The European Central Bank Provides Temporary Support to Banks

Interest-Rates / Credit Crisis 2011 Dec 09, 2011 - 02:42 AM GMTBy: Asha_Bangalore

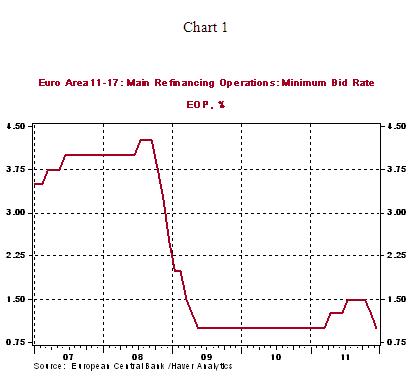

The European Central Bank (ECB) provides temporary support to the economic bloc with its actions today. The ECB lowered the policy rate 25bps to 1.00%, expanded the range of eligible collateral for loans extended to banks, increased the maturity of loans to 3 years from the current maturity of 13 months to alleviate funding problems, and lowered reserve requirements to 1.0% from 2.0%. These steps are necessary measures to ease pressures in the banking sector and prevent a severe credit crunch.

ECB President Draghi dashed hopes that the central bank would purchase large quantities of sovereign debt. He also indicated that deflation is not part of the ECB’s projections, so the justification for bond purchases on the grounds of expected deflation is not a suitable option. There is another conduit that could solve the funding issue. In theory, central banks of the eurozone could lend to the IMF which would turn around and extend these funds to the respective governments. Draghi stressed that the ECB should abide by its charter and not circumvent it by using the IMF to lend to indebted nations. But he mentioned that eurozone central banks could lend to the IMF for use in non-eurozone nations. This could be suggestion pointing to a loophole that can be exploited such that eurozone central banks could provide funds to the IMF’s general resources fund, which then can be used for lending to any member of the IMF. It remains to be seen if this option will be the final life-line.

Why are these steps temporary solutions? The ECB’s actions today address liquidity problems of the banking system. But, the core issue for European banks in capital inadequacy. The European Banking Authority announced today that the banking system in Europe is short of €115 billion of capital, which has to be replenished by June 2012. A recapitalization of the banking system is at the heart of the matter right now. Failure to recapitalization banks would imply a severe credit crunch. Therefore, today’s actions have touched the surface of the problem and not addressed the core. Markets are watching closely for the EU summit communiqué about how the sovereign debt issues will be resolved.

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.