Gold Price Long-term Advance Still in Place

Commodities / Gold and Silver 2011 Dec 15, 2011 - 07:56 AM GMTBy: Donald_W_Dony

Gold's multi-year rise remains firmly in place in spite of the recent drop to $1600. The elements that have fueled the advance over the past decade have not gone away. Concerns over mounting sovereign debt, the secular decline of the US dollar and future inflationary fears continue to drive gold higher in value over the long term.

Gold's multi-year rise remains firmly in place in spite of the recent drop to $1600. The elements that have fueled the advance over the past decade have not gone away. Concerns over mounting sovereign debt, the secular decline of the US dollar and future inflationary fears continue to drive gold higher in value over the long term.

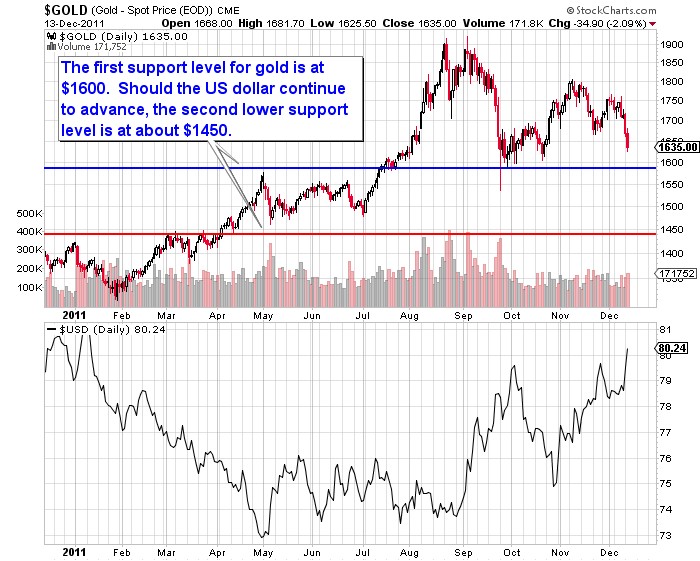

In the short term, the global bear market is having a negative impact on the precious metal. The current pullback in gold prices will largely depend on the duration of the bear market and not a lack of fundamental demand.

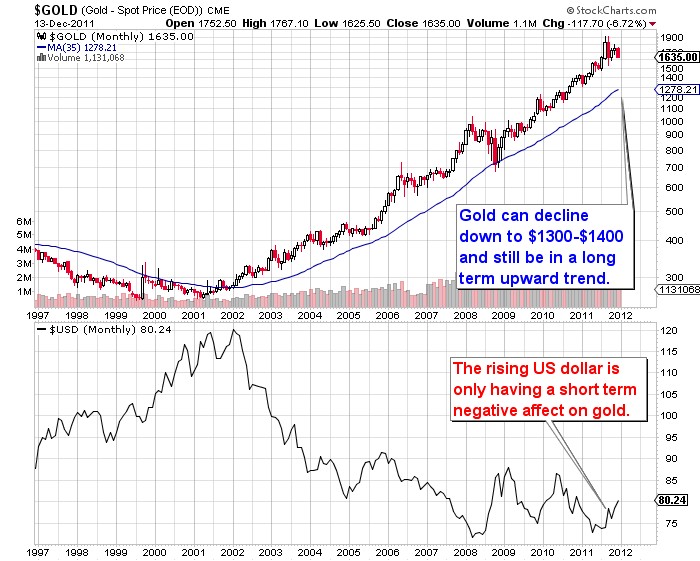

When equity markets start to decline, money shifts toward the safety of the US$. For example, in 2008, when stock indexes dropped 30%-40%, the dollar rose 22% in response to $0.88. This advance caused gold to fall $300 or about 30% of its value. Commodities are always priced in US dollars and an advancing American currency is negative for raw material prices. However, once the new bull market started in March 2009, the Greenback fell and the metal continued its long term rise.

The length of the this current bear is unknown. Should it persist into 2012, then the dollar could advance back to $0.88 and gold will likely decline down to the moving average again (Chart 1). The yellow metal can decline down to $1300-$1400 and still be in a decade long advance.

Bottom line: Gold's long term advance is not threatened by the present price weakness. The metal could decline to $1300-$1400 and still remain in a long term bull advance.

Investment approach: The short term pullback will largely be driven by the duration of the bear market and the sequential rise in the US dollar. Investors may wish wish to reduce their gold holdings while this market decline continues. Once the bear market has stopped, the US$ is expected to recede again and gold should continue its long term upward path.

Unless the underlying elements that are driving gold higher are removed, there is a very low probability of the precious metal stopping its advance.

Models point to a target of $2050 by late 2012 or early 2013 and the long term potential for $3000.

Note: More research on global market conditions are in the December newsletter. Go to member log in and follow the links.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2011 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.