Powerful Rebound In Gold and Silver Prices About To Begin?

Commodities / Gold and Silver 2011 Dec 31, 2011 - 05:01 AM GMTBy: Jeb_Handwerger

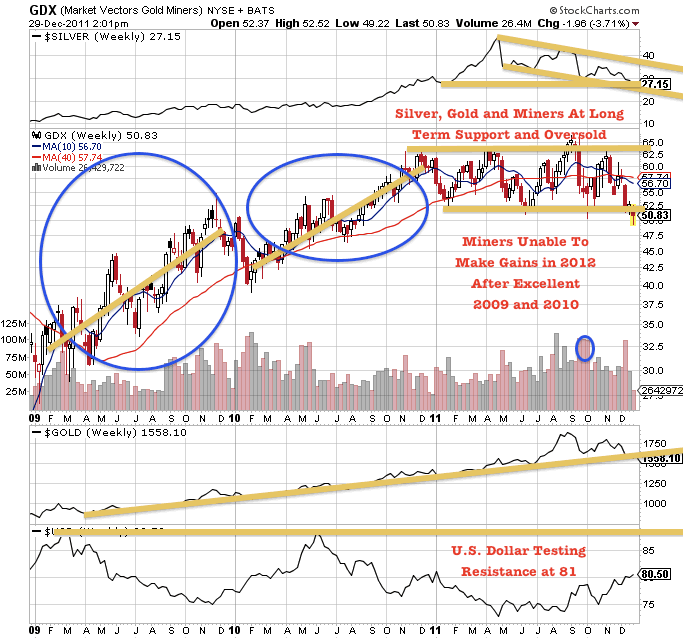

Rarely has such technical destruction been visited on stalwart sectors such as gold, silver and the mining stocks(GDX). The silver charts reveal technical damage not seen since the destruction of 1984. It can only be conjecture that can account for a once in a generation obliteration of a once hallowed sector. It must be remembered that both gold(GLD) and silver(SLV) had major moves earlier this year to the $1900 and $50, surpassing overhead resistance and reaching overbought territory. This may be the reason why the decline in precious metal is overextended and extremely oversold. We urged caution back in April for silver and in September for gold. Silver has characteristically corrected close to 50% from its highs, while gold has fallen less than 20%. Pullbacks are normal and restorative in a secular bull market in precious metals especially after explosive moves.

Rarely has such technical destruction been visited on stalwart sectors such as gold, silver and the mining stocks(GDX). The silver charts reveal technical damage not seen since the destruction of 1984. It can only be conjecture that can account for a once in a generation obliteration of a once hallowed sector. It must be remembered that both gold(GLD) and silver(SLV) had major moves earlier this year to the $1900 and $50, surpassing overhead resistance and reaching overbought territory. This may be the reason why the decline in precious metal is overextended and extremely oversold. We urged caution back in April for silver and in September for gold. Silver has characteristically corrected close to 50% from its highs, while gold has fallen less than 20%. Pullbacks are normal and restorative in a secular bull market in precious metals especially after explosive moves.

Unless such technical destruction is reflective of an upcoming geopolitical news development, we must look for more mundane causes. When the woods are ablaze, the fire obliterates the sequoias at the same time they incinerate the pines. The recent declines may be the result of a rush to the U.S. dollar (UUP) and treasuries (TLT).

Fukushima's can be explained rationally as a result of a millennial event consisting of fire, wind and flood. The chaos through which we are passing defies explanation. It is as if the inmates of the asylum have taken over Wall Street.

Unless there is an underlying exogenous catastrophe that lies ahead, what is being witnessed is a tale of sound and fury told by an idiot. We believe that the markets are reacting irrationally to rational fears of deflation compounded by a flight to cash in fear of risk. Gold Stock Trades has reiterated on many occasions that it is inadvisable to fight the Fed. On numerous occasions we said with one stroke of the pen the Central Bankers could reverse the entire market.

This year's surprise twist resulted in reversing a precious metals market that was on the verge of a runaway upward move. Deftly the dagger that accomplished the twist was thrust through the rising precious metals market and resulted in stiletto downward moves.

There was also a coordinated effort by the Japanese (FXY) and the Swiss (FXF) to boost the dollar and devalue their supposedly, safe haven yen and franc over the past few months and at the same time revive their own struggling economies. It may be that the Fed wanted to lower gold and silver prices and lift the dollar before instituting its next round of QE3 in the 2012 election year. This year may not have been the right time to weaken the U.S. dollar, especially as Europe struggles with its own debt crisis and China deals with its own weakening economy.

To avoid a domino contagion effect in Europe and to prevent nations from collapsing, actions were taken by the Fed to stall rising commodities, prevent a collapse in the U.S. dollar and keep a cheap Euro so peripheral nations have an easier time paying down debts. Best to save the PIIGS, through a cheap Euro and reserve QE3 for later.

The question arises: What will it take to cause a turnaround in what is the most severe correction in gold and silver in several years? Public sentiment and momentum indicators are hitting multi- year oversold levels indicative of a reversal. Heretofore, gold and silver have been safe havens, but not recently. Ergo it is hoped for that positive events in 2012 may serve to control the blaze. The U.S. dollar is reaching key resistance at 81, while gold, silver and the miners test support at oversold conditions indicative of a major rebound move. We could be setting up for the biggest move in precious metals and miners during this 10 year bull market run.

It should be mentioned that this entire decline is the possible result of an assault by market manipulators who have gone short on the traditional repositories of value, exactly at the end of the year thinly traded holiday period. The move to the downside is overextended and could indicate selling capitulation. There will be a turn around very soon. Shorts will cover. Gold and silver will rise again, benefiting the source of bullion, the gold (GDX) and silver (SIL)miners.

Further declines and tax loss selling may be in the offing, but are great bargain opportunities as gold, silver and the miners have reached record oversold levels. There is a rule that reactions to exogenous news items which create technical gaps down will be filled to the upside in a Newtonian equal and opposite move higher for gold, silver and the miners.

Stay tuned to my free newsletter for up to the minute developments in our chosen sectors of precious metals, uranium and critical/strategic metals.

By Jeb Handwerger

© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.