Fed's Twist, ECB's Turn, Euro Shouts

Currencies / Euro Sep 22, 2011 - 08:58 AM GMTBy: Ashraf_Laidi

The FOMC has done what was expected via Operation Twist; buying the same amount of Treasuries ($400 bln) as much it will sell, thereby maintaining the size of its balance sheet at $2.87 trillion. This explains today's jump in USD. And the fact that the Fed stayed away from cutting interest rate on overnight reserves is another positive for USD & negative for equity indices.

The FOMC has done what was expected via Operation Twist; buying the same amount of Treasuries ($400 bln) as much it will sell, thereby maintaining the size of its balance sheet at $2.87 trillion. This explains today's jump in USD. And the fact that the Fed stayed away from cutting interest rate on overnight reserves is another positive for USD & negative for equity indices.

Most market observers were correct in expecting Operation Twist rather than outright QE3. It was highly unlikely for the Fed to adopt an aggressive easing less than 1 week after delivering coordinated USD injection operations with the major central banks. These central banks need to preserve armory for more troubled times ahead (later this year). For now, they will tackle the yield curve and worry later about raising net expansion of liquidity into the system.

We repetitively mentioned to our Premium subscribers that the Feds twist operation will be USD-positive as long as it constitutes no increase in the Feds balance sheet. We mentioned this at the September 8 interview on BNN

EURUSD Cycles & Policy Divergence

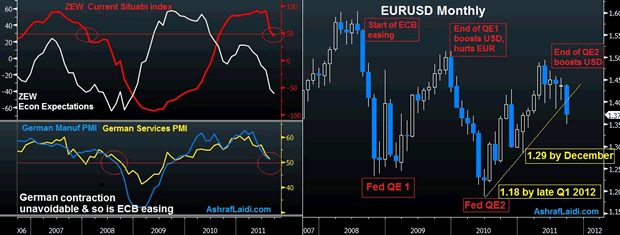

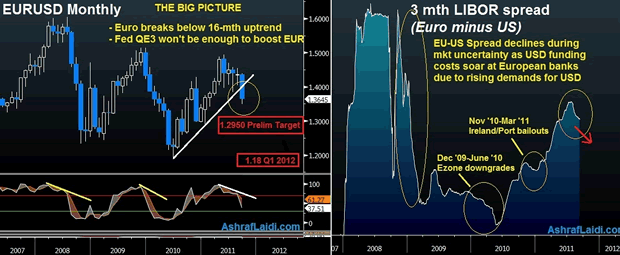

Monetary policy dynamics between the ECB and Fed have largely driven EURUSD cycles over the past 5 years. Each upcycle in EURUSD was boosted by Fed easing and relative ECB hawkishness. (see chart below on the right) The Operation Twist will be inadequately dovish to weigh on USD. Especially negative for the euro is the ECB's ensuing switch into easing mode via asset purchases and the eventual cut in its refi rate.

Germany's Looming Contraction (Yes, Germany)

The justifications for a lower euro have been primarily focused on a looming default of Greece, inadequate size of the EFSF and Italy's unsustainable debt situation. But Tuesday's release of Germanys ZEW investor survey signals that the Eurozone's largest economy is at risk of a looming economic contraction. The ZEW's Current Situation index for September fell below 50 for the first time since June 2010 (a time when Eurozone was dragged by the Greece/Spain/Portugal downgrades), while the economic Expectations Index deteriorated to its lowest since December 2008.

The chart above clearly illustrates that a contraction (sub-50) in the ZEW current situation index (red) has led to a contraction in both of Germany's services and manufacturing PMIs (lower chart). This time it should be no different. As Germany's economic dynamics worsen, they will force the ECB into more activist easing, with an emphasis on boosting growth, while relegating inflation priorities to statistical records.

Trichet Confirmed ECB Shift Ahead of Fed's Twist

The ECB side of the ECB/Fed rate divergence is already emerging. In an Tuesday interview with Spain's Expansion, Trichet described the recent shift in the ECB's economic outlook as "significant", confirming that growth risks are to the downside and inflation risks are broadly balanced. While the comments are no surprise considering this months ECB press conference (which emphasized growth concerns), they highlight the current process of ECB dovishness, which serves to offset the negative USD impact of the Fed's moves into further asset purchases.

EUR-USD Libor Spread to Extend Decline Despite CenBank Injections

In our September 14 note to clients we argued: "The cost of USD funding as measured by USD 3-month LIBOR hits 0.347%, its highest level since August 2010. USD-3-month LIBOR has risen by over 40% in 2 months (was 0.25% in July), a pace not seen since spring of 2010 when euro fell 22% against the US currency. As Eurozone banks rush into raising USD funding to alleviate the unfolding liquidity crunch, the cost of USD funding will further increase, thereby boosting USD. This has now reduced the Euro-USD LIBOR spread to a 3-month low".

1 day later, the central banks of the US, Eurozone, Japan, England and Switzerland injected USD-creating liquidity facilities for those European banks encountering difficulty borrowing in USD.

The EUR-USD spread shall continue to deteriorate and EURUSD is set to extend its path towards our preliminary target of $1.29 (mentioned last week) in light of evolving fundamental and technical dynamics. $1.29 is seen well before year-end, followed by $1.18 in late Q1 2012.

Get your free 1-week trial to our Premium Intermarket Insights on FX, commodities & equity indices.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2011 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.