Is the US Monetary System on the Verge of Collapse?

Currencies / US Dollar Sep 20, 2011 - 02:56 PM GMTBy: David_Galland

David Galland, Casey Research writes:  Tune into CNBC or click onto any of the dozens of mainstream financial news sites, and you’ll find an endless array of opinions on the latest wiggle in equity, bond and commodities markets. As often as not, you'll find those opinions nestled side by side with authoritative analysis on the outlook for the economy, complete with the author’s carefully studied judgment on the best way forward.

Tune into CNBC or click onto any of the dozens of mainstream financial news sites, and you’ll find an endless array of opinions on the latest wiggle in equity, bond and commodities markets. As often as not, you'll find those opinions nestled side by side with authoritative analysis on the outlook for the economy, complete with the author’s carefully studied judgment on the best way forward.

Lost in all the noise, however, is any recognition that the US monetary system – and by extension, that of much of the developed world – may very well be on the verge of collapse. Falling back on metaphor, while the world’s many financial experts and economists sit around arguing about the direction of the ship of state, most are missing the point that the ship has already hit an iceberg and is taking on water fast.

Yet if you were to raise your hand to ask 99% of the financial intelligentsia whether we might be on the verge of a failure of the dollar-based world monetary system, the response would be thinly veiled derision. Because, as we all know, such a thing is unimaginable!

Think again.

Monetary Madness

Honestly describing the current monetary system of the United States in just a few words, you could do far worse than stating that it is “money from nothing, cash ex nihilo.”

That’s because for the last 40 years – since Nixon canceled the dollar’s gold convertibility in 1971 – the global monetary system has been based on nothing more tangible than politicians' promises not to print too much.

Unconstrained, the politicians used the gift of being able to create money out of nothing to launch a parade of politically popular programs, each employing fresh brigades of bureaucrats, with no regard to affordability.

Such programs invariably surged during political campaigns and on downward slopes in the business cycle when politicians hearing the cries of the constituency to “do something” tossed any concern about balancing budgets out the window of expediency. After all, the power to print up the funds for debt service whenever needed makes moot any concern over deficit spending.

Former VP Cheney, who fashions himself a fiscal conservative, let the mask drop when, in 2002, he stated that “Reagan proved deficits don’t matter.”

Those words were echoed just a few weeks ago, when both former Fed Chairman Alan Greenspan and Obama economic advisor Larry Summers, in separate interviews, said almost the same, paraphrased as, “There is no chance of the US defaulting on its bonds, not when our government can borrow dollars and print new dollars to meet any future obligations.”

Of course, Greenspan and Summers were referring to an overt default – of just not paying – and not to a covert default engineered by inflation. Unfortunately, like virtually all of the power elite, both miss the point that the mountain of debt that has been heaped up since 1971 is fast reaching the point of collapsing like a too-big tailings pile and taking the monetary system down with it.

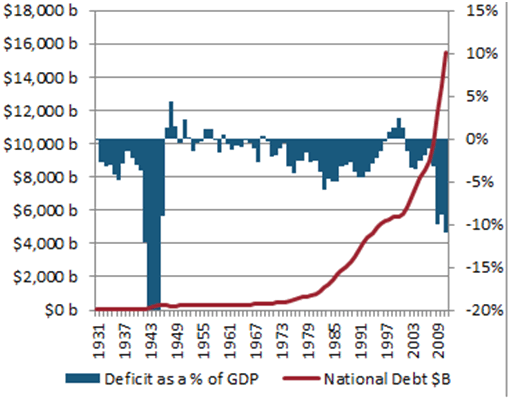

Importantly, the debt shown in this chart whistles past the government's unfunded liabilities, in particular for the Social Security and Medicare systems. Adding those would more than triple the US government’s acknowledged obligations – to over $60 trillion.

Given the role the US dollar plays as the world’s de facto reserve currency – with all major commodities priced in dollars, and dollars forming the bulk of reserves held by foreign central banks – the dismal shape of the US monetary system spells trouble for the global monetary system.

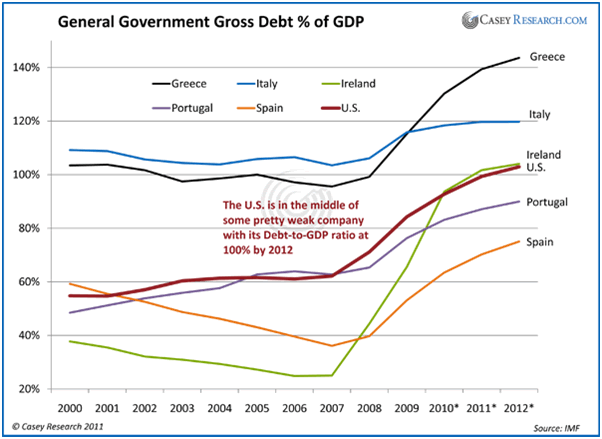

Making matters worse, following the lead of the United States, governments around the world long ago adopted similar fiat monetary systems. You can see the deficit contagion in this next chart. It is worth noting that the dire condition of the United States now leaves it in the same muddy wallow as Europe’s desperate PIIGS.

In a recent article in The Telegraph, Ambrose Evans-Pritchard referenced a paper out of the BIS that paints the picture using appropriately stark terms.

Stephen Cecchetti and his team at the Bank for International Settlements have written the definitive paper rebutting the pied pipers of ever-escalating credit.

“The debt problems facing advanced economies are even worse than we thought.”

The basic facts are that combined debt in the rich club has risen from 165pc of GDP thirty years ago to 310pc today, led by Japan at 456pc and Portugal at 363pc.

“Debt is rising to points that are above anything we have seen, except during major wars. Public debt ratios are currently on an explosive path in a number of countries. These countries will need to implement drastic policy changes. Stabilization might not be enough.”

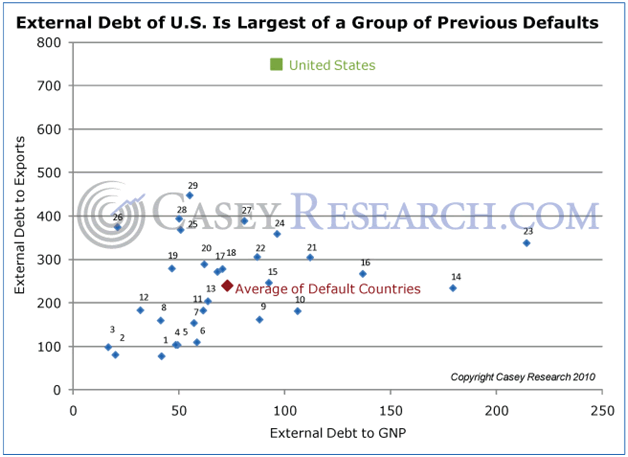

Viewing the situation from another perspective, we turn to the work of Carmen Reinhart and Ken Rogoff, who studied the factors contributing to 29 past sovereign defaults. They found that default or debt restructuring occurred, on average, when external debt reached 73% of gross national product (GNP) and 239% of exports. Using the Reinhart/Rogoff findings, Casey Research Chief Economist Bud Conrad prepared the following chart showing that the US government is already far along on the path to bankruptcy.

It’s hard to argue against the contention that the situation is, to be polite, precarious. Given that the obligations of the US government, as well as most of the world’s other large economies, are now impossible to repay and that their reserves are just IOUs backed by nothing, the stage is set for a highly disruptive but entirely necessary do-over of the fiat monetary system.

“Preposterous!” say the lords of finance and masters of all.

Is it?

Of course, these very same mavens completely missed the looming housing crash and the depth and duration of the subsequent crisis – a crisis that is still far from over. In other words, listen to them at your peril, because in our view it’s essential in calibrating your financial affairs to understand that, if history is any guide, we are now well down the road to a collapse in the monetary system.

In fact, over its relatively short history, the US monetary system has come unglued time and time again thanks to politically expedient attempts to interfere with the workings of a free market in order to reward constituents or kick the can on the economic problems of the day down the road.

Thus it is our contention that while the mainstream media focus on the daily gyrations of equity markets or the futile political charade that is Washington, they overlook powerful tectonic rumblings indicating the world’s prevailing monetary system is about to fracture.

A Brief Timeline of US Monetary System Failures

Here’s a brief history of past disruptions here in the United States. Importantly, with the US dollar now the de facto reserve currency of the world, this time around it’s global.

1861 – When the Civil War begins, the dollar is convertible into gold and silver.

1862 – Congress passes the Legal Tender Act and authorizes the issuance of non-redeemable "Greenback" currency. Convertibility into gold and silver is suspended for all US currency.

1863 – National Banking Act authorizes the chartering of banks by the federal government.

1865 – A 10% tax is levied on the issuance of bank notes by state-chartered banks, effectively ending that practice.

1879 – The US Treasury resumes redeeming dollars for gold and silver.

1900 – Passage of the Gold Standard Act, adopting the gold standard by the United States and demonetizing silver.

Specifically, the act provided for "...the dollar consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard..."

Specifically, the act provided for "...the dollar consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard..."

But 33 years later, to gain the power to inflate the currency and collect the profit from doing so…

1933 – By executive order, Franklin Roosevelt prohibits the private ownership of gold. Congress passes the Gold Reserve Act, which enacts Roosevelt's executive order, abrogates all gold clauses in all contracts public or private, past or future (which cancels the convertibility of Federal Reserve notes into gold), though it confirms the convertibility of US Treasury notes held by foreigners into gold. Eleven years later, the US government takes its show on the road…

1944 – Bretton Woods system adopted with signature countries agreeing to tie the exchange rates of their currencies to the US dollar, which itself is linked to a fixed price of gold. Foreign trading partners retained the right to swap dollars for gold, imposing a de facto restraint on printing more dollars. For all intents and purposes, the US dollar becomes the world’s reserve currency. But 27 years later…

1971 – Nixon abruptly closes the “gold window,” unilaterally reneging on the Treasury's promise to allow foreign governments to redeem dollars for gold. Bretton Woods collapses. With no remaining tie to a tangible, the dollar is reduced to a paper token. The transition to a global fiat monetary system is complete.

Until 40 years go by and the inevitable consequences of giving politicians free rein over money creation become untenable…

Present day – Sovereign debt crisis. Desperate, debt-laden governments around the globe – the bulk of their reserves composed of fiat US dollars and euros at risk of going up in smoke – turn to the only thing they know, printing more money and issuing yet more debt. The global monetary system cracks and heads toward failure with no workable alternative on the horizon.

Governments, corporations and investors alike are caught unprepared in the downward spiral of failing fiat currencies and are wiped out by a combination of frantic currency debasements, higher taxation, exchange controls and worse. Social unrest spreads, with the public paradoxically demanding that governments do more, not less.

That’s because all the world’s major currencies are at risk, simultaneously, as the issuers engage in a dangerous race to the bottom. As the monetary system moves inexorably toward terminal debasement and collapse, the results will be catastrophic for the unprepared.

Importantly, while the list of historical attempts to re-jigger the US monetary system have, to this point, more or less succeeded in kicking the can a bit further down the road, the sheer scale of today’s government obligations has driven us into a box canyon, with no way out. As the government’s debt and spending obligations are mathematically impossible to resolve, it is now a certainty that a lot of people are going to wake up one morning to the reality that they are a lot poorer than they thought.

Fortunately for those now paying attention, the collapse of a monetary system doesn't happen in a flash. It is a progression, like the spiral of water down a drain. Thus, while no one can predict exactly when the downward spiral will accelerate out of control, there is still time to prepare.

Dark though the lens may be, this is the lens through which we here at Casey Research view all our investments. Simply, being right or wrong about your investment decisions in the years just ahead will be insignificant if the currencies underpinning those investments shrivel to just a fraction of their current values.

The dismal state of the US economy and out-of-control government spending affects every American’s life and wealth. In our free online event, The American Debt Crisis – How Big? How Bad? How to Protect Yourself, five Casey Research experts were joined by guests John Mauldin, Mike Maloney and Lew Rockwell to discuss the potential for a breakdown in the monetary system, and specific ways to protect and build your assets. Watch the video now.

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.