Is Occupy Wall Street A Threat to the U.S. Dollar?

Currencies / US Dollar Oct 26, 2011 - 11:00 AM GMTBy: Axel_Merk

On its face, suggesting that the Occupy Wall Street movement may threaten the U.S. dollar may appear like a tall order. However, simply dismissing Occupy Wall Street as a fad may be a big mistake, just as it is a mistake to dismiss the Tea Party movement. Regardless of your political stance, and with no offense intended to supporters of either group, we believe they may be two sides of the same coin – quite literally. To determine where policy makers and with it, the U.S. dollar, may be heading, it is important to understand that the driving forces behind both movements have common roots.

On its face, suggesting that the Occupy Wall Street movement may threaten the U.S. dollar may appear like a tall order. However, simply dismissing Occupy Wall Street as a fad may be a big mistake, just as it is a mistake to dismiss the Tea Party movement. Regardless of your political stance, and with no offense intended to supporters of either group, we believe they may be two sides of the same coin – quite literally. To determine where policy makers and with it, the U.S. dollar, may be heading, it is important to understand that the driving forces behind both movements have common roots.

The short explanation is that rising costs coupled with stagnating real wages breeds an environment of social unrest. While the above movements are the face of this “unrest”, it helps to dig deeper and analyze the root causes to better understand and assess the ultimate implications of these protests.

The movements have been years in the making and are – in our assessment – the result of a highly intoxicating cocktail of policies that have driven recent global dynamics. The alcoholics are our policy makers; the protesters, though, are the ones stuck with the hangover. Unfortunately, it does not look like anyone is going to sober up anytime soon. With the movements embracing an array of goals and complaints, we shall focus on a common thread: sustainability of personal and government finances. However, there are diametrically opposed views on how to achieve these goals.

In the late 1980s, former Federal Reserve (Fed) President Greenspan embarked on a long journey to make the U.S. economy more "efficient." In those days, consumers may have had a mortgage, possibly a loan/lease for their car, but credit was not so pervasively used as it is today. Since then, we have learned to buy just about anything on credit. The upside: your monthly paycheck allows you to acquire greater goods and services, since you don't have to save to buy that dream mattress or exercise machine, but get to enjoy them for a "low monthly payment." The downside: you become more interest rate sensitive, less shock resistant, meaning that if you, say, lose your job, you are still stuck servicing your debt. Without debt, losing your job requires belt tightening; with debt, you are at risk of becoming a modern slave, at the mercy of your creditors.

After the tech bubble burst in 2000 and after 9/11, policy makers sought to keep consumers spending by lowering taxes and interest rates. In 2004, when the Fed started raising rates, consumers kept spending despite predictions of the demise of the American consumer. Consumers continued to spend by creating their own money, using their homes as ATM machines; financial institutions joined the frenzy by increasing their leverage, amongst others by creating off-balance sheet investment vehicles ("SIVs" and “SPVs”, amongst others).

But that's only part of the equation. A little over a decade ago, China and other Asian countries kicked their efforts to join the world stage into high gear. Driven by a desire to foster social stability, as millions migrated to cities, Asian policy makers promoted economic growth, amongst others boosting exports by keeping Asian currencies low versus the U.S dollar.

What happens when both U.S. and Asian policies promote growth at just about any cost? When too many gadgets are produced, the cost of such gadgets - all the stuff consumers buy at WalMart but don't really need - is low. Low interest rates and taxes in the U.S combined with pro-Asian growth policies are a key reason why the Consumer Price Index (CPI) has been so tame. However, the things we cannot import from Asia: education and health care, to name but two, are bound to rise at a faster pace.

Notably, too, prices of commodities will likely rise, as policy makers push for global economic growth with all the levers at their disposal. Where does that leave corporate America? On the one hand, corporations have no pricing power because of a flood of imports and consumers that are too indebted to afford to pay more; on the other hand, high commodity prices, as a result of global overproduction, squeeze margins of corporate America. So what does a rational executive do? Executives will strive to maintain margins by lowering variable costs; in the U.S., labor is the one variable cost that can be reduced through outsourcing. As with so many policies, the best of intentions (low interest rates and taxes) have contributed to accelerating the outsourcing trend of corporate America.

These pressures are primarily responsible for why real wages have stagnated. But what happens to those laid off? Because many of them have debt, and lots of it, they must find a new job. As jobs are hard to come by, they may start home-based businesses. 9 out 10 of these will fail, but the 10th might become the next big success story. The beauty of the American work force is that it is so flexible; the downside is that policies imposed on them have transformed society at a much faster pace than would have taken place otherwise. The American work force adjusts, but is increasingly dissatisfied.

It doesn't stop there. The artificially fast pace of transformation in the U.S. is embraced by young, new economy companies. But old economy companies - think General Motors - are not agile enough to keep pace. The economy is merciless to these firms that act like ocean freight ships. Mistakes in the case of GM were more than minor, paving the way to failure. Those forces, in turn, pushed more folks into the labor market...

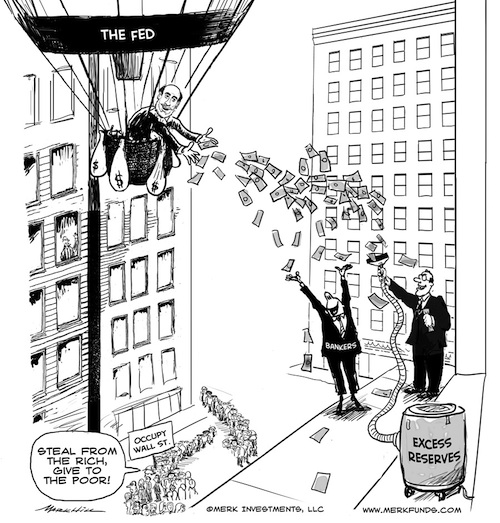

Keep these pressures up for a full decade and you shouldn’t be surprised that citizens are starting to revolt. As the credit bonanza came to an end, policy makers did not want to accept it. First billions, then trillions, were thrown at the financial system to stem against the tide that might have thrown the economy into another Great Depression.

Both Tea Partiers and Occupy Wall Streeters say this is all crazy and must stop - albeit they have different prescriptions. However, rather than stopping, policy makers are ever more engaged. Once again, the best of intentions are creating yet another avalanche of unintended consequences. Voting with their feet to get their voices heard, the Twitter revolution won't stop with the Arab spring, but sweep across America in it's own incarnation: we believe social networking is the perfect catalyst to enable ever more populist politicians to cater to the growing dissent. While the reality is that the issues are complex, the answers appear so easy; we don't want to belittle the movements, but see a trend that fosters politicians capable of distilling their political message into a tweet.

The implication is that at upcoming elections, ever more polarizing politicians will be elected. It is no coincidence that Republicans and Democrats cannot find common ground, but a consequence of the dynamics as they have been playing out.

What about the link to the US dollar? A couple of observations:

- Driving growth through debt (also at the government level) drives up the current account deficit. In our analysis, currencies of countries with a current account deficit are quite sensitive to changes in perception of economic growth. Foreigners may be more inclined to finance a current account deficit when a country has a positive outlook on growth. As such, the U.S. may be tempted to promote growth at just about any cost. Previous Administrations are just as guilty as the current one. Handcuffed by gridlock in Congress, the Administration now suggests allowing homeowners to refinance their mortgages even if they owe substantially more on their homes than they are worth. Who benefits? The primary beneficiary may be economic growth, as those that refinance are likely to go out and spend those savings - many of them are likely to buy new gadgets on credit. It's a form of stimulus that makes good politics, but if politicians really cared about consumers under water in their mortgages, they would require that the same monthly payment is made by consumers, but apply the savings of a lower interest rate to pay down the principal of the mortgage. Note that any loan refinanced with insufficient collateral is clearly riskier than a traditional mortgage and warrants a higher interest rate. A government guarantee can bridge that difference; it is clear, though, that taxpayer money will be needed to further inflate Fannie and Freddie, the Government Sponsored Entities (GSEs) that guarantee newly minted, blatantly irrational mortgages. Some will argue this is all fair, others cry foul. Consider that beneficiaries of the program are still not able to sell their home to take on a job opportunity elsewhere in the country.

- Of longer term concern to us is that the increased political polarization will make it ever more difficult to agree on major entitlement reform. We must make health care and social security sustainable. There are simply not enough rich people to tax to solve the problem long term. But odds are high that tough political choices cannot be made. The path of least resistance may well be that benefits are nominally paid to live up to promises, but the purchasing power of the payments will be eroded. Differently said: inflation may be the path of least resistance. The one reform item Democrats and Republicans appear to agree on is to redefine the CPI to achieve just that. However, if there is one thing we have learned from Europe, it's that the only language policy makers listen to is that of the bond market. It may take a misbehaving bond market before policy makers engage in meaningful reform. Unlike Europe, though, the U.S. has a significant current account deficit, making the U.S. Dollar far more vulnerable to a misbehaving bond market than the euro.

Subscribe to Merk Insights to be informed of our analysis as this crisis evolves; please also sign up to our Webinar on Thursday, October 20, 2011, to provide a live analysis on global dynamics, the U.S. dollar and the Merk Funds. We manage the Merk Hard Currency Fund, the Merk Asian Currency Fund, the Merk Absolute Return Currency Fund, as well as the Merk Currency Enhanced U.S. Equity Fund. To learn more about the Funds, please visit www.merkfunds.com

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.