Warning U.S. HyperInflation Ahead

Economics / HyperInflation Oct 09, 2011 - 02:20 AM GMTBy: Seth_Barani

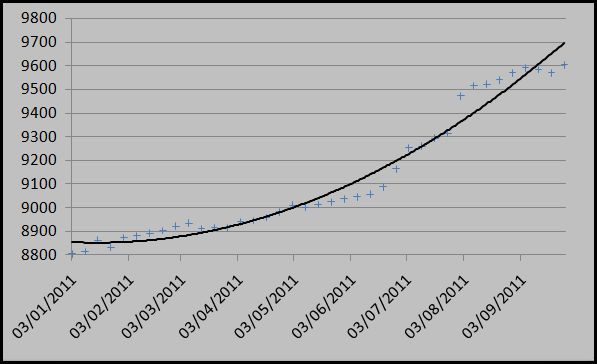

Money Supply M2 has expanded at Warp-9 within the past few months, based on Federal Reserve Data released on Sep.30th. In fact, the ratio of M2 to M1 has set a World Record, exponentially growing to over 5:1 (M2 is near $9.6 Trillion, over 12% growth this year so far, projected to show 15% growth in one year, while M1 has remained constant near $2 Trillion.)

Money Supply M2 has expanded at Warp-9 within the past few months, based on Federal Reserve Data released on Sep.30th. In fact, the ratio of M2 to M1 has set a World Record, exponentially growing to over 5:1 (M2 is near $9.6 Trillion, over 12% growth this year so far, projected to show 15% growth in one year, while M1 has remained constant near $2 Trillion.)

Chart below shows the growth of M2 in 2011:

The daily price chart of Gold is shown next.

The gold price is sitting precariously near the 100-day moving average awaiting a breakout on either side. The custom indicator Regression line is plotted in Aqua. Bollinger Bands are drawn at 65 to coincide with CCI indicator of 100 (not shown). If Gold Price breaks towards upside, it will indicate the onset of hyperinflation in US not adequately countered by interest rate hikes. If it breaks to the downside, it would imply that interest rates are poised to increase in US as early as April 2012, notwithstanding Fed's earlier gaffe about staying with low rates for long. High Octane CPI numbers will force the Fed to play the catch up game. Now that the Fed has opted for the "twist plan" to help the government to lock in low rates for long term bond, there is nothing holding the Fed back from raising the short term rates. Hence, it is the opinion of this author that Fed will be in a hurry to raise interest rates quickly and all through 2012-2014 and may not be able to control inflationary pressures early on mainly because of their concerns about job market. If you thought Bernanke had a difficult time, next Fed Chairman Fisher's job will be unenviable.

Of course, there is no guarantee that M2 expansion will improve the job market. As some more experienced authors have pointed out, this is going to be a Hyperinflationary Depression in United States. The Fed will be creating and fighting the inflation. The OWS class will live through depression. This is the consequence of artificial inflation being incapable of creating real economic activity. With nearly 78% of workforce employed in service sector, there is little scope that manufacturing can pick up and show growth. For that matter the latest nonfarm payroll data details showed the manufacturing sector actually lost jobs (and the NFP data itself is partly fudged by including the Verizon workers returning from a 2 week strike as newly employed...).

Money supply alone is insufficient to overcome depression. The haves and havenots are in disjoint circuits. Until and unless efforts are undertaken to circulate the money through the less fortunate class, it will flow in short circuit within the wealthy class. Some of the economic indicators of this scenario would be (a) improved sales of luxury goods (b) falling sales of economy class goods. The poor class has ruined credit profiles, untrained in new skills for many years, and often beyond an age group preferred by many employers. Certain level of financial amnesty may be required to help them rejoin the economic activity.

Reference:

- M1 data is available at http://research.stlouisfed.org/fred2/data/M1.txt

- M2 data is available at http://research.stlouisfed.org/fred2/data/M2.txt

Author Seth Barani is a PhD in physics and is a freelance capital market researcher and trader. He can be reached at s.barani@gmail.com.

© 2011 Copyright Seth Barani - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.