Governor Raskin's Remarks Contain Noteworthy Observations about Credit Markets

Interest-Rates / Credit Crisis 2011 Sep 27, 2011 - 01:59 AM GMTBy: Asha_Bangalore

Fed Governor Raskin’s comments today were largely devoted to soft and worrisome labor market conditions and a justification of the Fed’s unconventional policy actions. She also presented her views about credit availability pertaining to households and small businesses.

She noted that “it seems plausible that the effectiveness of our monetary policy tools is being attenuated by a number of unusual persisting factors, including the excess supply of housing and impaired credit for many households and small businesses.” Paul Kasriel has written extensively about the importance of credit in an economic recovery and how the credit contraction following the financial crisis has trimmed the pace of economic growth. It appears that Governor Raskin’s remarks partly echo this opinion.

She went to add that “lenders continue to maintain relatively tight terms and standards on credit cards and, to a lesser extent, other consumer loans. Consequently, many households may be unable to take advantage of the lower borrowing rates that are available to those who have a high net worth and pristine credit records.”

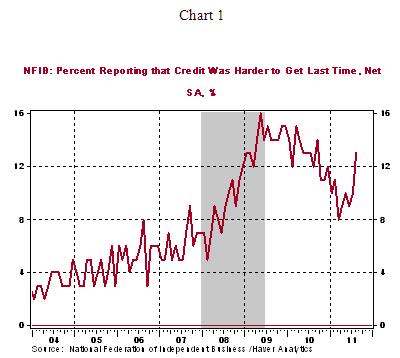

With respect to the woes of small businesses, Governor Raskin cited the latest National Federation of Independent Businesses, which indicated that there was an increase in the percentage of small businesses reporting that “credit has become difficult to obtain.”

Governor Raskin makes a telling point that “a smooth transmission mechanism” in which low interest rates would fuel credit and lead to an economic expansion is not in place. As a result, households are not purchasing homes at historically low rates and businesses are not borrowing to finance payrolls, capital investment, inventories and other operating expenses. The implication here is that credit has to grow to get the economy back on its feet once again.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.