Where the Euro Should be Trading

Currencies / Euro Dec 16, 2011 - 12:13 PM GMTBy: Bloomberg

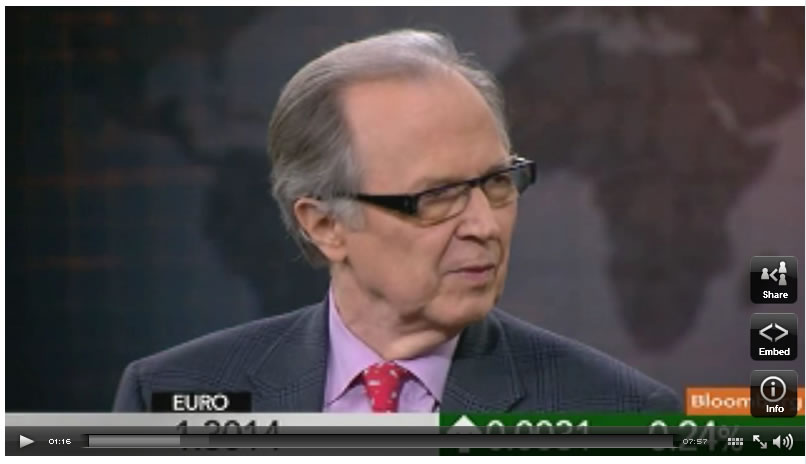

John Taylor, founder of the world's largest currency hedge fund FX Concepts LLC, spoke to Bloomberg TV's Lisa Murphy. Taylor talked about what currencies his fund is currently investing in and gave his thoughts on the euro and USD.

John Taylor, founder of the world's largest currency hedge fund FX Concepts LLC, spoke to Bloomberg TV's Lisa Murphy. Taylor talked about what currencies his fund is currently investing in and gave his thoughts on the euro and USD.

On where he thinks the euro should be trading:

"It seems to me that [the euro] should be a lot lower than it is."

"I think there's a distinct possibility [that the euro will drop to parity with the dollar]. What's surprising to me is that it's part of the policy settings that Europe ought to have. It really ought to be at parity. Things could be better for the Mediterranean states. They would sell more products, they'd import fewer products because they'd be expensive. That would help current account balances."

"If Mario Draghi just came out and made a statement, you know, Gee whiz, I think the euro's a little high, all of us would be happy to oblige and the currency would drop sharply."

On why the euro is still high:

"All the European banks have to raise capital. This is very difficult for them. So instead of raising the capital in order to increase their capital ratios, they're bringing back assets that were overseas, into Europe. So, that means a building that was maybe financed in New York by Hypobank out of Germany, that financing is going to Citibank, or J.P. Morgan, and a German bank is moving its money back into Germany, and that buys euros."

"The easiest place for [European banks] to cut back is in the U.S., Asia and Latin America, so they're taking money home."

On following these money flows into Europe:

"It's extremely hard to follow. One of the easiest ways to follow it is, looking at the number of deals being brought to private equity people from European banks where they are trying to sell things -- not just a loan, but a whole subsidiary they don't want anymore. They're going to take the dollars they get for that, buy euros, and send it home. That flow has increased dramatically...on a percentage basis, around 400%, or 500%."

"In fact, there are so many things to be sold that European banks aren't going to get good prices at all."

On FX trading:

"The European banks are in trouble, so the euro goes up. That seems wrong. In 2008, we had a crisis in the mortgage market, and the dollar went up."

"For the same kind of reason because J.P. Morgan Chase, Citibank had to bring money home in order to protect their capital position in the U.S. So, also, the central banks of Asia and everybody are trying to protect Europe. They want Europe to do well."

"So enough though we look at it as a good deal, the central bankers might because they want to protect their brethren."

On Washington, D.C.:

"One of the things [I'm watching in Washington, D.C.] is, what is Ben Bernanke going to do? If we do QE3, that's bad for the dollar."

"What are the Republicans and Democrats going to do about extending the tax benefits that existed in 2011 into 2012? If they don't, that will put the U.S. into a recession, which is again one of these perverse things that will strengthen the dollar. The dollar is negatively correlated to its growth: when the U.S. is doing great, the dollar goes down. When the U.S. is doing lousy, the dollar goes up."

On currencies in Europe:

"The Norwegian krone is one of the best currencies because they have all the oil. They don't belong to the European Union so they're completely free -they can do what they want. [The krone] a strong currency, a stable currency."

"We own more dollars than anything else but in Europe our favorite currencies are Norway and Sweden."

"The Canadians are looking fairly good because they're close to us. We have the best economy. They import a lot of raw materials we need, and we're using them, so they look very good."

"For Norway, the price of oil is somewhat dominated by the OPEC decisions. If OPEC keeps the supplies tight, oil won't go down very much. I'm more worried about Australia, New Zealand, countries that are selling a lot to China."

"[If China slows down], I think commodities could do something like they did in 2008, I'm not saying it will be that aggressive, but if they dropped in half, it will really kick Australia in the teeth."

"I am long the Australian dollar, and short New Zealand."

On why he is long the Australian dollar and short New Zealand:

"Looking behind the scene, it looks like a lot of money is coming into Australia to develop the mineral sector. Capital inflow into Australia is very strong. The export market is turning down, but capital inflow is very strong. New Zealand doesn't have that capital inflow so therefore it's not protected by that."

Copyright © 2011 Bloomberg - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.