Euro-zone Debt Crisis Contagion Has Spread

Interest-Rates / Global Debt Crisis Sep 26, 2011 - 06:20 AM GMTBy: Capital3X

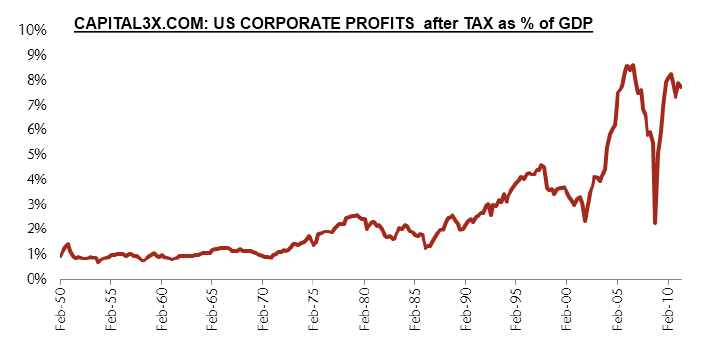

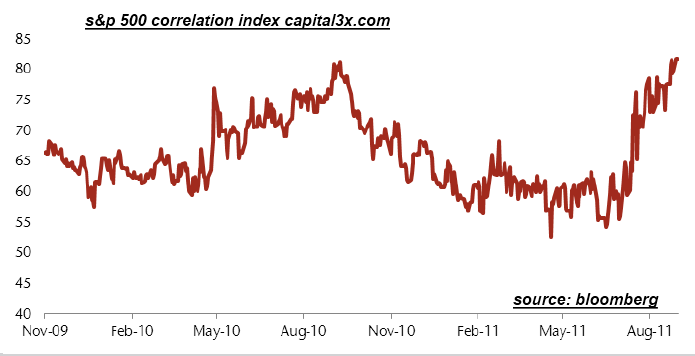

A chart is worth a thousand words and therefore we focus on charts and analysis. So with a few introductory words, we will present the charts.

A chart is worth a thousand words and therefore we focus on charts and analysis. So with a few introductory words, we will present the charts.

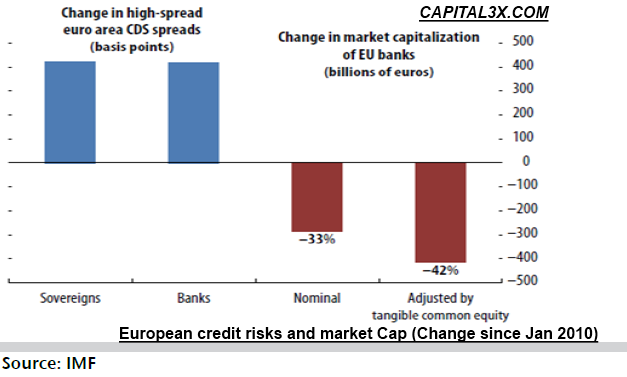

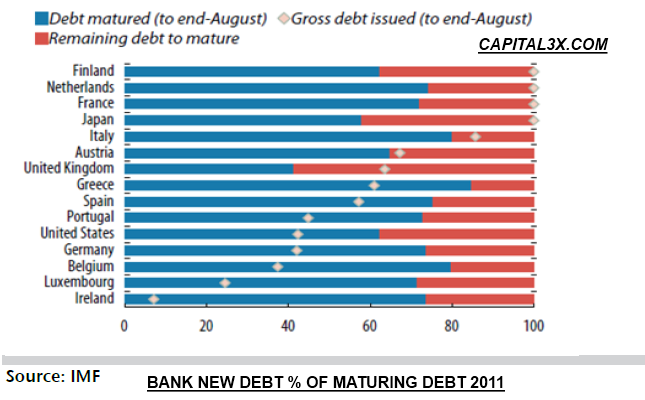

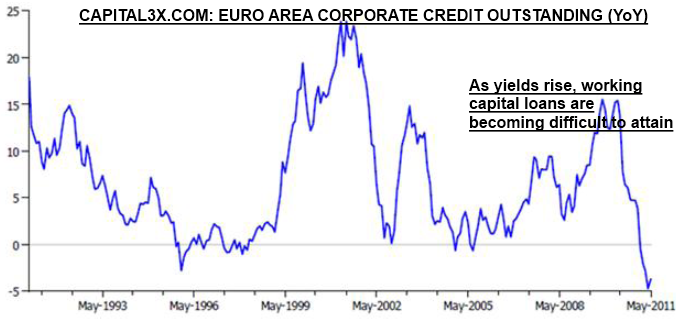

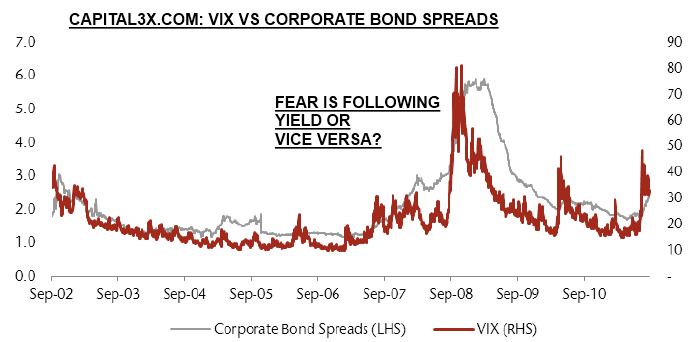

The problem for the policy makers is that risk is being repriced faster than they counteract.The EU banking system is under-strain because they are being denied funding and also deposits are moving elsewhere. The speed of the adjustment is difficult for the banks to maintain their solvency. The confidence virus is a self-reinforcing one that requires an entity to backstop it just as the Fed did it during 2008. The under-capitalised EU banks are being required to de-leverage faster than they can re-capitalise.

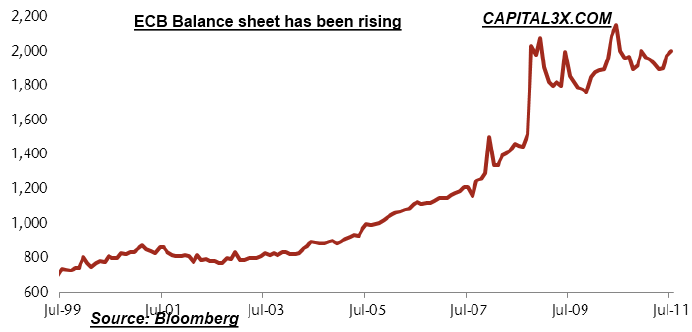

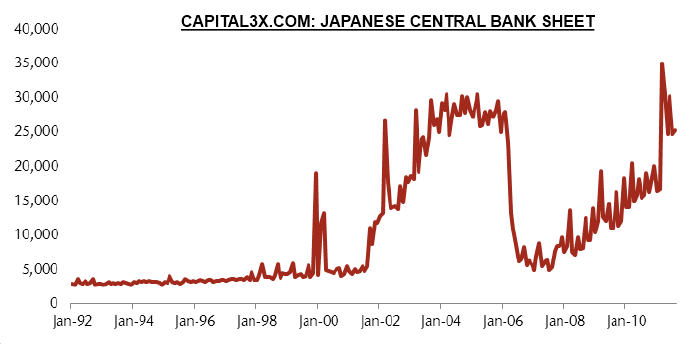

The increasing strains have pushed the EU banks to become more reliant on ECB funding

as a lender of last resort. While the draw-downs are modest at the moment, it hints that as the EU banks need to roll-over more debt, the funding gap will need to be provided by the ECB. Furthermore, other sources of funding may become untenable, particularly the repo

markets if further inter-bank strains became evident.

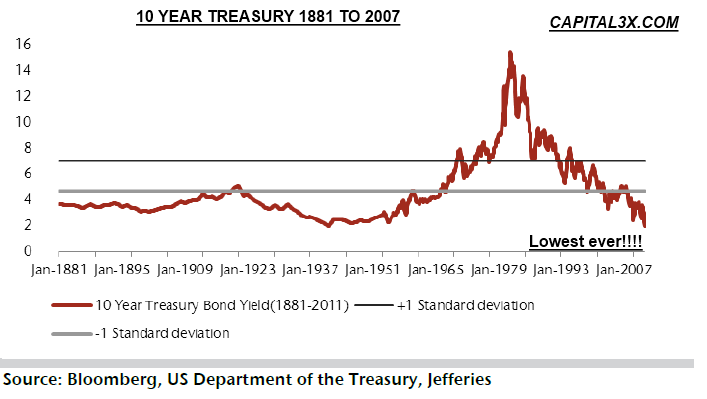

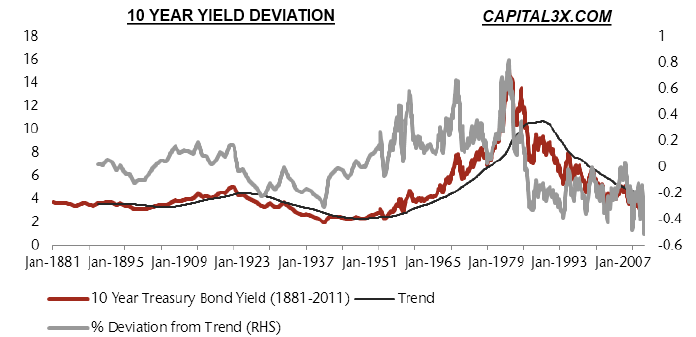

The rapid declines in Asian and emerging market currencies alongside a rallying dollar point to capital flight. It appears that rather than just holding cash overseas, investors are preferring to deposit it in ‘safe havens’.

“Bad news drives out good news”, Spiro Agnew

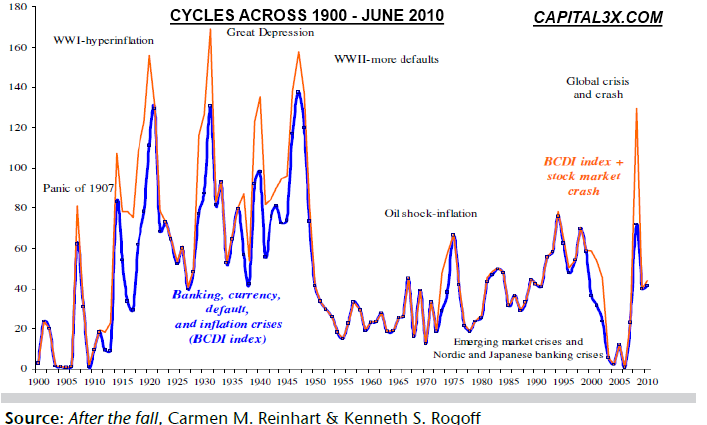

“Severe financial crises rarely occur in isolation. Rather than being the trigger of recession, they are more often an amplification mechanism: a reversal of fortunes in output growth leads to a string of defaults on bank loans, forcing a pullback in other lending, which leads to further output falls and repayment loans, and so on”,

This time is different , Reinhart and Rogoff.

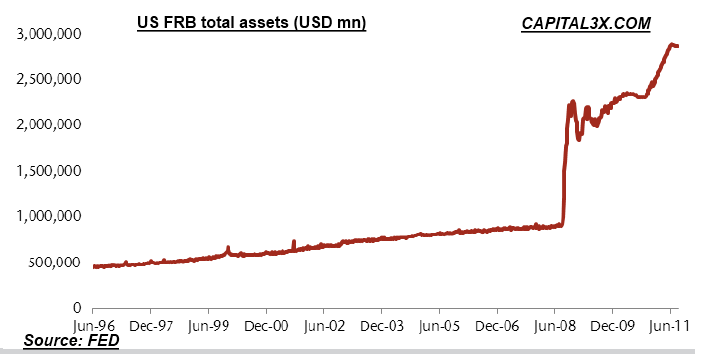

The events of the past two months are not without precedent. Investors who experienced

the 2008 US financial crisis will remember the headlines concerning ‘funding problems

for banks’ or ‘inter-bank liquidity strains’ and the rout in equity prices as investors sought cash at any price. Sovereign defaults and banking crises have been the staple of economic history since 1800. The adoption of fiat currency systems and the ability to develop a ‘fractional banking system’ empowered bankers to expand credit based on their

customers deposits. Thus dis-intermediation was born. Gresham’s law states that ‘bad money drives out good’. However an alternative law has been proposed by Peter Bernholz, called ‘Thiers’ Law”. He showed under some circumstances that good money drives out bad particularly whenever the bad money eventually becomes worthless. In essence if you gave a person the choice between two currencies to own, people will chose the money they consider to have the highest perceived value.

“With US$2.7 trillion in assets, US money market mutual funds (MMMF) are systemically important institutions. Any change in the MMMF willingness to hold European bank paper is likely to affect the cost and availability of dollar funding. Ample dollar funding had also helped to contain pressures in dollar funding markets despite intensifying sovereign risk. That is no longer the case: Offshore dollar denominated issuance by European banks and dollar denominated foreign issuance has begun to decline, as money funds are reluctant to increase exposure to European banks and pressures in dollar funding markets have risen. The cushion of reserves built up by US branches of European banks helps to buy time, but the cushion is at risk of being depleted if a pullback by the money funds is accompanied by a generalised rise in risk aversion among other lenders. This could lead to further pressures in bank funding markets”

IMF Stability report, September, 2011

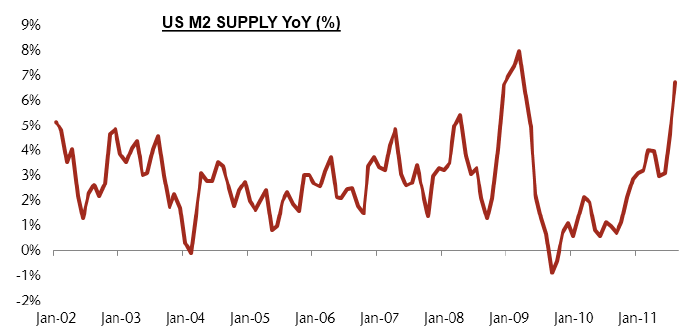

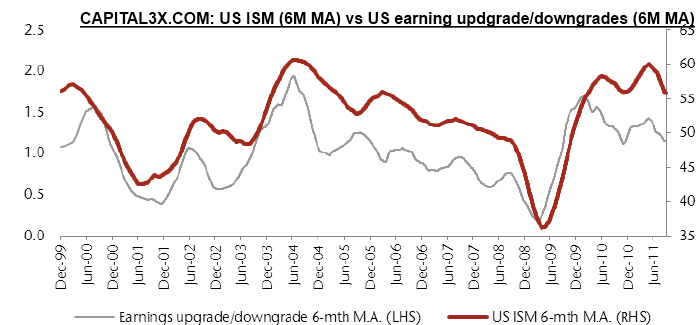

The contagion has quite clearly spread and we are heading for a global fall across asset classes. Our technical analysis had already suggested the scenario on Sept 5 when we were laughed to scorn but obviously we are now been subscribed on a fast scale. We do believe we have not yet seen the end of the fall till the time that Bernanke launched QE3.

If you are not yet a premium subscriber you can do so now and be updated of trend and pattern analysis charts and daily and medium term trade portfolio. Premium Subscription.

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2011 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.