Europe Bond Market To Remain Problematic For Stocks In 2012

Stock-Markets / Stock Markets 2012 Dec 24, 2011 - 10:58 AM GMTBy: Chris_Ciovacco

Wall Street tends to segregate “bond-guys” from “stock guys”. The bond side of the market tends to be more conservative; they also perform more detailed research meaning they actually look at the numbers. The stock side of the market is based more on momentum, gut feel, and stories.

Wall Street tends to segregate “bond-guys” from “stock guys”. The bond side of the market tends to be more conservative; they also perform more detailed research meaning they actually look at the numbers. The stock side of the market is based more on momentum, gut feel, and stories.

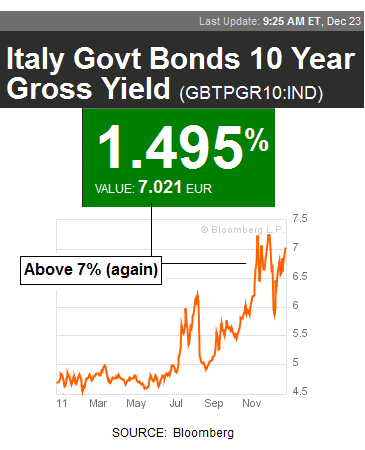

The current stock market story is the problems in Europe have been solved. The bond market does not share that bullish sentiment. On Friday morning, the yield on a 10-year Italian bond moved back above 7%. The stock guys will say “so what, countries have survived with higher yields.” That’s true, but the yield is only one of the factors; you must also consider the size of the country’s debt, their revenues, and the size of their banking system. The size of the banking system is relevant in the event the government needs to bail them out and/or recapitalize them.

From Bloomberg (12/23/2011):

Prime Minister Mario Monti’s market honeymoon is ending as Italian bond yields approaching 7 percent signal mounting concern his government may struggle to sell 440 billion euros ($574 billion) of debt next year.

“The Monti effect has now also been priced in and I think there is a lot of room for disappointment next year,” said Lex Van Dam, who manages $500 million in assets at Hampstead Capital LLC in London

“The structural reforms are regarded by the market as more important than the budget measures,” said Stephen Lewis, chief economist at Monument Securities Ltd. in London. “Because these structural reforms impinge on special interest groups, Monti will face strong opposition, possibly on the streets, but definitely from politicians representing those interests.”

To understand the scope of the current problem, the following questions are addressed at various points in this December 18 video:

- When does debt become unsustainable? See 00:29 mark in video.

- How can rising yields create a crisis so quickly? 13:30 mark.

- Why have the financial markets been so volatile? 21:37 mark.

The stock side of the market likes the “Santa Claus rally” story (it requires little effort). Therefore, we cannot rule out a push as high as 1,340 in the S&P 500 over the next few weeks. However, the bond market’s fundamental analysis will most likely, in the end, prove to the stock guys the problems in Europe are not solved. Longer-term, we will continue to favor deflationary assets, such as cash, conservative bonds, and inverse stock positions/shorts (SH). If the euro (FXE) cannot muster a short covering rally soon, we would also consider adding to our relatively conservative position in the U.S. dollar (UUP). If stocks break above the S&P 500’s 200-day (now at 1,259), we may take on a small hedge to offset our exposure to deflationary assets. For now, our largest position is cash.

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.