Reasons The Stock Market S&P 500 Index Is Headed Below 1,050

Stock-Markets / Stock Markets 2011 Sep 22, 2011 - 08:54 AM GMTBy: Chris_Ciovacco

There are numerous fundamental and technical reasons supporting a move below 1,050 on the S&P 500:

There are numerous fundamental and technical reasons supporting a move below 1,050 on the S&P 500:

- The market is fixated on the approval of the next bailout for Greece. There is little evidence supporting an “all clear” signal in the markets if the next pile of money is delivered to Greece. As signaled by the bond market, Greece is most likely headed for default.

- It may only be a matter of time before the bond market turns its full attention toward Italy. The expression, “Italy is too big to fail, but too big to bail”, says it all.

- Politicians in the United States are more interested in getting re-elected and catering to their core base than solving problems, which is an ongoing and sad commentary on the lack of leadership in this country.

- Before the dot-com bust, investors thought stocks were invincible, which was somewhat rational since the S&P 500 went on a credit-fueled bull run from 1982 to 2000. The NASDAQ, a recent market “leader”, remains 50% below the March 2000 peak of 5,048. Needless to say, as we enter the third bear market in the last eleven years, investors no longer think “stocks always go up”. Consequently, they will be much less willing to listen to the self-serving Wall Street creed of “you have to think long-term”. A mass exodus from stocks could make 2008 look like a correction.

- Before the mother of all credit bubbles burst in 2008, investors believed “housing prices can never go down.” After watching their home equity evaporate before their eyes, homeowners around the globe fully understand that asset prices, all asset prices, fall after a credit bubble bursts.

- Until very recently, investors thought the Fed was omnipotent. Yesterday’s reaction to ‘Operation Twist’ clearly demonstrates the investing public understands fiddling with the money supply and shifting a bond portfolio on the deck of the economic Titanic has significant limitations and unintended consequences. On September 9, we noted the market’s collective yawn to the Wall Street Journal headline, “Fed Prepares to Act.” This was a clear signal the markets were not excited about ‘Operation Twist’.

- Government bailouts and large-scale stimulus spending are a thing of the past. The Fed and deficit spending prevented the last bear market from doing what it wanted to, which was purge all the bad debt and businesses from the system. We cannot hope for a repeat Fed/deficit-spending performance, meaning this bear market could be worse. The S&P 500 could drop well below 1,050 before this bear has run its course.

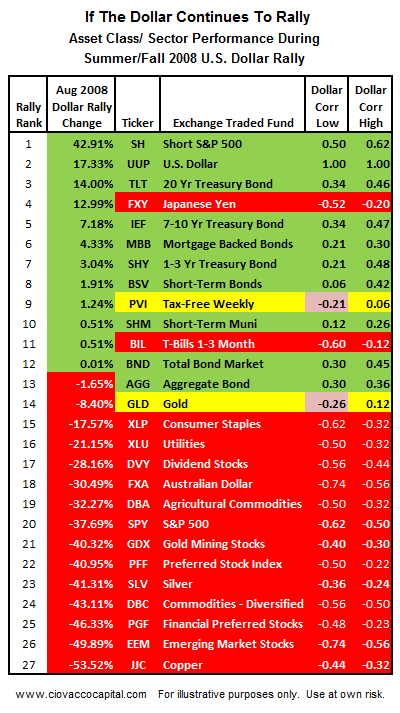

- The official shift from an inflationary bias to a deflationary bias occurred on September 9. Our recent analysis supports a deflationary shift has taken place, meaning the bias for all asset prices is now to the downside. In this stage of the bear market, investment options may be limited to shorting (SH), conservative bonds (TLT), and the dollar (UUP). We own all three. The table below shows asset class performance during a similar period in the last bear market.

- Widely watched retracement levels and long-term trendlines point to possible buying support coming in between 1,018 and 1,044 on the S&P 500 – if we get down that far and bounce, it may offer a good time to consider covering short positions and cutting back on defensive assets.

- Emerging markets have lead markets higher countless times in the last decade or so, including off the 1998, 2009, and 2010 lows. As we highlighted on September 12, emerging markets have been laggards for some time now, which was a big red flag heading into Wednesday’s Fed announcement.

- The technical deterioration in the European indexes points to a crisis that is just getting started, not one that is nearing completion. The mountains of debt and flawed structure of the euro also support that theory.

- The S&P 500 needs to catch up with Europe in terms of declines. As noted on September 13, U.S. stocks recently reached the top of a trend channel that preceded big declines in 2008 and 2010.

- Short position data recently indicated significant downward pressure could still be exerted on stock prices. We are not the only ones that have seen the items listed on this page.

- Stocks dropped over 50% after the technology bubble burst. Stocks dropped over 50% after the housing bubble burst. A logical case can be made that stocks will also drop over 50% in the wake of the bursting of the “Fed bubble”.

- The lack of interest in QE2 winning assets, something we have noted numerous times since August 31, was another deflationary red flag heading into Wednesday’s Fed meeting. Our analysis the day before the Fed announcement also supported a bearish reaction to shifting the Fed’s balance sheet. We were short stocks (SH) and long the dollar (UUP) heading into the 2:15 announcement, a stance that had me questioning our sanity around 2:00 p.m.

- On August 26, our ETF and asset class rankings pointed to more downside in stocks. When the top-ranked ETFs include the VIX (VXX), a short (SH), and bonds (BND), it means something is wrong with the long side of the market.

- Even recent action in gold and silver is leaning toward deflationary or bearish outcomes. The gold:silver ratio remains above its 200-day and the 50-day is above the 200-day. These are deflationary shifts since silver is the more economically sensitive precious metal.

- The parallels to 2000 and 2008 that we presented on August 12 are still in place and they remain concerning. Long-term sell signals are easy to find on weekly and monthly charts.

- The domino effect of crippling levels of debt will eventually impact corporate earnings (see video in post). There are very few, if any, safe haven stocks in a bear market.

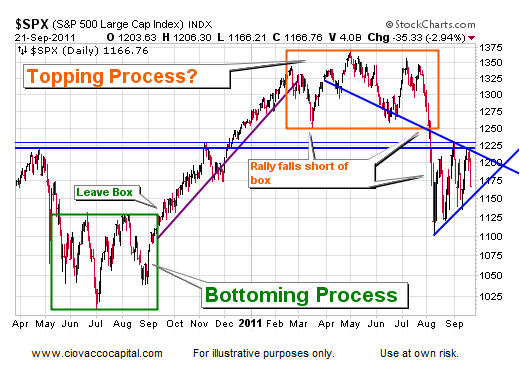

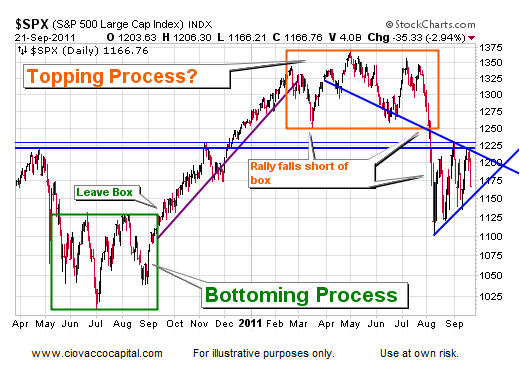

- A clear topping process has unfolded, along with a now almost-officially-failed rally attempt. The chart below was originally presented on August 3; the version below has been updated.

- The slope of the S&P 500’s 200-day moving average is rolling over in a bearish manner. The 50-day moving average is below the 200-day, which is known as a death cross. As our research indicted on August 17, the current death cross, occurring last in an economic cycle, may be more deadly than most.

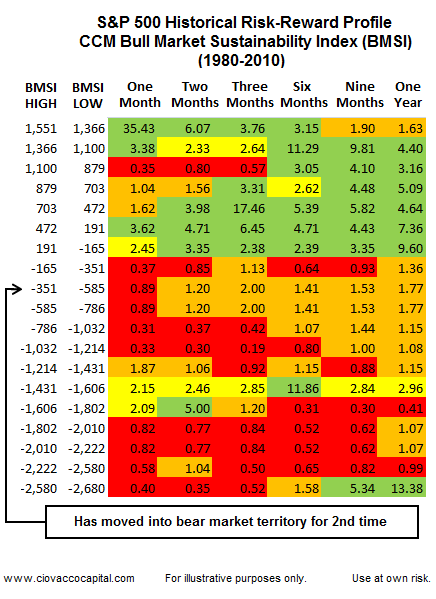

- The CCM Bull Market Sustainability Index (BMSI) officially moved into bear market territory on September 6. On September 22 it dropped all the way down to -601, which clearly aligns with poor risk-reward markets in the past (see table below). A risk-reward ratio below 1.00 is unfavorable and tells us the odds favor lower lows in stocks and risk assets in general.

We will maintain a bearish bias until fundamental (mainly Europe) and technical conditions improve. If the S&P 500 (SPY) breaks below last Monday’s low of 1,136, we would consider adding to our deflationary/bearish stance, which includes bonds (TLT), the dollar (UUP), and a short (SH). Since gold, silver, and gold mining stocks may get caught in the deflationary downdraft for a time (see “If The Dollar Continues To Rally” table above), we may sell our GDX relatively soon.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.