participants, coming from 17 different countries (21), several common institutions, and it roots itself in the discussions of seventeen public opinions. Yet it’s from the clash of ideas that light shines forth: of the brutal clash of ideas, the Greek philosopher Heraclitus said 2500 years ago "Some it makes gods, some it makes men, some it makes slaves, some free". But Euroland’s citizens refuse to let this crisis turn them into slaves and that’s why the current debates within Europe are needed and useful. In three years, between 2008 and 2011, they have made two key things possible in the future:

. they relaunched European integration around Euroland and henceforth placed it on a path of accelerated integration. Our team now expects a strong revival of European politics from the end of 2012 (similar to the 1984-1985 period) including a Euroland political integration treaty which will be put to a Euroland-wide referendum by 2015 (22)

. they allowed the gradual emergence of two simple but very strong ideas: saving private banks is of no use to solve the crisis and it is necessary that the markets (that is to say essentially the big Wall Street and City financial operators) fully assume their risks without any further guarantee from the state. Today, these two ideas are at the heart of the Euroland debate, both in public opinion and amongst the elite ... and they gain ground every day. This is what causes fear on Wall Street, in the City, and amongst major private financial operators. This is the wick that has nearly burned down that will trigger the implosive fusion of global financial assets in the fourth quarter (in the prevailing context of the US recession and its inability to reduce its public deficits).

If markets begin to anticipate a 50% drop in Greek and Spanish securities it’s because they really sense the direction which events in Euroland are taking. For LEAP/E2020, there is no doubt that minds are ripe, throughout most of Euroland, for private creditors being asked to pay 50%, or even more, to resolve the future problems of public debt. This is, without doubt, a problem for European banks, but it will be managed to protect depositors. The shareholders themselves will have to take full responsibility: besides it’s really the foundation of capitalism!

Wall Street and the City, and their media intermediaries desperately want this debate not to take place, regardless of whether it’s ended by panic, so that governments should be forced to listen to their "experts" who assure them that the only way is to continue to recapitalize banks, and flood them with liquidity (23) ... as is the case in Washington and London. Two countries where these same financial institutions reign supreme in the government.

Incidentally the battle rages around the ECB as we mentioned in a previous GEAB: the appointment of Mario Draghi, a formerly with Goldman Sachs, the resignation of Jurgend Stark (24), ... arise out of these attempts to put Frankfurt under the same tutelage as London and Washington. But they are doomed from the start by virtue of this open forum, structurally inscribed in European construction, where discussions are fed by the failed policies of 2008 and the growing outbreak of public opinion in the debate. "Qui va piano va sano e qui va sano va lontano" (25) as the Italians say. This crisis is of historic proportions as we have said since February 2006. The steps to take to get through it as best as possible and come out of it stronger (free men and not slaves to quote Heraclitus) thus require serious and deep discussion (26) ... therefore time. And the time taken by the Eurolanders, is money lost to the markets ... which explains their fears. LEAP/E2020 thinks, of course, that it’s also necessary to act and we have pointed out from May 2010 that the actions taken in Euroland were of a magnitude unprecedented in recent European history. And we believe that we must allow time for the second aid package to Greece to be implemented. For the rest, we know also that the current leaders are mostly "at the limit" and it will be necessary to wait until the mid-2012 to witness a new and powerful boost to Euroland integration (27).

Meanwhile, with 340 billion USD to find for refinancing in 2012 (28), the European and American banks will continue to kill each other while trying to maintain the pre-crisis situation which gave them unlimited central bank support. As for Euroland, they may have a very bad surprise.

Comparison of the Philadelphia Federal Reserve index and US industrial production (2002-2011) - Sources: Philadelphia Fed, MarketWatch, 08/2011

The fourth quarter 2011 marks the end of two key examples of the world before the crisis

The implosive fusion of the fourth quarter will thus directly result from the encounter between two new realities that contradict two basic conditions of existence of the world before the crisis:

. one, born in Europe, consists of now rejecting the idea that private financial operators, of which Wall Street and the City are the embodiment par excellence, are not fully responsible for the risks they take. Yet for decades, this was the prevailing idea that fueled the tremendous growth of the financial economy: “Heads I win, tails you bail me out”. Even the existence of large Western banks and insurance companies has become intrinsically linked to this certainty. The balance sheets of major players on Wall Street and the City (and of many large Euroland and Japanese banks) are unable to withstand this tremendous paradigm shift (29).

. the other, generated in the United States, is the proven end of the US engine of global growth (30) against a background of the country’s complete political paralysis which, de facto, will end 2011 as Greece ended 2009: the world discovering little by little that the country has a debt it can no longer support, that its creditors are unwilling to lend, and its economy is unable to cope with significant austerity without plunging into a deep depression (31). In some ways, the analogy can be taken further: just as the EU and the banks, from 1982 to 2009, lent freely to Greece ... and without pressing for accounts, over the same period, the world has lent freely to the United States believing its leaders’ promises about the state of the economy and the country’s finances. And in both cases, the money has been wasted in real estate booms with no future, in extravagant crony politics (in the US cronyism is Wall Street, the oil industry, health service providers) and in unproductive military spending. And in both cases, everyone discovers that in a few quarters you can’t fix decades of recklessness.

The politico-financial « perfect storm » of November 2011

So, in November 2011 the United States will brace itself for a politico-financial "perfect storm" that will make the summer problems look like a slight sea breeze. The six elements of the future crisis have already come together (32):

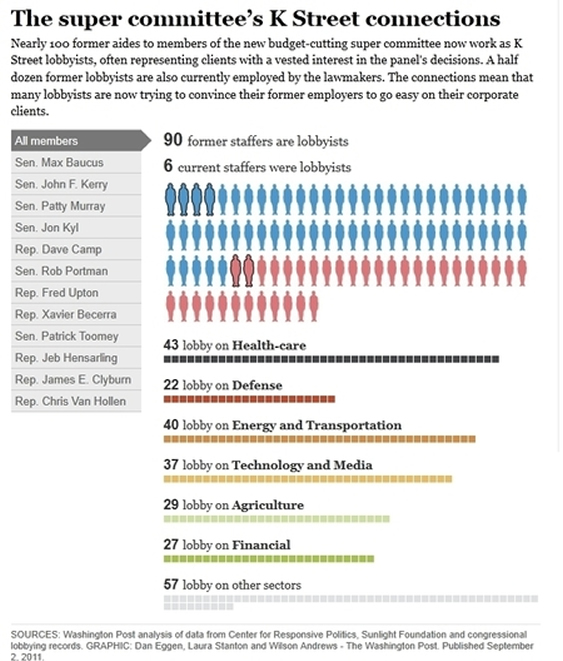

. the "super committee" (33) responsible for deciding budget cuts on which there was no agreement this summer will prove incapable of resolving the tensions between the two parties (34)

. the automatic budget cuts required to be made in the absence of agreement will result in a major political crisis in Washington and increasing tensions, especially with the military and the recipients of social benefits. At the same time, this "automatic function" (a real abdication of decision-making authority by Congress and the United States Presidency) will generate major disturbances in the functioning of the state system.

. the other major rating agencies will join S&P in downgrading the US credit rating and diversification out of US Treasury Bonds will accelerate, in the knowledge that the United States now depends primarily on short-term financing (35).

. the inability of the Fed to do anything but talk and manipulate stock markets or gasoline prices in the United States (36), now makes any last-minute "rescue" impossible.

. over the next three months the US public deficit will increase dramatically as tax revenues are now already in the process of collapsing under the impact of the relapse into recession (37). In other words the increased debt ceiling voted in a few weeks ago will be reached well before the November 2012 elections (38)... and this is information that will spread like wildfire in the fourth quarter of 2011 ... reinforcing all investors’ fears to see the United States follow Euroland’s example over Greece and force its creditors to take heavy losses.

. Barack Obama’s new plan in the fight against unemployment will have no significant effect. On the one hand, it’s not up to the challenge and, for this reason, can’t rally the country’s energies; and on the other, it will be cut to pieces by the Republicans who will only keep the tax cuts... The only result of which will be to increase the country's debt even more (39).

The US debt super committee’s connections with Washington lobbyists - Source: Washington Post, 09/2011

So for LEAP/E2020, it's a combination of all these elements at the end of 2011 that will trigger this major financial shock ... a kind of final shock thrusting the planet out of the world before the crisis for good. But the world after is still to be built because many futures are possible, beginning 2012. As Franck Biancheri anticipated in his book, the period 2012-2016 forms an historical crossroads. One must try not to mistake the path (40)!

Notes here.

GEAB is an affordable and regular decision and analysis support instrument intended for all those whose work involves some understanding of ongoing and future global trends seen from a European point of view: advisors, consultants, researchers, experts, heads of public institutions, research centres, international companies, financial institutions and major NGOs.

Available in: Français, English, Deutsch, Español

Frequency: Monthly - 10 issues a year published on the 16th of each month (interruption in July/August)

Contributors: Every issue is coordinated by Franck Biancheri and mobilises the totality of our research teams

© 2011 Copyright LEAP - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.