Goldman and BOA Maintain 12 Month Gold Forecasts of $1,860 & $2,000

Commodities / Gold and Silver 2011 Oct 05, 2011 - 02:01 PM GMTBy: GoldCore

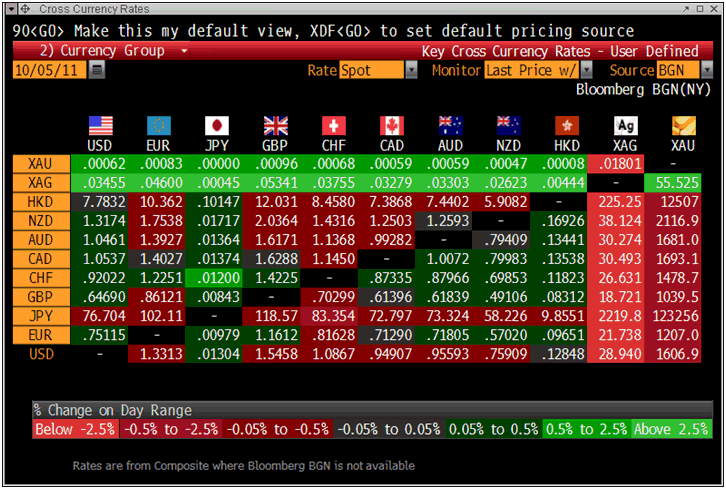

Gold is 1.3% lower in US dollars and has fallen in all currencies today and is trading at USD 1,606.90, EUR 1,207/oz, GBP 1,039.50, JPY 122,637.90, AUD 1,672.28 and CHF 1,474.38 per ounce.

Gold is 1.3% lower in US dollars and has fallen in all currencies today and is trading at USD 1,606.90, EUR 1,207/oz, GBP 1,039.50, JPY 122,637.90, AUD 1,672.28 and CHF 1,474.38 per ounce.

Gold’s London AM fix this morning was USD 1,600, EUR 1,202.56, and GBP 1,035.40 per ounce. Yesterday’s AM fix was USD 1,672, EUR 1,267.05, and GBP 1,086.35 per ounce.

Cross Currency Rates

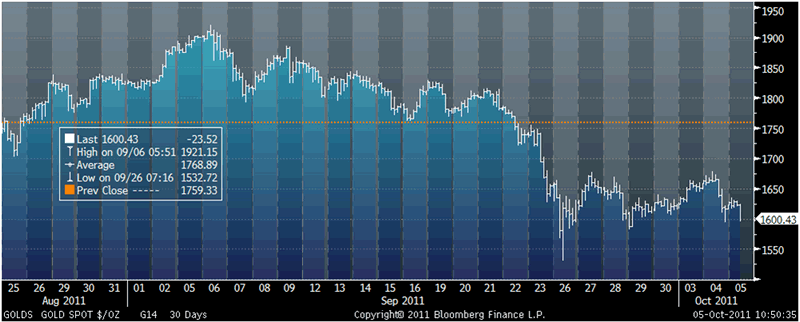

Gold rose nearly 1% in early trade in Asia to a high of $1,635/oz. Gold remained higher until sharp selling was seen at 09:20 GMT this morning leading to gold falling to $1,597.35/oz just before the London AM Fix. A fall below yesterday’s low of $1,596.05/oz could lead to a sharp fall to the low from September 26th when gold fell to $1,532.72/oz.

Gold in US Dollars - 30 Day (Tick)

Yet another unsourced rumour - this time that European Union officials are examining ways to recapitalize banks in the region - led to a massive short squeeze which propelled US indices some 4% higher. Bernanke’s comments that he would take further action to support the fragile US economy likely also supported equities and hindered gold.

Given the flimsiness of the EU bank rumour, it is worth considering whether the Working Group on Financial Markets may have intervened in order to prevent further sharp declines in stock markets and a possible crash.

Asian indices greeted the rumour with skepticism and were more subdued especially after the slashing of Italy’s credit rating by three notches. This saw the Nikkei fall another 0.86% while other Asian indices were mixed.

European stocks rose at the open amid the continuing speculation regarding “assistance” for European banks.

Continuing signs that this latest price decline is another sell off due to speculators taking profits and being forced out of positions due to margin calls continues to be seen in the very robust demand being seen in Asia.

These strongly suggest that the fundamentals of the gold bullion market remain sound.

Premiums on gold bars in Asia have remained steady at $2 an ounce to spot London prices in Singapore. These are the highest premiums since February. Vietnam gold bars were at a premium of $72.49 to world gold of $1,662.90 (Monday $88.81/$1,632.35) yesterday morning.

Markets in Hong Kong were closed for the holidays as the Chinese ‘Golden Week’ continues. Thus, no premiums were available from Hong Kong.

Physical demand has surged across Asia after the recent decline in gold prices and this is leading to a “tight supply of gold bars in Singapore and Hong Kong” according to Reuters this morning.

Reuters quoted a physical dealer in Singapore who said that he believed "supply is going to be tight until the end of October. It's difficult to generate enough stocks without any selling back from the market."

Past experience is leading western gold and silver buyers to be more savvy and we are seeing far more buying on this dip and far sooner than on previous sell offs. Throughout this bull market GoldCore have tended to see stronger buying as gold moved towards intermediate highs and a lack of buying on sell offs and when gold was at intermediate lows.

There is a notable change on this sell off as some clients were reluctant to buy when gold was surged over $1,900/oz and left cash on account. These same clients have begun accumulating again in recent days.

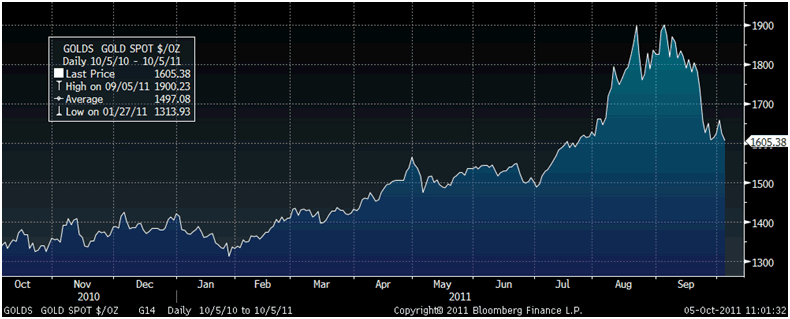

Gold – 1 Year (Daily)

Analysts at Goldman Sachs reiterated their 12-month gold price target of $1,860 an ounce as the fundamentals have not changed.

”As we expect gold prices will continue to be driven in large measure by the evolution of U.S. real interest rates and with our U.S. economic outlook pointing for continued low levels of U.S. real rates in 2012, we continue to recommend long trading positions.”

Bank of America Merrill Lynch said it was maintaining a forecast for gold to reach $2,000 an ounce in 12 months, the bank said in a report today.

SILVER

Silver is trading at $29.00/oz, €21.71/oz and £18.74/oz

PLATINUM GROUP METALS

Platinum is trading at $1,444.00/oz, palladium at $558/oz and rhodium at $1,575/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.