Gold and Silver Bear, India Massive Keynesian Economic Failure

Commodities / Gold and Silver 2011 Dec 28, 2011 - 12:31 PM GMTBy: Ned_W_Schmidt

2011 has been a truly enlightening year. We learned that change had not arrived, despite all our hope. We learned that the U.S. Congress cannot be trusted to prevent the financial calamity which lies ahead for the U.S. But most important, we learned that Keynesianism, a form of socialism taught in modern day academia, has been a complete failure, and perhaps a complete hoax.

2011 has been a truly enlightening year. We learned that change had not arrived, despite all our hope. We learned that the U.S. Congress cannot be trusted to prevent the financial calamity which lies ahead for the U.S. But most important, we learned that Keynesianism, a form of socialism taught in modern day academia, has been a complete failure, and perhaps a complete hoax.

Greece, Italy, et al. have been good lessons for the world. Government debt is not the means to achieving prosperity. The Keynesian roadmap is ultimately paved with poverty and crushed dreams. However, those learning experiences are dwarfed by the massive Keynesian failure in India.

Success of a nation can be measured in many ways. GDP is one method, but has been long recognized as an incomplete metric. Literacy and level of education are, for example, important national goals, but are not in GDP. Availability of clean water on a 24/7 basis might be another. Most of us though are real world people, and prefer real world measures. The wealth of a nation and its ability to feed the citizens may be far more important than theoretical measures like GDP.

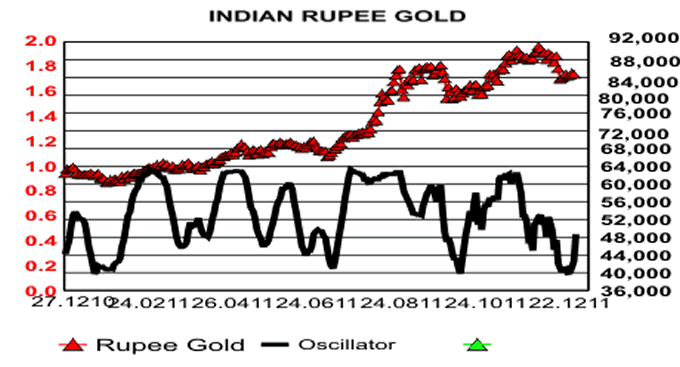

In the chart above we can observe what has been happening to the wealth of India. Plotted is the value of Gold in Indian Rupees over the past year. Over the past year, the value of Rupee Gold is up by more than a third. Reason for that appreciation is that the Rupee has been hammered due to a long list of government failures. Most recent was the reversal of a policy change on retail store ownership which has demonstrated to the world that India has not yet entered the 20th century.

That appreciation of Rupee Gold also gives an important message. It allows us to estimate what the wealth of India would buy today versus a year ago. Based on the price of Rupee Gold, the wealth of India will only buy ~70+% of what it would have a year ago. And there we have it, another Keynesian success story!

Far more important indicator of a nation's success is its ability to feed its citizens. India's government is moving to provide more low cost food to the populace(Food subsidy bill to test India's finances, Financial Times, 19 December), as they cannot feed themselves. Reality of inadequate food in India is shocking, and was largely hidden till the drive for this legislation. Per the above article, 75% of the rural population and 50% of the urban population are to now receive government subsidized food. When 60% of a nation with 1.2 billion people cannot eat adequately without government food, Keynesian socialism has clearly failed.

Indian investors could have protected their wealth by investing in Gold rather than in their nation. Gold is indeed, as has been proved so many times in history, wealth insurance. It protects one's wealth from the destructive activities of politicians and Keynesian economists. Those living in such countries should own Gold to protect their wealth. They are not alone in this need for Gold. Those living at risk of the radiation clouds likely to be a consequence of Putin ascending to the throne of Russia in March should also own Gold, but that is a story for another time.

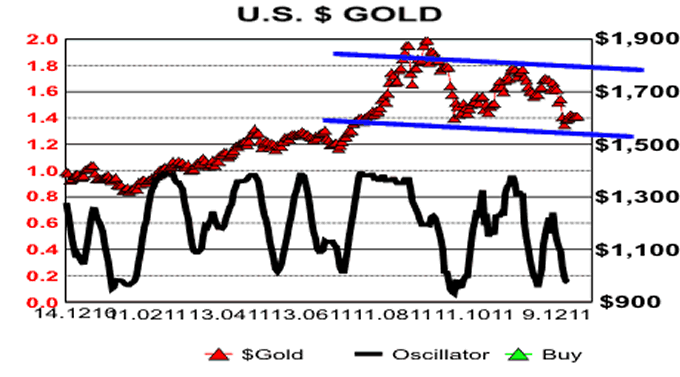

Despite our positive long term view on Gold, we recognize that market action is comprised of both bull and bear phases. Up and down are both part of the process. In the chart above the continuance of the bear market in $Gold is apparent. $Gold failed to make a new high, and has now made a new low. The channel highlighted by the arrows is likely to develop a far more negative slope with the breaking of the $1,600 support level.

All popular support(resistance) levels are ultimately violated, and their implications are reversed. $1,600 is now a resistance level for $Gold while $29 is now a resistance level for $Silver. Based on the second dimension of any market action, time*, the Silver Bear Market is roughly three quarters complete. $Gold is only about a third of the way, in terms of time, through its bear formation. Investors with longer term perspectives should use the secret weapon of Gold and Silver investors during this period. That weapon being patience.

As this is our last message for 2011, we want to wish all a Happy New Year and the best in 2012. To all those new friends we made this year that took time to write us notes of love and adoration, we send a special thanks. We appreciate you noting how right we were in 2011!

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.