Corporate Earnings: Stock Market's Brightest False Beacon

InvestorEducation / Corporate Earnings Nov 03, 2011 - 09:04 AM GMTBy: EWI

Four times a year, investors and Wall Street watch the quarterly corporate earnings reports, trying to anticipate the trend in stocks. Another earnings season is upon us right now, so read this excerpt from our free Club EWI report, "Market Myths Exposed."

Four times a year, investors and Wall Street watch the quarterly corporate earnings reports, trying to anticipate the trend in stocks. Another earnings season is upon us right now, so read this excerpt from our free Club EWI report, "Market Myths Exposed."

"Myth No. 1 -- 'The bottom line is earnings drive stock prices' -- Investopedia.com.

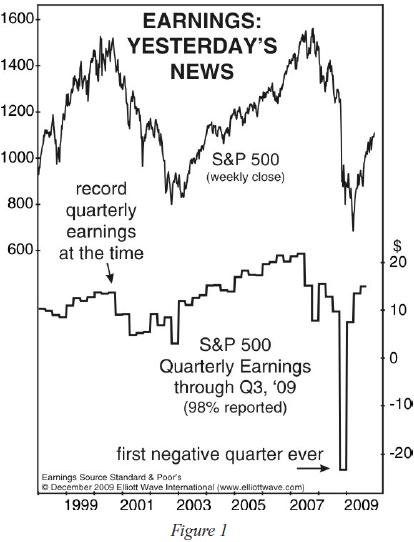

"It's simply not true. The flawed notion that profits drive stock prices is something that EWI has discussed numerous times over the years. For one thing, quarterly earnings reports announce a company's achievements from the previous quarter. The trends in earnings and stock prices sometimes even move in opposite directions, such as in the 1973-74 bear market when S&P earnings rose every quarter as the S&P declined 50%. More recently, earnings have been cycling with stocks, but that still leaves the problem of reporting delays, which leave investors eating the market's dust when the trend changes.

"To try to get around this, pundits use analysts' estimates of future earnings as a guide. In doing so, however, they are subject to the same herding impulses as investors. As [Robert Prechter's] Conquer the Crash puts it, 'Earnings estimators are too pessimistic at bottoms and too optimistic at tops, just when you most need the indicator to tell the truth.'"

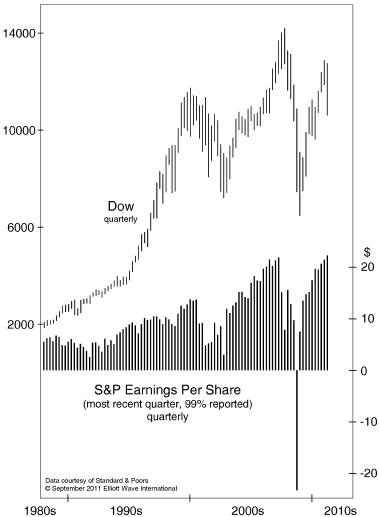

The S&P earnings hit a new record in Q2 of this year. This chart from our September 2011 Elliott Wave Financial Forecast puts them next to the Dow. Observe when the previous high in earnings took place:

|

Market Myths Exposed, a FREE ebook from Elliott Wave International, uncovers 10 of the most common misconceptions about the markets that can affect your investment decisions. Learn the truth about inflation and deflation, the FDIC, diversification, speculation and more in this 33-page eBook. Get valuable insights you won't find anywhere else. Download your free eBook >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Earnings: Stock Market's Brightest False Beacon. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.