Interbank Interest Rates Fall as Central Banks Succeed in Easing Liquidity Squeeze

Interest-Rates / Credit Crunch Dec 19, 2007 - 12:02 PM GMTBy: Nadeem_Walayat

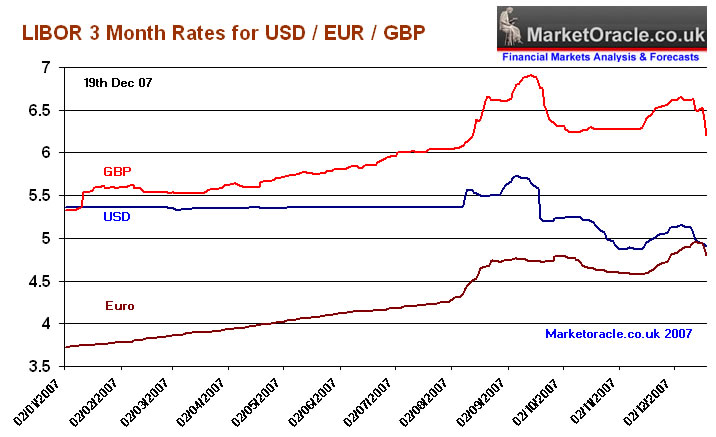

Concerted action by the worlds central banks is beginning to have an impact on the money market interbank rates. This resulted in a a sharp drop today in the Sterling LIBOR rate down from 6.38% last night to 6.20% today. Similar action by the US Fed and ECB has pushed Euro and US Dollar LIBOR rates significantly lower as the graph below demonstrates.

Concerted action by the worlds central banks is beginning to have an impact on the money market interbank rates. This resulted in a a sharp drop today in the Sterling LIBOR rate down from 6.38% last night to 6.20% today. Similar action by the US Fed and ECB has pushed Euro and US Dollar LIBOR rates significantly lower as the graph below demonstrates.

Yesterday, the European Central Bank pumped in a record $500 billion into the financial system which resulted in a record drop of 0.5% in the 2 week euro interbank LIBOR rate.

The Bank of England similarly pumped in $10 billion at substantially lower interest rates than the interbank rate of 6.53%, the bulk of which was auctioned to bidders at the minimum rate of 5.36% which is below the base interest rate of 5.5%. This resulted in the rate dripping yesterday to 6.38% and today to 6.20%

Further similar auctions over the coming weeks by the worlds central banks are expected to continue to ease the liquidity squeeze which is inline with the Market Oracle analysis of 12th December 07 - Worlds Central Banks to the Rescue with $110 billions

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.