Will Modified Program to Alleviate U.S. Residential Housing Mortgage Problems Raise Consumer Spending?

Housing-Market / US Housing Oct 25, 2011 - 02:55 AM GMTBy: Asha_Bangalore

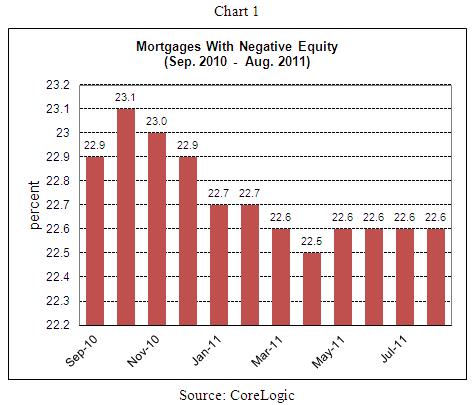

The Federal Housing Finance Agency (FHFA), the regulator of Fannie Mae and Freddie Mac and the 12 Federal Home Loan Banks, announced a modification of the original Home Affordable Refinance Program (HARP) passed in 2009. The main objective is to make refinancing easier for people with mortgages backed by Fannie Mae and Freddie Mac. HARP allows borrowers whose mortgage is worth more than the current value of their homes to refinance and take advantage of the low interest rate environment. CoreLogic estimates that currently 22.6% of mortgages (10.8 million mortgages) exceed the current value of homes (also referred to as under water mortgages or mortgages with negative equity).

The Federal Housing Finance Agency (FHFA), the regulator of Fannie Mae and Freddie Mac and the 12 Federal Home Loan Banks, announced a modification of the original Home Affordable Refinance Program (HARP) passed in 2009. The main objective is to make refinancing easier for people with mortgages backed by Fannie Mae and Freddie Mac. HARP allows borrowers whose mortgage is worth more than the current value of their homes to refinance and take advantage of the low interest rate environment. CoreLogic estimates that currently 22.6% of mortgages (10.8 million mortgages) exceed the current value of homes (also referred to as under water mortgages or mortgages with negative equity).

The FHFA announced modifications of the original HARP which includes removing the current 125% cap on loan-to-value ratio. In other words, borrowers owing more than 125% of their home’s value can tap into this program, while eliminating limits set under the original HARP. Requirement of an appraisal may be waived and underwriting requirements will be reduced. This is noteworthy because the National Association of Realtors reported last week that contract cancellations have risen in September in cases where the negotiated prices have exceeded appraisal values. Although, refinancing does not involve a purchase, the prevailing preference for conservative appraisals could have presented a hurdle for refinancing.

Fannie and Freddie have also indicted that burdensome fees entailed in refinancing will be waived. The program will be in place until December 31, 2013 for loans originally sold to Fannie Mae and Freddie Mac on or before May 31, 2009. The original HARP was set to expire in June 2012. The streamlining of procedures and reduction of fees is expected to help homeowners and bring about stability in the housing market. As of August 31, 2011, 894,000 borrowers had refinanced under the original HARP. The sheer size of existing mortgages underwater (10.8 million) suggests that actions such as the latest modification of the HARP program should be beneficial per se and more so if a larger number are able to refinance compared with the achievement thus far.

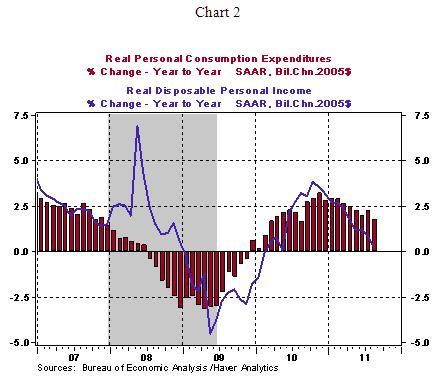

It is generally assumed that home mortgage refinancing should increase cash flow of households and translate into increased consumer spending. Consumer spending has shown a decelerating trend since the beginning of the year and Fed officials, Bernanke included, have expressed concern in recent speeches. As shown in Chart 1, disposable income also has failed to post meaningful growth in recent months. At first blush, it appears that refinancing will change the current income constraint of households and enable more spending on goods and services in an environment of negligible growth in income. But, a more thorough analysis suggests that the impact of mortgage refinancing is likely to be muted because lenders obtain less interest income and their spending will suffer a setback (Paul Kasriel, my boss, had repeatedly educated me about this overlooked aspect). Therefore, the likely spending outcome of mortgage refinancing is less positive than expected and could also be a wash when considering the macroeconomic impact.

There is an alternative route that will have a significant positive impact on consumer spending. In the past week, Fed officials have been speaking about the possibility of purchasing more securities to bolster economic activity. In particular, Fed Governor Tarullo mentioned that there is “ample room” to purchase mortgage-backed securities to enhance economic growth. If the Fed were to purchase mortgage-backed securities from lenders, it would lead to more credit created in the economy, without offsets. If lenders spend the newly created credit or extend funds to a new borrower it would create a virtuous cycle of economic activity.

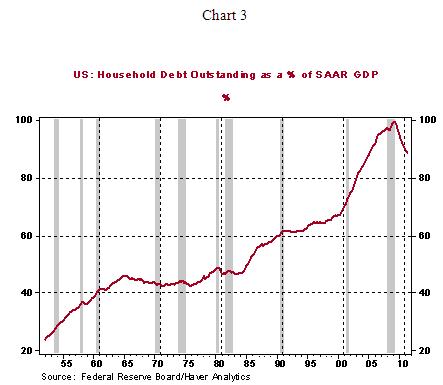

It is also important to note that households have been focused on reducing debt in recent quarters (voluntary and involuntary). It is entirely conceivable that the new found dollars could be channeled into paying off debt. Household debt as a percentage of GDP has declined from a historical peak of 99.42% in first quarter of 2009 to 88.6% in the second quarter of 2011 (see Chart 3). This is a positive long-term trend but has pitfalls in the near term because consumer spending is adversely affected as households strengthen their balance sheets.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.