It’s Time To Dump U.S. Treasury Bonds

Interest-Rates / US Bonds Dec 03, 2011 - 03:08 AM GMTBy: Sy_Harding

First let’s make sure we understand the basics of bonds.

First let’s make sure we understand the basics of bonds.

Bonds are a form of debt. When a company or a government needs to borrow money it can borrow from banks and pay interest on the loan, or it can borrow from investors by issuing bonds and paying interest on the bonds.

One advantage of bonds to the borrower is that a bank will usually require payments on the principle of the loan in addition to the interest, so that the loan gradually gets paid off. Bonds allow the borrower to only pay the interest while having the use of the entire amount of the loan until the bond matures in 20 or 30 years (when the entire amount must be returned at maturity).

Two main factors determine the interest rate the bonds will yield.

If demand for the bonds is high, issuers will not have to pay as high a yield to entice enough investors to buy the offering. If demand is low they will have to pay higher yields to attract investors.

The other influence on yields is risk. Just as a poor credit risk has to pay banks a higher interest rate on loans, so a company or government that is a poor credit risk has to pay a higher yield on its bonds in order to entice investors to buy them.

A factor that surveys show many investors do not understand, is that bond prices move opposite to their yields. That is, when yields rise the price or value of bonds declines, and in the other direction, when yields are falling, bond prices rise.

Why is that?

Consider an investor owning a 30-year bond bought several years ago when bonds were paying 6% yields. He wants to sell the bond rather than hold it to maturity. Say that yields on new bonds have fallen to 3%. Investors would obviously be willing to pay considerably more for his bond than for a new bond issue in order to get the higher interest rate. So as yields for new bonds decline the prices of existing bonds go up. In the other direction, bonds bought when their yields are low will see their value in the market decline if yields begin to rise, because investors will pay less for them than for the new bonds that will give them a higher yield.

Prices of U.S. Treasury bonds have been particularly volatile over the last three years. Demand for them as a safe haven has surged up in periods when the stock market declined, or when the eurozone debt crisis periodically moved back into the headlines. And demand for bonds has dropped off in periods when the stock market was in rally mode, or it appeared that the eurozone debt crisis had been kicked down the road by new efforts to bring it under control.

Meanwhile, in the background the U.S. Federal Reserve has affected bond yields and prices with its QE2 and ‘operation twist’ efforts to hold interest rates at historic lows.

As a result of the frequently changing conditions and safe-haven demand, bonds have provided as much opportunity for gains and losses as the stock market, if not more.

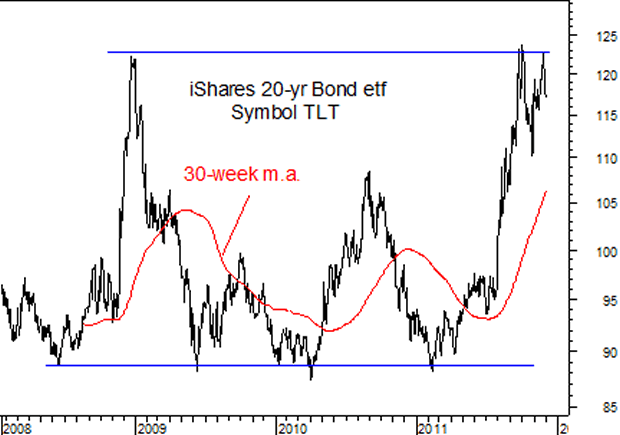

For instance, just since mid-2008, bond etf’s holding 20-year U.S. treasury bonds have experienced four rallies in which they gained as much as 40.4%. The smallest rally produced a gain of 13.1%.

But they were not buy and hold type situations. Each lasted only from 4 to 8 months, and then the gains were completely taken away in corrections in which bond prices plunged back to their previous lows.

Most recently, the decline in the stock market during the summer months, followed by the re-appearance of the eurozone debt crisis, has had demand for U.S. Treasury bonds soaring again as a safe haven.

The result is that bond prices are again spiked up to overbought levels, for instance above their 30-week moving averages, where they are at high risk again of serious correction. In fact they are already struggling, with a potential double-top forming at the long-term significant resistance level at their late 2008 high.

Here are some reasons, in addition to the technical condition shown on the charts, to expect a significant correction in the price of bonds.

The current rally has lasted about as long as previous rallies did, even during the 2008 financial meltdown. Bond yields are at historic low levels with very little room to move lower. The stock market in its favorable season, and in a new leg up after its significant summer correction. Unprecedented efforts are underway in Europe to bring the eurozone debt crisis under control. And this week those efforts were joined by supportive coordinated efforts by major global central banks that are likely to bring relief by at least kicking the crisis down the road.

Holdings designed to move opposite to the direction of bonds and therefore produce profits in bond corrections, include the ProShares Short 7-10yr bond etf, symbol TBX, and ProShares Short 20-yr bond, symbol TBF. For those wanting to take the additional risk, there are inverse bond etfs leveraged two to one, including ProShares UltraShort 20-yr treasuries, symbol TBT, and UltraShort 7-10 yr treasuries, symbol TBZ, designed to move twice as much in the opposite direction to bonds. And even triple-leveraged inverse etf’s including the Direxion 20+-yr treasury Bear 3x etf, symbol TMV, and Direxion Daily 7-10 Treasury Bear 3X, symbol TYO.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2011 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.