Euro Fudge Distracts From Global Debt Titanic; Intervention in Gold Market?

Commodities / Gold and Silver 2011 Dec 09, 2011 - 06:11 AM GMTBy: GoldCore

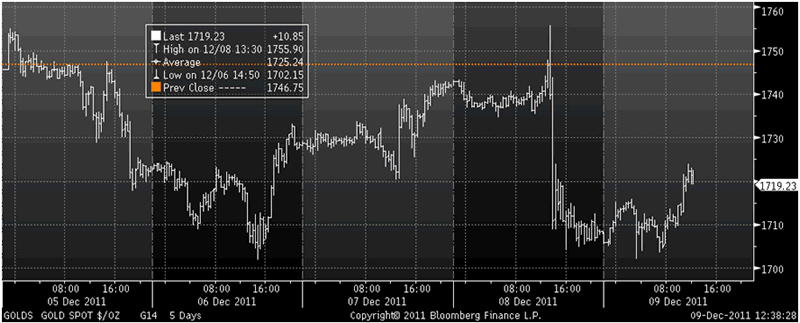

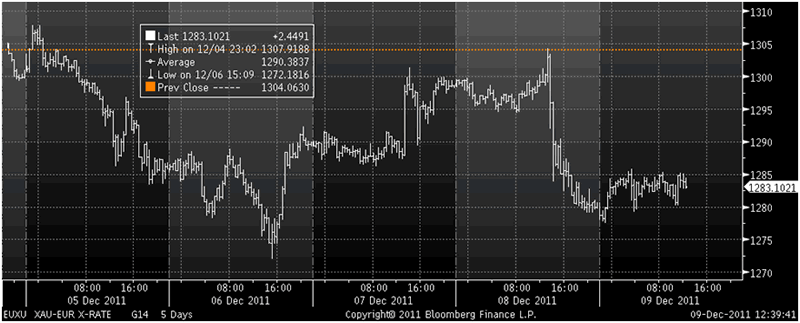

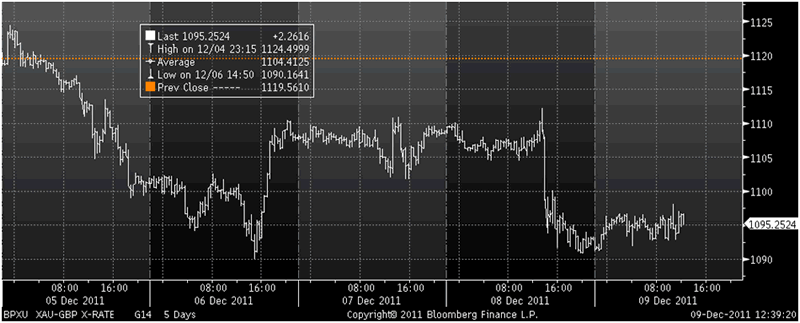

Gold is trading at USD 1,719.00, EUR 1,283.70, GBP 1,095.30, CHF 1,582.40, JPY 135,510 and AUD 1,689.0 per ounce.

Gold is trading at USD 1,719.00, EUR 1,283.70, GBP 1,095.30, CHF 1,582.40, JPY 135,510 and AUD 1,689.0 per ounce.

Gold’s London AM fix this morning was USD 1,712.00, GBP 1,094.49, and EUR 1,281.34 per ounce.

Yesterday's AM fix was USD 1,739.00, GBP 1,105.81, and EUR 1,297.28 per ounce.

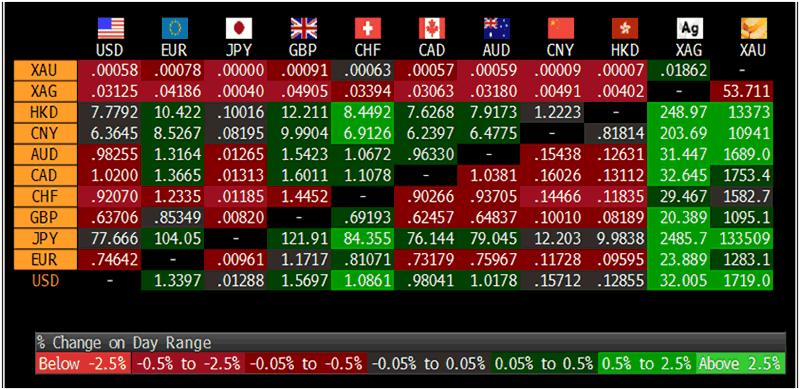

Cross Currency Table

Gold edged higher in euros, pounds, dollars and all currencies today after the European Union leaders failed overnight to get all of the bloc's 27 members to agree a change in the EU treaty allowing fiscal integration as the ‘decisive’ summit in Brussels ended its first day in the early hours Friday.

Gold traded higher after the ECB interest rate cut yesterday, prior to sharp selling that came into the market at 1335 GMT. This led to gold falling 2% on the day and it is now down 1.3% on the week – again outperforming many equity indices.

Market News International (MNI) reported that market sources said that the Bank for International Settlements, the Bank of England and the Federal Reserve have been “good sellers of gold” after it had popped to a fresh session high of $1,755.90/oz.

The MNI report has not been explored and there have not been any official denials of official selling.

From a trading perspective there is at least a ring of truth to the MNI report as the sharp fall in the gold price was counterintuitive given there was no negative gold news and indeed the news was bullish with significant risk ahead of the EU summit and continued ultra loose monetary policies and negative real interest rates.

Given the scale of the coordinated intervention in markets by central banks recently one would have to be completely naïve to dismiss the report out of hand. There is of course the historical precedent of the London Gold Pool which ended in failure.

However, before jumping to conclusions it would be good if the MNI report was looked at and some questions asked - in the finest traditions of journalism.

Markets reaction to the euro summit fudge was not as bad as some of the ‘end of the world in 9 days if no agreement’ theorists who fear mongered in recent days. Many of the ‘9 day’ doom merchants had banking and political interests and agendas.

European indices are tentatively higher despite losses in Asia.

At the end of the day, agreement or no agreement the fundamental challenge facing Europe and the developed world is humungous levels of debt in the banking sector and in the shadow banking system (derivatives with a value in the hundreds of trillions) and real global financial system.

The root cause of the problem is this debt, as has been pointed out by many for months and years now. The problem cannot be solved by socializing the debt and piling public debt on top of this private banking debt.

As long as the official policy response is the printing and electronic creation of trillions of dollars, euros and pounds and ‘bazooka’ style currency debasement remains the monetary panacea du jour, there will be no real resolution of this crisis.

Therefore, fiat currencies will continue to be debased and fall in value versus gold.

Myopic markets continue to have the attention span of a goldfish with the sole focus on the Eurozone crisis again in recent days while completely ignoring the global fiscal titanic as seen in the appalling finances of Japan, the UK and the US.

The iceberg approaches and we only see the tip of the iceberg.

The total net cost of the Federal Reserve’s bailout alone is now estimated at an incredible $29.616 trillion according to research from the Levy Economics Institute (see commentary).

The global debt crisis is not a short term phenomenon rather it is a medium and long term phenomenon that will challenge us for years. No magic wand solution from central bankers or politicians is possible.

One UK analyst made the witty comment this morning that the UK is “as isolated as someone left on the dock in Southampton as the Titanic sailed away.”

Witty, however it ignores the fact that this crisis is very close to or already in the early stages of contagion and very close to another Lehman Brothers systemic ‘event’. The UK and the massive liabilities in the City of London are very much part of the global debt titanic.

These huge fiscal and monetary challenges remain the reason why the vast majority of investors and savers are being prudent in having a healthy allocation to gold for the foreseeable future.

Gold will continue to reward and protect prudent investors and savers from negative real interest rates and global currency debasement.

SILVER

Silver is trading at $31.83/oz, €23.84/oz and £20.33/oz

PLATINUM GROUP METALS

Platinum is trading at $1,487.75/oz, palladium at $666.00/oz and rhodium at $1,500/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.