Gold Accepted as Collateral by LCH.Clearnet; ECB and BoE Likely to Keep Rates Ultra Loose

Commodities / Gold and Silver 2011 Oct 06, 2011 - 07:51 AM GMTBy: GoldCore

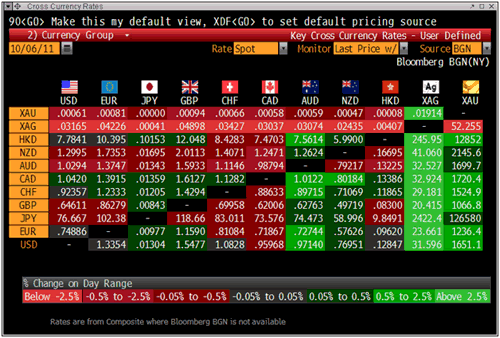

Gold is trading at USD 1,650.20, EUR 1,235.92, GBP 1,066.23, JPY 126,484.50, AUD 1,698.96 and CHF 1,524.98 per ounce.

Gold is trading at USD 1,650.20, EUR 1,235.92, GBP 1,066.23, JPY 126,484.50, AUD 1,698.96 and CHF 1,524.98 per ounce.

Gold’s London AM fix this morning was USD 1,649.50, EUR 1,234.19, and GBP 1,065.43 per ounce. Yesterday’s AM fix was USD 1,600, EUR 1,202.56, and GBP 1,035.40 per ounce.

Cross Currency Rates

ECB and BoE Likely to Keep Rates Near Zero as Universal Currency Debasement Continues

Markets await key central bank announcements from the ECB and the BoE. The ECB is likely to keep rates on hold at 1.5% and the Bank of England is also expected to keep its benchmark rate unchanged at 0.5%.

Inflation is at 3.0% in the Eurozone and 4.5% in the UK. Thus negative real interest rates continue which continues to make non yielding gold attractive. Negative real interest rates have been a key driver of higher gold prices and will likely continue to be.

Despite deepening inflation there is speculation that there is a chance that both banks will reduce interest rates, if not today, then at the next meeting. This would likely put further pressure on both the euro and the pound and see gold make further gains against both currencies.

The BoE is expected to announce further quantitative easing measures in the form of another tranche of some £100 billion ($154.60 billion) in asset purchases. The market is divided over whether this will be announced Thursday or at the next meeting in November.

The spectre of Eurozone quantitative easing (QE) or euro printing is no longer unthinkable given the scale of the European banking and sovereign debt crisis.

The German experience of the Weimar hyperinflation makes them rightly extremely wary of money creation (printing or electronic) on a grand scale.

However, political pressures may see money creation en masse in order to buy not just Greek, Irish and Portuguese paper but the paper of the other peripheral European governments such as Spain, Italy and other Eurozone countries.

Universal currency debasement continues as seen in the monetary policies of the BoE, ECB, Federal Reserve and even the central banks of Japan and Switzerland.

Currency debasement benefits financial, banking and sovereign government interests in the short term at the expense of citizens – particularly the frugal, savers and those on fixed incomes such as pensioners and social welfare recipients.

In the long term, society as a whole suffers from virulent inflation and hyperinflation as it can lead to the collapse of governments and societies as paper assets and currencies lose their purchasing power.

Gold and silver protect against this risk.

The risk is of hyperinflation remains low but it is rising and is only dismissed out of hand by the naïve and those without a historical understanding of currency debasement. At the very least the extremely loose monetary policies of recent years and continuing today are likely to lead to inflation and stagflation.

Stagflation is a real possibility given the real deflationary pressures continuing due to the massive debt burdens globally. This will exert downward pressure on non essential goods, luxury items and goods and assets that are bought using debt such as cars and property.

While ultra loose monetary policies, money printing and currency debasement are likely to lead to inflation with regard to the essentials of life – such as food and energy.

Any significant deflationary event, recession and/or depression will almost inevitable lead to even greater money creation. Therefore deflation poses a short term risk but as ever in a fiat monetary system the real long term risk is inflation.

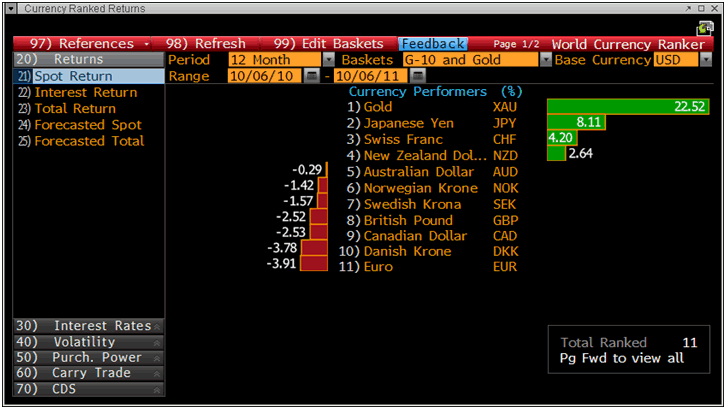

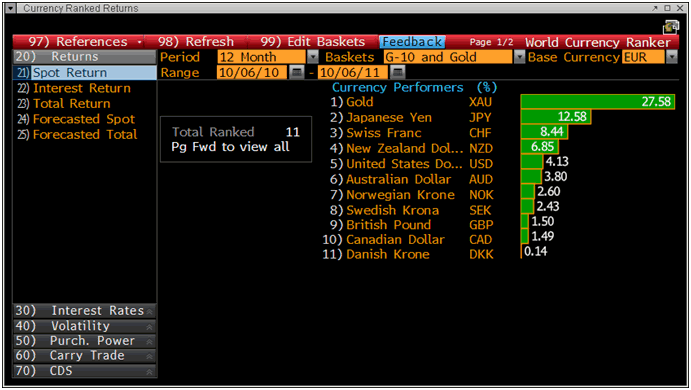

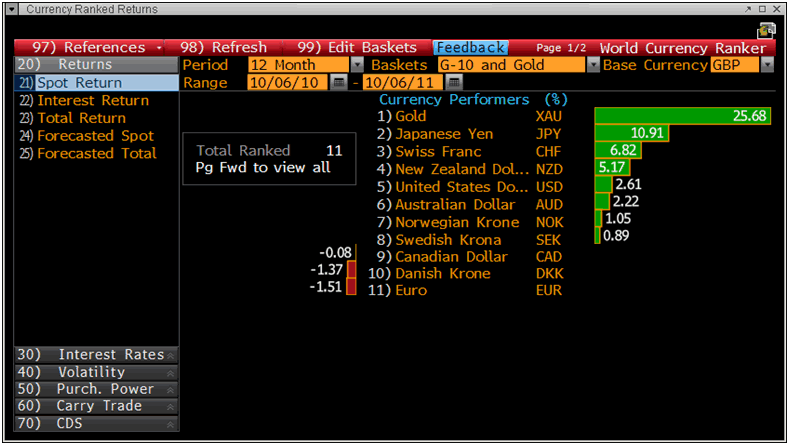

The outperformance of gold versus fiat currencies as seen in the ‘Currency Ranked Returns’ tables above is likely to be seen again in the coming months.

Gold Accepted as Collateral by LCH. Clearnet as Gold Becomes Safe Haven Asset and Money Again

Gold’s remonetisation in the international financial and monetary system continues.

LCH.Clearnet Group Ltd. made an important announcement today that they will accept gold as collateral by the end of October.

LCH.Clearnet are an independent clearing house, serving major international exchanges and platforms, as well as a range of OTC markets. They clear approximately 50% of the $348 trillion global interest rate swap market and are the second largest clearer of bonds and repos in the world. In addition, they clear a broad range of asset classes including commodities, securities, exchange traded derivatives, CDS, energy and freight.

Last July LCH.Clearnet announced that they were considering allowing gold bullion to be used as collateral and they have confirmed that today.

LCH. Clearnet announced today that “the initiative is supported by the World Gold Council, who recently submitted evidence to the Basel Committee for gold to be included in banks’ ‘Tier 1’ assets by European banking regulators, recognising gold’s growing relevance as a high quality liquid asset.”

Gold bullion bars will be lodged in vaults in London. The quality and fineness of the 400 troy ounce gold bars will be based on the LBMA Good Delivery List.

David Farrar, Director, LCH.Clearnet said “Market participants want greater choice when it comes to assets that can be used as collateral. Gold is ideal; as an asset it typically performs well in times of financial stress, remains liquid and has a well established pricing mechanism.”

We pointed out the importance of this development last July but it was ignored by most of the media and even the blogosphere.

The news comes in the wake of the announcement on Monday by the CME Group that they will increase to $500 million the amount of physical gold its U.S. clearing members can post as collateral for margin requirements, from the existing $200 million.

Both developments are extremely bullish for the gold market.

With counterparty and sovereign risk remaining elevated, gold is no longer being seen simply as a commodity. Rather, it is increasingly viewed by market participants as an important asset and a currency with no counterparty risk.

We are gradually seeing the remonetisation and indeed the ’financialisation’ of gold, as gold is gradually being reincorporated into the modern financial and monetary system.

Keynes’s ‘barbaric relic’ is becoming less barbaric by the day. However, the man on the street remains completely unaware of this trend and continues to sell gold (jewellery) rather than buy gold (bullion) as clearly seen in the international phenomenon that is cash for gold.

Huge developments in the gold market such as this continue to be ignored by non specialist financial media and its implications not realized by many so called experts. They continue to see gold simply as a commodity, an investment or a “bubble” rather than as a finite currency and as money.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $31.25/oz, €23.48/oz and £20.41/oz

PLATINUM GROUP METALS

Platinum is trading at $1,505.20/oz, palladium at $591/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.