Gold Price Could Fall to $1600, Even Lower During this Correction

Commodities / Gold and Silver 2011 Dec 13, 2011 - 12:00 PM GMTBy: Dr_Nu_Yu

Gold is in the bump phase of a seven-year Bump-and-Run Reversal Top pattern which typically occurs when excessive speculation drives prices up steeply, and is now at a critical juncture which could change the long-term trend of gold. Silver is already in the run phase which does not bode well for its future price. Let me explain.

Gold is in the bump phase of a seven-year Bump-and-Run Reversal Top pattern which typically occurs when excessive speculation drives prices up steeply, and is now at a critical juncture which could change the long-term trend of gold. Silver is already in the run phase which does not bode well for its future price. Let me explain.

According to Thomas Bulkowski, the Bump-and-Run Reversal Top pattern consists of three main phases:

- A lead-in phase in which a lead-in trend line connecting the lows has a slope angle of about 30 degrees. Prices move in an orderly manner and the range of price oscillation defines the lead-in height between the lead-in trend line and the warning line which is parallel to the lead-in trend line.

- A bump phase where, after prices cross above the warning line, excessive speculation kicks in and the bump phase starts with fast rising prices following a sharp trend line slope with 45 degrees or more until prices reach a bump height with at least twice the lead-in height. Once the second parallel line gets crossed over, it serves as a sell line.

- A run phase in which prices break support from the lead-in trend line in a downhill run.

A Look at the Future for Gold

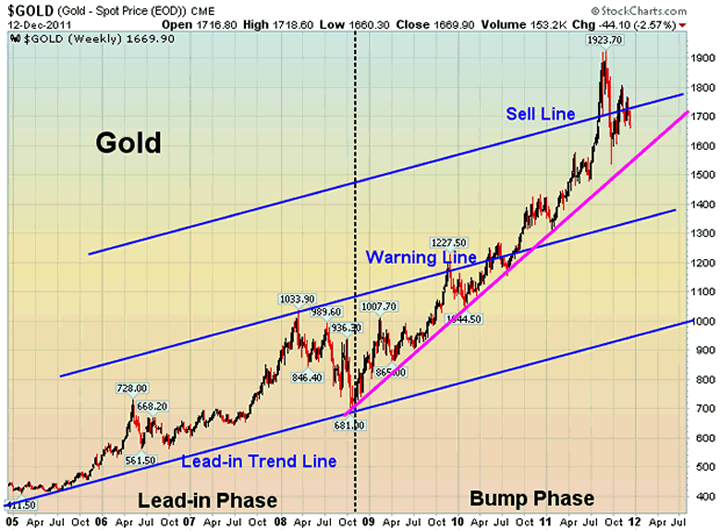

The seven year weekly chart below for gold offers a cautious early view regarding the long term trend of gold and is an updated version of a previous article entitled How Low Will Gold Go in This Correction? Gold has been in the bump phase of the Bump-and-Run Reversal Top pattern since late 2009 after almost three years in the lead-in phase.

As can be seen in the chart below the major decline over the past few days has dragged the price of gold sharply below the sell line which suggests the formation of a long-term Bump-and-Run Reversal Top for gold.

If prices keep staying in the territory under the sell line, gold could get into a bear market going forward into 2012 with downside price targets as follows:

- $1,600 for support from the trend line of last three years.

- $1,400 for support from the warning line.

- $1,000 for support from the lead-in trend line.

A Look at the Future for Silver

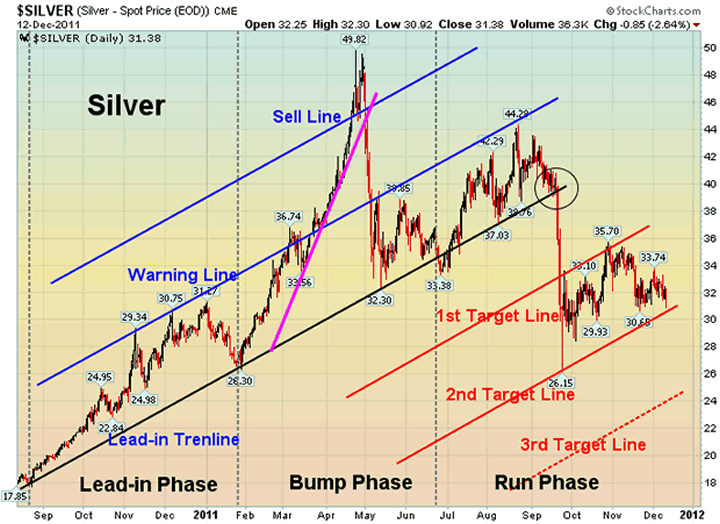

Silver also has a bearish picture with a bump-and-run reversal top pattern in its intermediate-term timeframe. Silver has been in this run phase for some time as I pointed out in my earlier article entitled Will Silver "Bump-and-Run" Down to $22/ozt? Time Will Tell But it Doesn't Look Good.

As can be seen in the chart below, silver has been oscillating between the first and second target lines for almost three months and appears to be on the verge of breaching the second target line.

Silver could get well into a bear market going forward into 2012 with downside price targets as follows:

- $31 for support at the 2nd target line.

- $24 for support at the 3rd target line.

Conclusion

There you have it. As I have been saying for months now in my previous articles, as supported by my technical analyses as evidenced by the charts above, the outlook for gold (as low as $1600 and conceivably as low as $1000) and silver (as low as $31 and conceivably as low as $24) look rather bleak in the short term at least. It should prove to be a very interesting 2012.

The time has come to re-check the fundamentals, reality, and risks for gold and silver especially in light of the current bearish performances of all BRIC emerging markets, and the U.S. Fed's Operation Twist.

By Nu Yu, Ph. D with Lorimer Wilson

If you found the above article of interest, you may wish to read my Market Weekly Update on gold, silver, the U.S. dollar and the S&P 500 by going here.

Dr. Nu Yu (fx5186.wordpress.com/), co-founder and president of Numarkan Investments and an affiliate of the Market Technician Association, is a frequent contributor to www.munKNEE.com

Visit http://www.FinancialArticleSummariesToday.com, “A site/sight for sore eyes and inquisitive minds”, and www.munKNEE.com, “It’s all about MONEY”, where you can sign up for their FREE weekly "Top 100 Stock Market, Asset Ratio & Economic Indicators in Review."

© 2011 Copyright Dr. Nu Yu - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.