U.S. Real GDP Momentum Pickup Buys Time Before Fed Acts Again

Economics / US Economy Oct 28, 2011 - 05:25 AM GMTBy: Asha_Bangalore

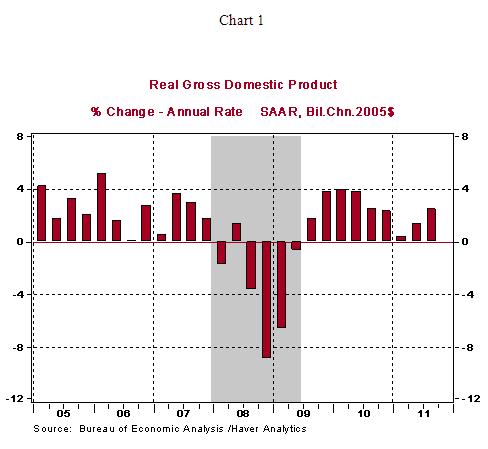

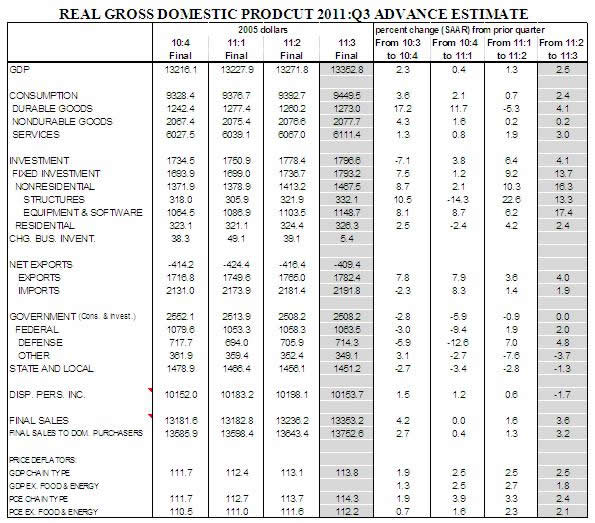

Real gross domestic product (GDP) of the U.S. economy grew at an annual rate of 2.5% in the third quarter after registering an abysmally slow performance in the first-half of the year (+0.9%). The headline and details of the third quarter GDP report are both encouraging given that considerations of a double dip surfaced in recent weeks.

Real gross domestic product (GDP) of the U.S. economy grew at an annual rate of 2.5% in the third quarter after registering an abysmally slow performance in the first-half of the year (+0.9%). The headline and details of the third quarter GDP report are both encouraging given that considerations of a double dip surfaced in recent weeks.

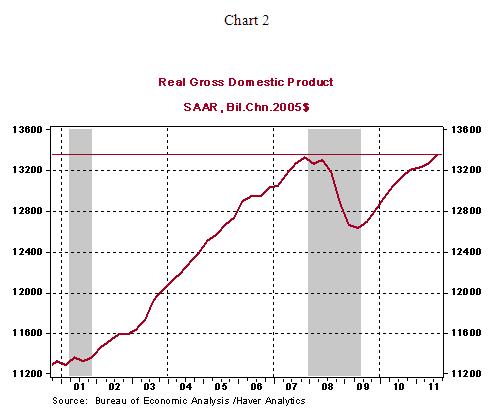

The level of real GDP in the third quarter now surpasses the peak reached in the fourth quarter of 2007 (see Chart 2), which allows us to note that the U.S. economy has entered a phase of expansion in the current business cycle. Real GDP estimates of earlier quarters had reached this mark only to be revised away. Final sales, which exclude inventories, posted a robust increase of 3.6% in the third quarter after 1.6% gain in the second quarter.

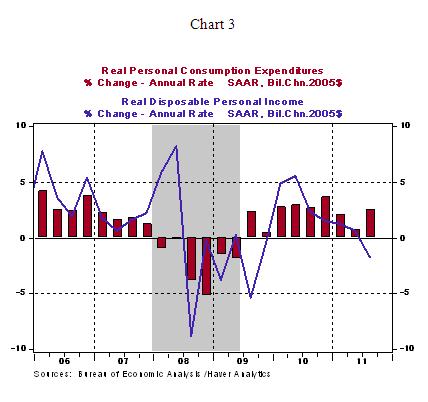

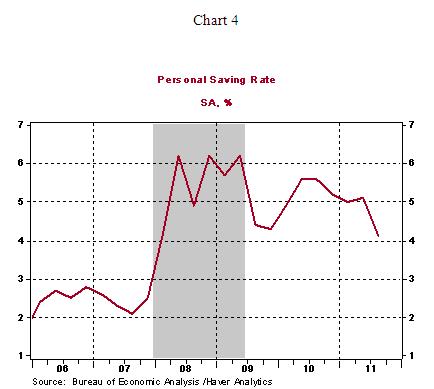

Consumer spending advanced at a significant pace in the third quarter (+2.4% vs. +0.7% in 2011:Q2). Among the three components of consumer spending, durable goods (+4.1%) and services (+3.0%) posted strong gains, while expenditures on non-durables were nearly steady. The worrisome part is that the increase in consumer spending in the third quarter was accompanied by a drop in real disposable income (Chart 3) and the saving rate (Chart 4). The obvious conclusion is that the consumers spent more than their income in third quarter. Will the upward trend of saving snap back in the near term? The best guess is that soft employment and income growth suggests that a conservative consumer will prevail in the months ahead.

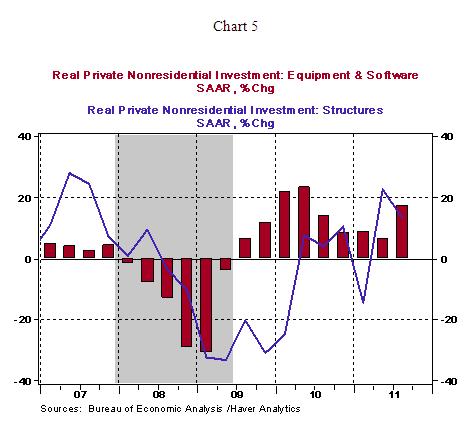

Business spending grew at a rapid clip in the third quarter, both structures (+13.3%) and equipment and software spending (+17.4%) show noticeable growth. These numbers run counter to claims that uncertain economic conditions are holding back business spending. Exports of goods and services grew at an annual rate of 4.0% in the third quarter, slightly higher than the pace seen in the prior quarter.

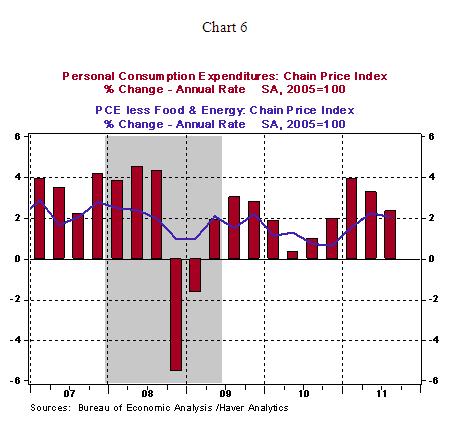

The big surprise in today’s report was the large drop in inventories during the third quarter ($5.4 billion vs. $39.1 billion in the second quarter). Businesses are likely to add to their stockpiles in the near term and account for a large increase in headline GDP, but the timing of this event is unclear, for now. Inflation numbers point to a moderation in the third quarter. The personal consumption expenditure price index rose 2.4% in the third quarter vs. a 3.3% jump in the second quarter. Likewise, the core personal consumption expenditure price index, which excludes food and energy, advanced 2.1% in the three months ended September vs. a 2.3% increase in the previous three-month period. The moderation in inflation data works in favor of the doves in the FOMC and supports their case for additional monetary policy action.

The FOMC meeting of November 1-2 is likely to end without changes in Fed policy, following unconventional announcements after the August and September meetings. Incoming economic data present a mixed picture, which allows the FOMC time to confirm that additional support may be necessary to bolster economic activity before taking action at the December or January meetings. In the past week, several Fed officials, have been presenting arguments that make a case for a third round of quantitative easing (QE3). The elevated unemployment rate is at the top of their list of concerns. Although details of the resolution of the debt crisis in Europe are not available as of this writing, a compromise has been reached regarding the Greek debt problem and further strengthening of the European Financial Stability Fund is in the offing. The bottom line is that headwinds from Europe seen to be large and detrimental a few days ago may not occur implying that downside risks to U.S. economic growth in the near term have been reduced.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.