Gold Likely Heading Lower, Silver in a Bear Market

Commodities / Gold and Silver 2011 Oct 09, 2011 - 06:21 PM GMTBy: Ned_W_Schmidt

2011, quickly moving toward history book status, may be known more for what did not happen than what did. Hyperinflation may still be lurking, but for about the fourth year is yet to be seen. U.S. dollar should have been to zero, per the many popular forecasts, at least twice. Euro's imminent demise has been quietly rescheduled for 2012. Beginning of Silver's decade became instead the beginning of Silver Bear Market II. $Gold is not trading above $2,000. Guess that means $5,000 was not reached either. Fourth year in a row for the conspicuous absence of hurricanes in Florida. So much for weather gurus, climate change, Keynesian forecasters, and other forms of sorcery.

2011, quickly moving toward history book status, may be known more for what did not happen than what did. Hyperinflation may still be lurking, but for about the fourth year is yet to be seen. U.S. dollar should have been to zero, per the many popular forecasts, at least twice. Euro's imminent demise has been quietly rescheduled for 2012. Beginning of Silver's decade became instead the beginning of Silver Bear Market II. $Gold is not trading above $2,000. Guess that means $5,000 was not reached either. Fourth year in a row for the conspicuous absence of hurricanes in Florida. So much for weather gurus, climate change, Keynesian forecasters, and other forms of sorcery.

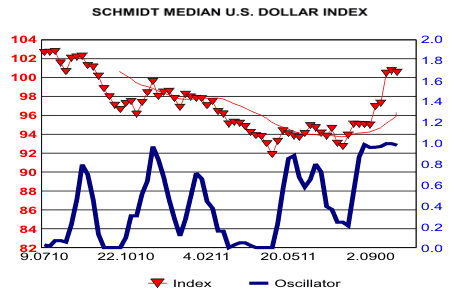

As the above graph portrays, the U.S. dollar did not become worthless. Rather, it has staged an unexpected, that is if one is a consistently confused regular on CNBC, rally. Dollar's value is now at a high for the year, having erased all of the earlier depreciation.

Two reasons primarily explain this rally. First, the end of QE-2 and the decision to not implement

QE-3 certainly helped. Operation Twist II, part of the Federal Reserve's relentless pursuit of failure, is a meaningless gesture to date.

A more important explanation is the dollar shortage being created by those hoarding dollars. Seems no one wants to lend EU banks burdened by billions of bonds issued by the PIGS. That has caused EU financial institutions, even the good ones, to frantically seek out dollars in order to continue funding their balance sheets.(See collapse of Dexia, Franco-Belgian bank.) In part, such is the reason the Gold lease rate has been negative.

That dollar rally capped Gold. As a currency alternative to the dollar, Gold should move directionally opposite of the value of the dollar. That is simply the math of the situation. To expect otherwise is to insure unhappiness.

No group, we note, has had a worse forecasting record over the past twenty years as the Keynesian-Elitists filling our academic institutions and governmental policy making centers. But, that is good. Knowing someone is always wrong is as helpful as knowing someone that is generally correct.

Woeful failure of Keynesianism is now well documented. Like many economic theories that have failed, it should be discarded. However, too many Keynesian-Elitists have been created by our academic institutions, and they are still spouting loudly their outdated gibberish.

Those purveyors of economic failure recommend that nations abandon the Euro. Some continue to forecast the dissolution of the Euro area. The era of multiple national currencies has been long recognized as an economic failure. Do not forget that is the reason the Euro was created. The world does not need more currencies. It needs no currencies. Leaving the EU is to enter an economic death spiral, and all in the EU know that. Will these same gurus be recommending that Illinois go off the dollar as near bankruptcy approaches in that state? Should the financially dysfunctional California issue its own peso?

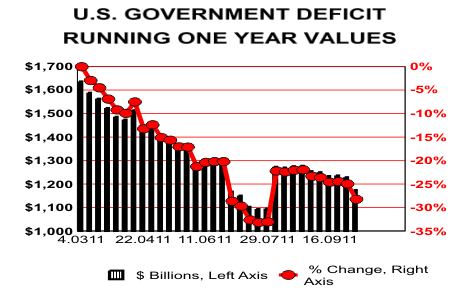

Does the above graph portray another reason for the dollar's strength? In it is portrayed, with black bars, the true deficit of the U.S. government on a trailing one year basis, plotted weekly. Thanks to the lack of cooperation in the U.S. Congress, the U.S. deficit has been shrinking.

U.S. government reports on a unified budget basis, which is intended to mislead. A unified budget includes operating budget of the government plus what has been an annual surplus in the social security scheme. When the social security system is running a surplus, the reported budget deficit is understated. When social security system starts running a deficit, the unified budget deficit will make the reported deficit larger. Watch for abandonment of the unified budget concept in coming years.

With the U.S. dollar no longer in collapse and the likelihood of the Euro disintegrating now not worth discussing, should we sell our Gold? No, unequivocally. Until we purge the Keynesian-Elitists from Western governments, Gold will have a role in portfolios. Until we purge the intellectually inbred academics from the Federal Reserve, Gold will have a portfolio role. Until a sunshine law is passed forcing the Federal Reserve to have meetings open to the public, Gold should be owned.

However, let us never adopt the foolish naivety of the Street. Investments go up and down. Silver, now in a bear market, must put in place that classic low marked by pain and agony. Gold is likely to move lower as speculators are purged from that market. Accumulating funds in Chinese Renminbi denominated bank deposits or ETFs until such time is likely a wise move.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.