Cash Rich Firms Will Not Hire and Invest Until Demand Gains Momentum

Economics / US Economy Oct 14, 2011 - 03:18 AM GMTBy: Asha_Bangalore

Non-financial corporate firms were holding $2.047 trillion in liquid assets in the second quarter of 2011. These liquid assets (Sum of foreign deposits, checkable deposits/currency, time & savings deposits, money market fund shares, security RPs, commercial paper, US government securities, municipal securities, and mutual fund shares) as a percent of short-term liabilities are close to historical highs (see Chart 1).

Non-financial corporate firms were holding $2.047 trillion in liquid assets in the second quarter of 2011. These liquid assets (Sum of foreign deposits, checkable deposits/currency, time & savings deposits, money market fund shares, security RPs, commercial paper, US government securities, municipal securities, and mutual fund shares) as a percent of short-term liabilities are close to historical highs (see Chart 1).

It is also noteworthy that liquid assets vis-à-vis total liabilities are at the highest level since the late-60s (see Chart 1). So, what is preventing firms from increasing their payrolls, purchasing new equipment, and building new plants?

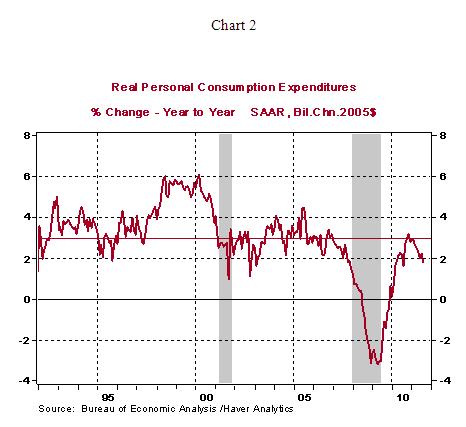

As we have written in several commentaries, a soft labor market and the resulting soft trend in consumer spending are factors that explain tepid business conditions. On average, consumer spending in the last 20 years grew at a nearly 3.0% pace (see Chart 2); the pace of consumer spending in the June-August months has slowed to 2.0%, an entire percentage point decline in the largest component of GDP.

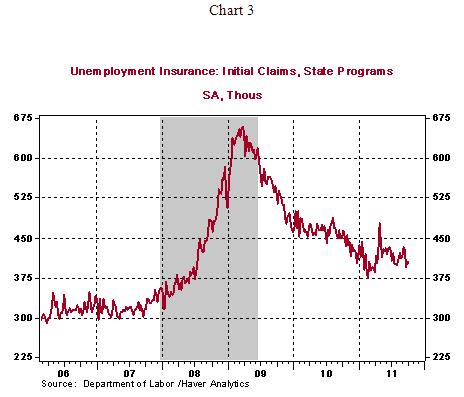

The elevated unemployment rate (9.1%) after four years of economic recovery remains at top of the Fed’s worry list. The latest initial jobless claims report once again indicates reluctance on the part of firms to hire. Initial jobless claims fell 1,000 to 404,000 during the week ended October 9. Continuing claims, which lag initial jobless claims by one week, declined 55,000 to 3.67 million.

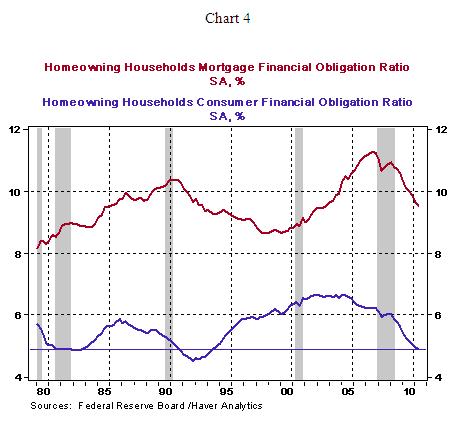

Households have shifted from a spending frenzy prior to the onset of the crisis to a phase marked with balance sheet consolidation, particularly by paying off debt. The non-mortgage financial obligation ratio (minimum debt service obligations as a percent of disposable income) has declined to 4.9% in the second quarter of 2011 (see Chart 4), the level last seen in 1994.

The current focus of deleveraging in an environment of soft labor market conditions has translated into a deceleration of consumer spending. In other words, strong and sustained consumer demand is the key to shake off this economic stupor and get cash rich firms to hire and invest.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.