Bank Earnings, Heads I Win Tails You Lose

Companies / Banking Stocks Oct 24, 2011 - 02:17 AM GMTBy: Tony_Pallotta

The "Too Big To Fails" have reported Q3 2011 EPS and in a word, horrible. On the surface earnings looked like another beat on both the top and bottom line but simply reading through the press release reveals the truth about how desperate the banks are right now.

The "Too Big To Fails" have reported Q3 2011 EPS and in a word, horrible. On the surface earnings looked like another beat on both the top and bottom line but simply reading through the press release reveals the truth about how desperate the banks are right now.

Their ability to generate real income has simply vanished. With a flat yield curve, constrained consumer and a balance sheet loaded with risk they only have one tool left. Their last line of defense between the reality of insolvency and the absurdity of accounting is known as CVA.

Credit Value Adjustment (CVA) is an accounting practice that allows use of the "market" value of debt as compared to the par value.

For example Company A issues $100 in bonds with a 5% coupon payment. In 10 years when the bond matures Company A pays $100 to the holder of the bond. During the life of the bond though it is traded on the secondary market. Assume Company A gets into financial trouble. The owner of the bond wants more than 5% in annual interest due to the increased risk so they offer to buy the bond from another investor (again on the secondary market, Company A already was paid their $100 from the original investor) for $50 versus the par value of $100.

The new owner of the bond now receives the 5% interest but since they spent half of the par value (remember Company still pays $5 for every $100 in par) they are actually collecting 10%. Additionally assuming Company A does not default when the bond matures they pay full par value of $100. Not a bad trade for the investor assuming Company A does not default.

So far so good but here is where it gets laughable from an accounting standpoint. In theory Company A could buy back the $100 in debt they owe for $50. So in essence they only owe half of what they originally borrowed. The way they would recognize this is by recording as income the difference between "market value" and "par value." They still owe the same $100 and they certainly don't have the capital to buy back the debt but for some reason they can record the difference as income.

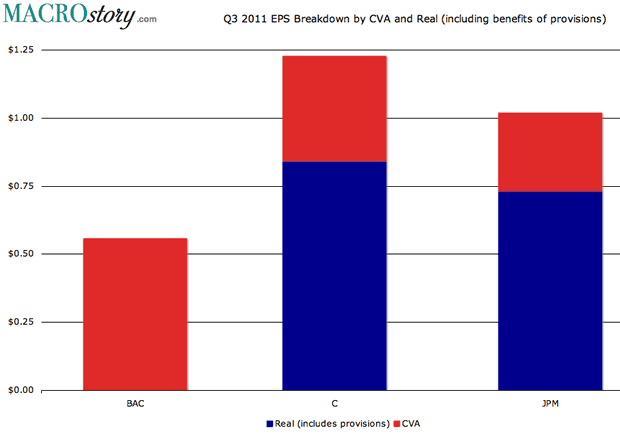

This is exactly what the banks have done in Q3. As counter party risk of these banks has grown, their debt has risen in yield (fallen in price) and this is viewed from an accounting standpoint as a favorable impact on earnings. How favorable and how prevalent? Look at the chart below showing the reported EPS for BAC, C and JPM and the portion that is attributed to CVA.

In other words BAC would have reported EPS of zero and JPM and C would have fallen well below estimates. Beyond "suspect accounting" the simplest way to understand how well the banks are or are not doing is to simply look at their ability to generate income before provisions for loan losses as compared to those provisions for loan losses. Simply stated can they generate the income needed to cover loan losses?

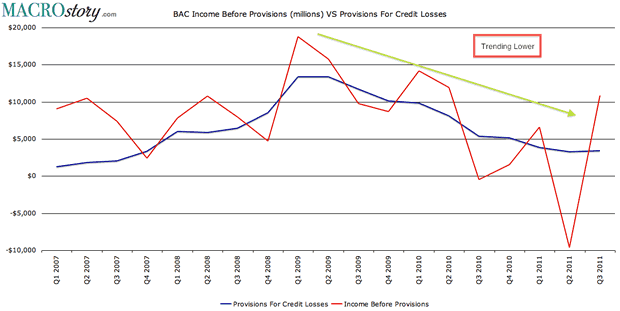

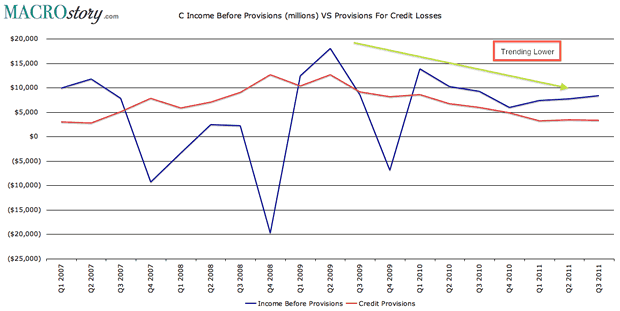

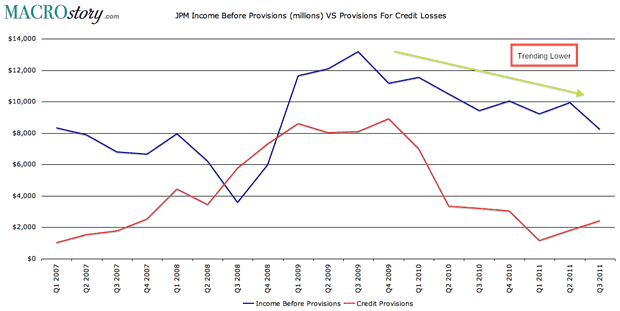

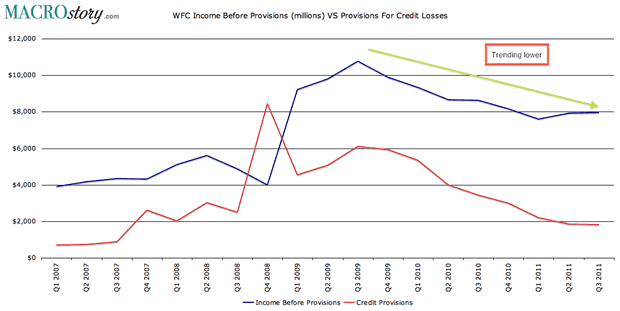

Income Before Provisions For Loan Losses

Since Q4 2009 an interesting trend has developed. Pre provisional income has fallen. With flat revenue growth and rising non operating expenses (overhead to handle foreclosures, litigation, etc) their income is simply diminishing. At the same time they have begun reducing provisions for loan losses.

One could say they reserved so much during the height of the crisis they can now begin to reverse those provision which by the way make pre provisional income look that much better. Problem with that logic is home prices are falling. Labor market are deteriorating and probably worse is the reality that second lien mortgages still remain fully valued versus the reality of the losses they will impose on future earnings.

So the answer to the question can pre provisional income service future losses? Assuming housing has bottomed maybe. Assuming housing stays flat or depreciates further definitely no.With the GSEs and banks themselves calling for further home price depreciation it's even more ironic that they are reducing provisions for future losses.

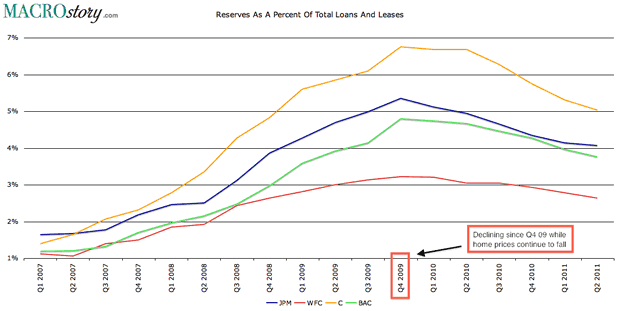

Reserves As A Percent Of Total Loans And Leases

Following up on the point above, notice the chart below of the reserves for loan losses as a percent of total loans and leases. See how they peaked in Q4 2009. This is while home prices have continued to fall.

Let's assume the most probable outcome and that being housing continues to depreciate. At some point banks will once again be forced to increase reserves for loan losses which is a negative on earnings as witnessed during 2008. Making matter worse now though versus 2008 is pre provisional income is also flat to declining.

But wait all is not lost. Under that scenario the perceived risk of their bonds will increase meaning the cost of that debt will fall which will give the banks another chance to pad earnings through CVA. Heads I win, tails you lose.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.