Which Fiat Currency Behaves Most Like Gold?

Commodities / Gold and Silver 2011 Nov 28, 2011 - 02:03 AM GMTBy: Bob_Kirtley

In this article we are going to be focusing on gold and showing how it behaves more like a currency than a commodity. We will be viewing how gold has performed in regards to other currencies and try and find the most correlated currency pair. In other words, we will be asking the question, “which other currency pair behaves most like gold?”

In this article we are going to be focusing on gold and showing how it behaves more like a currency than a commodity. We will be viewing how gold has performed in regards to other currencies and try and find the most correlated currency pair. In other words, we will be asking the question, “which other currency pair behaves most like gold?”

There are many people that categorize gold as a commodity, which we at SK Options Trading strongly disagree with. There are two unique features that make gold trade as a currency and a third that we believe makes gold far superior to all other currencies. The first is that gold is held in international central banks as an asset, which cannot be said for any other commodity. The second is that only a small part of gold’s yearly production is consumed by the jewelry industry; this means that gold is not affected by supply and demand like other commodities are. Gold is rarely “used up”, the way that commodities such as oil and corn are. The third and greatest feature of gold is that it does not have its own central bank that actively monitors its value and can move to intervene to devalue gold should its value rise above a tolerable level. This means that gold could be viewed as an even safer haven than currencies like the Swiss Franc, US Dollar and the Yen.

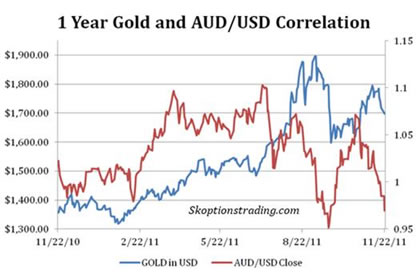

The first currency we will be looking at is the Australian dollar; the AUD/USD is the most prominent commodity currency pair. Correlation is expressed between 1 and -1, with 1 being a perfect positive correlation and -1 being a perfect negative correlation. The AUD/USD had a correlation of 0.68 for 5 years of daily data, 0.73 for 2 years and -0.02 for 1 year.

Below is a 1-year chart of the AUD/USD against gold.

As we can see from the chart above, the AUD/USD has not been correlated at all over the past year. The fact that gold, which is seen as a commodity by some, is not correlated with the most prominent commodity pair in the world adds weight to the argument that gold is a currency, not a commodity and should therefore be classified as such.

Furthermore the currency of gold is viewed as a safe haven. There are several other currencies that also have this safe haven status, two of which include the Japanese Yen and the Swiss Franc. The Japanese Yen and Swiss Franc are viewed as safe havens because of their strong net international surplus. Japan is the worlds largest creditor, last year having a surplus of over 3 trillion dollars. Switzerland ranks as 5th but is the only other currency out of the top 5 creditors that is not pegged or not convertible. There is also the issue of low interest rates in both these countries. Since interest rates across the term structure in Japan and Switzerland are close to zero, this leaves little room for further interest rate cuts. Since interest rates cannot be cut, in times of stress these currencies are less likely to weaken than others where interest rates can be cut in an attempt to lower the currency. Therefore both the yen and the Swiss Franc are treated as safe havens.

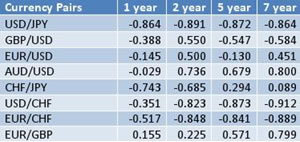

The correlation between the USD/JPY and Gold was negative, with the 7 year correlation standing at -0.86, 5 year -0.87, 2 year -0.89 and 1 year -0.86. This extremely strong correlation shows that gold is in fact viewed as a safe haven currency as opposed to a commodity, which it is often sited as. As a reminder, gold being negatively correlated with USD/JPY implies it is positively correlated with JPY/USD; so we can say that gold behaves in a similar way to the Yen. Below is a graph of the 5-year correlation between gold and the USD/JPY, the USD/JPY values on the RHS scale are in reverse order.

As we can see above, the negative correlation between the USD/JPY and gold is very tight. The reason this correlation exists is because gold is viewed as a safe haven currency in the market, however this correlation does not always work. The reason it does not always work is because of the intervention of the Swiss National Bank. An example of this happening was only a month ago when Japan decided to weaken its currency after it reached post war highs of 75.35. It weakened its currency by selling JPY and buying USD. The reason a country would deliberately weaken its currency is to make its products more attractive in the export market. Gold does not have the problem of intervention from a Central Bank, at least not to the extent of other currencies (there is arguably evidence that suggest the gold price is often subject to manipulation, but this topic would require separate discussion). Its interest rate is always constant and although the interest rate for holding gold is negative, in the current market environment most major currencies can also only offer negative real interest rates. For this reason we believe that the fundamentals behind gold as a currency are far safer than any national currency, thus making it the “super safe haven” currency.

The Swiss Franc is also viewed as a safe haven currency. Like Japan, Switzerland has a surplus of international investment and has low interest rates across its term structure. This has made the Swiss Franc a core safe haven currency. For this reason Gold was very closely correlated with the USD/CHF. The correlation for 7 years was -0.91, 5 years -0.87, 2 years -0.82 and 1 year -0.35. Below is the 7-year and 5-year charted correlation between the USD/CHF and Gold.

As we can see from the two charts above, the negative correlation between Gold and the USD/CHF is very compelling. Of all the currencies we tested, the Swiss Franc came out on top for correlation with gold. This is further evidence that gold should have its commodity title dropped and be viewed by all as a safe haven currency. However this high correlation did not continue for the 1 year time frame, the reason for this is the Swiss Franc is now effectively pegged to the Euro. Pegging is when a central bank sets and maintains a rate as the official exchange rate. In order to maintain this, the central bank must buy and sell its own currency in return for the currency it is pegged against, in this case the Euro. Currently the EUR/CHF is effectively pegged at a price of no less than 1.20, meaning the Swiss Nation Bank will not allow the Franc to strength past EUR/CHF 1.20, but it will allow it to weaken. Therefore because this currency is effectively pegged against the Euro, it means it will trade like the Euro. This strips the currency of its safe haven status as long as it is pegged to the Euro, for how long this peg will last, it’s anyones guess. Gold does not have the problem of Central Bank intervention (at least not the same extent), therefore it is free to appreciate as much as it wants to. For this reason we believe that Gold is an even safer haven than any safe haven currency in the exchange.

Above is a table of all the currencies considered and there correlations. We can see that safe haven currencies such as the USD/JPY, USD/CHF and EUR/CHF (before Europe’s financial woes) all had a strong correlation with gold. The prominent commodity currency, AUD/USD did not have a strong correlation with gold. Other currencies such as GBP/USD, EUR/GBP and EUR/USD as expected did not have strong correlations with gold. After closely analysing the correlations between Gold and a number of currencies, it is clear that Gold falls under the safe haven currency category. However, the difference between gold and other safe haven currencies is the fact that gold has no baggage. By baggage we mean, Central Banks trying to interfere in its price, by manipulating its supply and associated interest rates. For this reason we view gold as the ultimate of all safe haven currencies and this research has only strengthened that view.

In conclusion, it is clear through looking at correlations with other safe haven currencies that gold is also a safe haven currency. However no other currency behaves like gold, for if they did appreciate year after year, they run the risk of Central Bank intervention. It is clear then that not only does gold out perform these other safe haven currencies but it also provides more safety through its complete lack of baggage. For this reason we view gold as the ultimate flight to safety and a very sound investment for the foreseeable future.

Regarding www.skoptionstrading.com. We currently have a number of open trades at the moment however, we do not update the charts until the trade is closed and the cash is back in our account.

Also many thanks to those of you who have already joined us and for the very kind words that you sent us regarding the service so far, we hope that we can continue to put a smile on your faces.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.