Negative Real Interest Rates, Central Banks Prepare For the Worst Life After Euro

Stock-Markets / Global Debt Crisis Dec 08, 2011 - 07:31 AM GMTBy: GoldCore

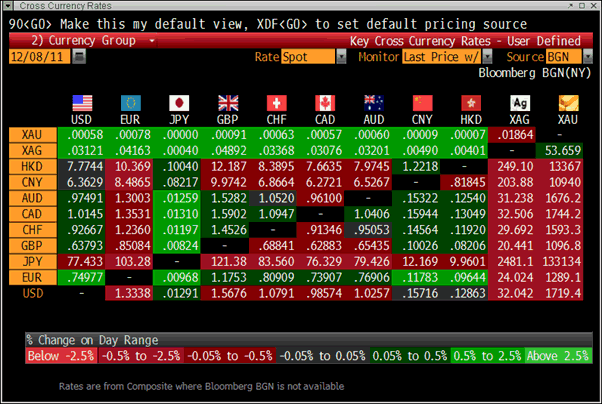

Gold is trading at USD 1,719.40, EUR 1,302.70, GBP 1,109.30, CHF 1,608.40, JPY 135,050 and AUD 1,689.4 per ounce.

Gold is trading at USD 1,719.40, EUR 1,302.70, GBP 1,109.30, CHF 1,608.40, JPY 135,050 and AUD 1,689.4 per ounce.

Gold’s London AM fix this morning was USD 1,739.00, GBP 1,105.81, and EUR 1,297.28 per ounce.

Yesterday's AM fix was USD 1,731.00, GBP 1,108.20, and EUR 1,289.96 per ounce.

Gold edged higher in euros, pounds, dollars and most currencies today after the ECB cut its main interest rate from 1.25% to 1% and the Bank of England kept interest rates at 0.5%. Sharp selling came into the market after the ECB's Draghi commented that the economic outlook was bad. It is another strange and counter intuitive market reaction as a bad economic outlook is of course bullish for gold.

Gold appears to be consolidating between $1,667/oz and $1,803/oz and looks well supported at these levels due to concerns about whether EU policy makers can resolve the 2 year long eurozone debt crisis and protect the euro from a possible break up.

Gold in USD – 1 Day

UK interest rates remain at their record low of 0.5% and QE continues in the UK with a further £275 billion being created to monetize debt and buy gilts. Eurozone interest rates are now back at record all-time lows.

The ECB, Bank of England, Federal Reserve and even the People’s Bank of China continue to pursue extremely loose monetary policies. Inflation is the official policy response in order to overcome this deflationary debt crisis.

Negative real interest rates, with inflation much higher than deposit rates, make gold an important diversification for investors and savers to hedge against currency debasement and monetary risk.

Central Banks Prepare For Life After Euro

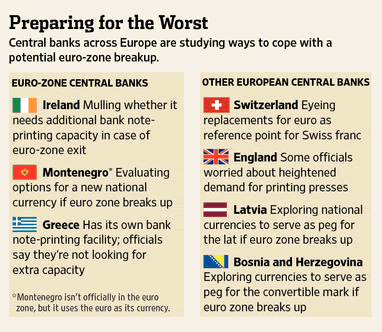

The Wall Street Journal reports today that central banks are preparing for life after the euro with countries studying printing national currencies in case the single monetary union collapses.

Given the real risk of a breakup of the currency as we know it today, that would seem like the logical and prudent thing to do.

Major multinational corporations are planning for the possibility of this scenario and recently British Chancellor George Osborne said his government had contingency planning in place in the event of the break-up of the euro.

The Wall Street Journal reported that the Irish central bank is evaluating whether it needs to secure additional access to printing presses in case it has to print new bank notes to support a "reborn" currency.

The Journal quotes "people familiar with the matter" and says other central banks have started to weigh contingency plans to prepare for the possibility that countries leave the eurozone or the eurozone breaks up entirely.

The central banks said they would not comment and the Irish central bank called the article "speculation".

Currency devaluations are inevitable in the coming months and years.

Whether that be a sharp, fast devaluation of individual national currencies (lira, pesetas, escudos, punts) or that be a more gradual devaluation of a surviving single currency that is debased through massive and unprecedented debt monetisation.

While market and media attention is on the Eurozone and euro crisis the real risk of a systemic crisis remains. The risk of a ‘Lehman Brothers’ banking failure and consequent global financial contagion and failure of the banking system rises every day.

UBS Chief Economist Warns of Possibility of Euro Break Up and Importance of Precious Metals

The chief economist of UBS, Larry Hatheway, has warned that banks “should be asking themselves whether they would survive a collapse of the payments system, a run on deposits and widespread default on assets.”

And amid ensuing chaos, where should investors be allocating their assets? Precious metals feature highly on Hatheway's favourite asset allocation.

"I suppose there might be some assets worthy of consideration—precious metals, for example. But other metals would make wise investments, too. Among them tinned goods and small caliber weapons."

"Break-up runs the risk of becoming one wretched scenario. Sadly, however, it can’t be ruled out, just as it would have been improper to rule out the horrors of the first half of the 20th century before they happened."

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.