Gold Bull or Bear?

Commodities / Gold and Silver 2011 Dec 19, 2011 - 09:37 AM GMTBy: Tony_Caldaro

Gold did something this week it had not done in three years, and had done only twice before since the bull market began in 2001. It completely retraced an entire uptrend. Amazing as that should sound, and it is, as I have never seen this kind of bullish action ever before, there is one potential bearish implication. While 2011 has been a difficult year for the equity markets with a lot of volatility and uncertainly. Gold has just thrown its OEW count into the same ring of fire. Tough year!

Gold did something this week it had not done in three years, and had done only twice before since the bull market began in 2001. It completely retraced an entire uptrend. Amazing as that should sound, and it is, as I have never seen this kind of bullish action ever before, there is one potential bearish implication. While 2011 has been a difficult year for the equity markets with a lot of volatility and uncertainly. Gold has just thrown its OEW count into the same ring of fire. Tough year!

After kicking this event around in the OEW forum with several in our group, who closely monitor and trade Gold, we arrived with four potential long term counts. Three are bullish and one is bearish. Presenting the four possible counts, in no order of preference, to allow the reader to make their own determination.

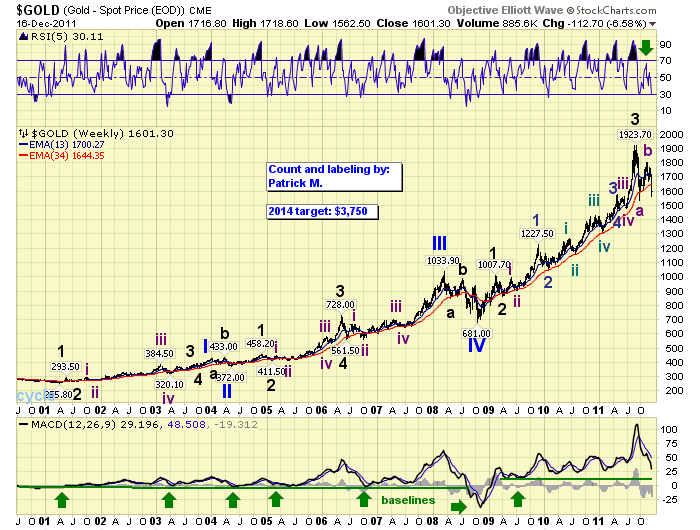

The first count is a slight internal deviation from what we had been expecting for 2011: a Major wave 3 high and a significant Major wave 4 selloff. This count was presented by Patrick in the US, who has done an excellent job in tracking the precious metals. Major wave 4 support, under this scenario, is in the range of the previous downtrends lows and the Intermediate wave iii high: $1463 to $1559. We have this support band posted the daily Gold chart. Gold hit $1563 on thursday. Once this downtrend concludes Gold should enter a 2-3 year Major wave 5 advance. Taking it to our long term target of $3750. This is a popular count.

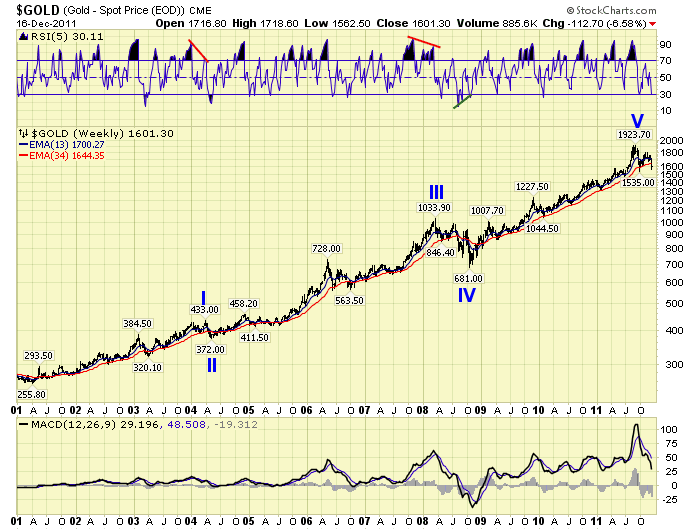

The second count, both Patrick and I are concerned about. This count suggests the bull market in Gold is over. We can see five completed waves from the 2008 low. Just like we observed from the 2001 and 2004 lows. At $1923 Primary wave V has nearly a perfect 1.618 fibonacci relationship to Primary waves I through III. The recent uptrend, to $1804, was the first one that failed to reach an overbought condition on the weekly RSI in the entire 10 year bull market. Also, the $1923 high displays the highest weekly MACD since 2001 as well. It will take quite a selloff to confirm this scenario. But it is one everyone Gold investor should take into account. This is a popular count.

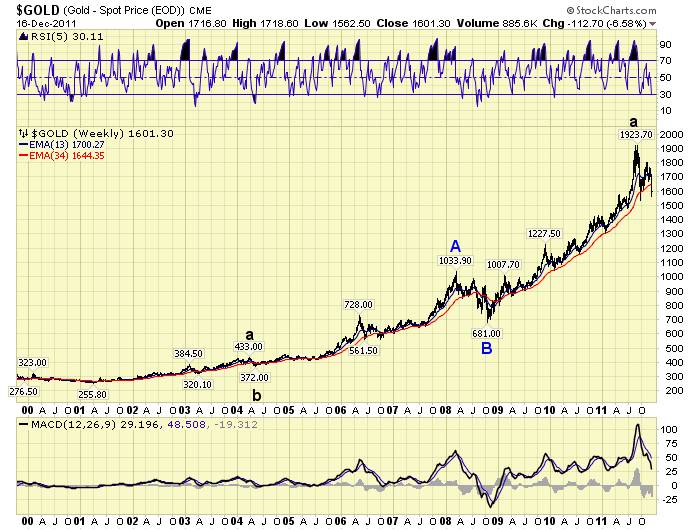

The third count is offered by Nick in Sweden. Nick suggests the Gold bull market may be tracking the traditional ABC commodity pattern. As you are aware nearly all commodities, in both bull and bear markets, unfold in ABC patterns. Currencies as well. This is the reason they are difficult to track with the traditional EW approach. Since OEW quantifies waves we have clearly seen these ABC patterns unfold for decades. Under this scenario the first level of support is currently near the $1470 area, and the next level is around $1200. Have not seen this count anywhere.

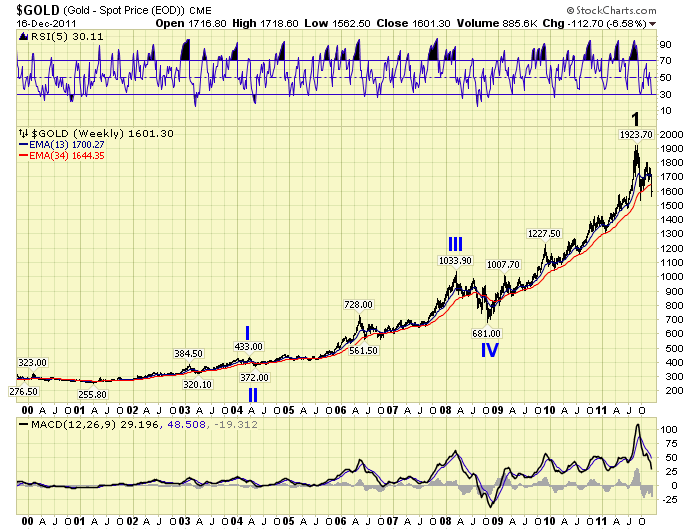

The fourth count is super bullish long term, but not so medium term. This suggests the recent $1923 high only ended Major wave 1 of Primary wave V. Again, support for Major wave 2 would be in the $1200-$1470 range. Have not observed this count anywhere either.

That’s it. Four potential long term counts with three bullish patterns, and one bearish. Medium term we additional downside risk into the $1463 to $1559 support zone. Typically Gold takes about two months to correct, which suggest a low next month. Then, during the next uptrend we can start eliminating some of these potential counts. One last note. Should either the FED, or the ECB, start a Quantitative Easing program this would be quite bullish for Gold. Review the four counts and decide for yourself which one fits your own investment objectives.

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.