Gold and Silver Patterns Could Weigh On Stocks

Commodities / Gold and Silver 2011 Dec 14, 2011 - 06:49 AM GMTBy: Chris_Ciovacco

If you own stocks, you want gold and economically-sensitive silver to perform well. Weakness in precious metals is reflective of diminished concerns about future inflation and increasing concerns about deflation. The Fed, via money-printing exercises such as quantitative easing (QE), is attempting to “inflate away” the large debt burdens plaguing governments around the globe. The Fed is also trying to hold off deflationary forces, which can morph into a negative economic feedback loop of falling asset prices. If gold and silver cannot muster a sustainable rally soon, it will tilt the economy and markets toward bearish/deflationary outcomes over the coming weeks and months.

Chart patterns in technical analysis are a way of monitoring human behavior. The patterns tend to produce fairly predictable results, but sometimes humans stray from the pattern. In recent months, potentially bearish patterns have surfaced for both gold and silver, which could be an ominous signal for stocks. The action in precious metals aligns with the concerning setups in the currency markets outlined on December 12.

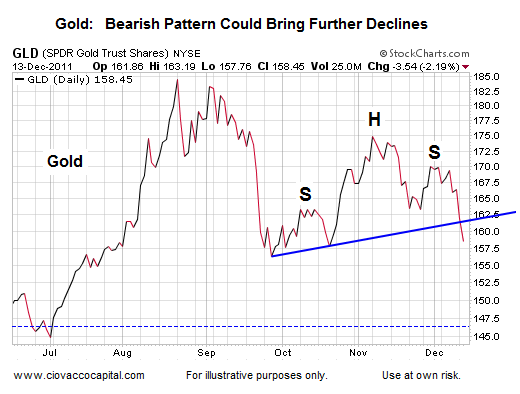

As shown below, gold has traced out a head-and-shoulders topping pattern. The blue line is neckline of the pattern. A break of the neckline tends to foreshadow further downside. However, it is not uncommon for price to retest the neckline, which means the gold ETF (GLD) could move back toward the 161.50 to 164.00 range while staying within the confines of the potentially bearish set-up. A sustainable move above the neckline would greatly reduce the odds of the pattern holding true to form. If the pattern remains in place, GLD could logically fall toward 146.00 in the coming weeks, which would represent an additional loss of 7.8%.

In addition to the head-and-shoulders pattern appearing on the chart of the silver ETF (SLV), gold’s cousin has traced out a series of lower highs (orange arrows) and lower lows (blue arrows). The lower highs and lower lows define a bearish downtrend. A retest of the upward sloping blue neckline could bring SLV back toward the neighborhood of 30.64 to 31.05. If SLV fails to retake the neckline, a decline toward 26.40 could be in the cards. A move to 26.40 would add 11.46% to the losses incurred in SLV since the late April peak.

We have been concerned about gold and silver for some time. We stopped out of SLV near 36.00 way back on May 10. SLV has dropped roughly 17% since May 10. We exited GLD on August 24 near 170.00. GLD has dropped roughly 7% since August 24.

The Fed and global central bankers remain bullish wild cards for precious metals and stocks. The Fed seems to be taking a wait-and-see approach on the next round of QE. If risk assets take another leg down, gold and silver could provide early clues relative to the market’s expectations for more QE. As long as gold and silver remain weak, it is bearish for both risk assets and expectations for QE. Until conditions improve, we will continue to favor conservative assets, such as cash and the U.S. dollar (UUP). Given the generic statement for the Fed on Tuesday, we also have a small exposure to shorts (SH).

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.