China Economy, Gold 2012 And Von Mises’ Crack-Up Boom

Economics / China Economy Jan 04, 2012 - 08:43 AM GMTBy: Darryl_R_Schoon

The credit boom is built on the sands of banknotes and deposits. It must collapse… If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders.

The credit boom is built on the sands of banknotes and deposits. It must collapse… If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders.

Ludwig von Mises, Human Action, 1949

I first attended the Canton Trade Fair in October 1976. All Chinese men and women were dressed in blue shirts and blue pants, bicycles were China’s main mode of transportation, Chairman Mao had just died and China’s mantra, “We will continue to support the policies of Chairman Mao Tse-Tung and criticize the policies of Deng Xiao-Ping”, was heard everywhere.

But three years later when I received White House invitations to attend the Washington DC reception for the Vice-Premier of the Peoples’ Republic of China, it was Deng Xiao-Ping who arrived; not a hard-line inheritor of Chairman Mao’s revolutionary precepts.

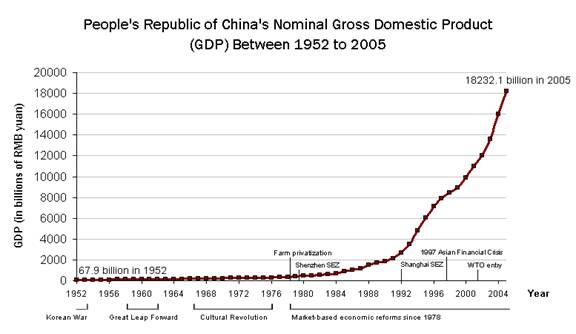

In 1977, Deng Xiao-Ping wrested power from China’s conservative communist ideologues and in 1978, opened China’s socialist economy to private ownership. By 2005, China’s private sector had expanded to 70 % of its economy and China became an economic power in only 25 years.

While Mao Tse-Tung had successfully steered China away from Western suzerainty, it was Deng Xiao-Ping who put China on the path to financial and geopolitical power; a path that would be as rapid as it would be unsustainable—for China’s explosive growth was founded in large part on excessive credit creation in the West.

http://upload.wikimedia.org/wikipedia/commons/b/b3/Prc1952-2005gdp.gif

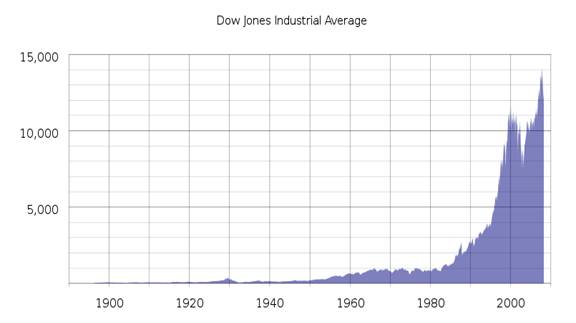

The remarkable rise in China’s GDP reflects the just as remarkable rise of the Dow during the same period

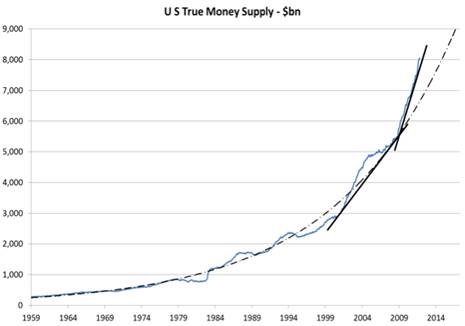

The correlation between the rise of China’s GDP and the rise of the Dow is unmistakable. It’s also the reason why China’s growth is unsustainable. China’s rapid growth was fueled by the unprecedented expansion of the US money supply—an expansion directly responsible for America’s exploding appetite for consumer goods from China and the US dot.com stock market bubble in the 1990s.

http://www.goldmoney.com/gold-resear...

Appointed Fed chairman in 1987, Alan Greenspan presided over the greatest credit and monetary expansion in US history, an expansion which led to America’s three largest speculative bubbles; the 1992-2000 dot.com bubble, the 1991-2006 consumer bubble and the 2002-2006 real estate bubble; three bubbles whose cumulative collapse would derail the world economy and set in motion Ludwig von Mises’ crack-up boom.

THE CRACK-UP BOOM

As von Mises wrote in Human Action in 1949 … If the credit expansion is not stopped in time, the boom turns into the crack-up boom; the flight into real values begins, and the whole monetary system founders…

Von Mises’ crack-up boom, or more correctly Greenspan’s crack-up boom, had its origins in the 1980s when the US greatly increased spending yet cut taxes and initiated unprecedented levels of borrowing to make up for lost revenues, consequently flooding America with excess liquidity which would set in motion America’s largest stock market bubble since the 1920s.

Although Alan Greenspan had the intellect of an über-economist, he lacked the courage to stand up to Washington DC and Wall Street. In the 1990s, when the Dow began rising far out of proportion to economic growth, Greenspan moved to stop the developing bubble in stocks by raising Fed interest rates:

I think we partially broke the back of an emerging speculation in equities. - Alan Greenspan, February 1994

But Greenspan’s rate increase didn’t stop the bubble. Share prices continued higher so Greenspan continued raising rates. After seven consecutive increases between February 1994 and February 1995 and another increase in March 1996, Wall Street demanded Washington DC stop Greenspan from further Fed tightening.

Greenspan capitulated.

…it was not the policy of the Fed to prick bubbles by monetary means. - Alan Greenspan, March 1997

In 1998, Greenspan lowered Fed interest rates three times allowing the dot.com bubble to continue its dizzying liquidity-driven ascent. Finally, in 1999, the Fed was forced to prick the dangerously large stock market bubble which Greenspan now denies recognizing.

My video, Dollars & Sense show #11, titled The Fix Is In, explains Greenspan’s flawed tenure at the Fed, see http://youtu.be/65CnOUhEFIk; and, while there are reasons to explain Greenspan’s shortcomings, none can reverse the damage he has done.

Because of his inability to just say no, Greenspan left a legacy of three historic credit bubbles whose catastrophic collapse would trigger Ludwig von Mises’ crack-up boom and send America and the world into the greatest economic meltdown since the Great Depression.

THE GOAT RODEO OF CREDIT DISTORTED DEMAND

The bankers’ artificial injection of credit into free markets ultimately overwhelms supply and demand fundamentals. This distortion, conveniently overlooked during expansions, becomes painfully apparent during contractions when demand disappears leaving behind excess capacity, defaulting debts and high levels of unemployment.

Capitalism’s foundation of debt-based money was destabilized by America’s expansion of its monetary base after 1980; resulting in the eventual overcapacity of supply in the East, e.g. China. Japan, Korea, whose economies had expanded to satisfy the artificially inflated demands of the West, e.g. the US, the UK, Europe.

Capitalism, an always uneasy imbalance between credit and debt, is now trying to regain its balance. It can’t. The present crisis, created by decades of excess credit, is being treated with even more credit; a dangerous palliative that will exacerbate, not solve, what is happening

Credit expansion is the government’s foremost tool…to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises, 1949

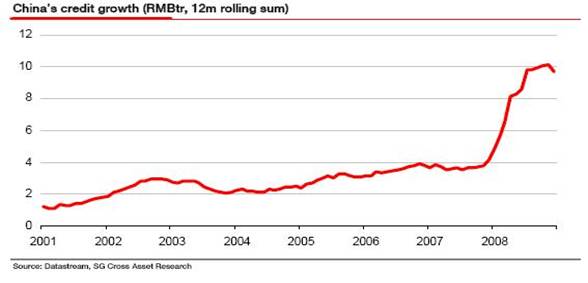

Today, China’s late run at capitalism’s table is fueling the very collapse von Mises predicted; for if Greenspan’s credit expansion was excessive—and it was—China has set in motion an even larger expansion.

To offset the global collapse in demand, China expanded its money supply in 2008 by an extraordinary 150 %, an increase driven by China’s need to maintain economic growth or risk losing political control.

Modern monetary debauchery is no longer a Western phenomenon. China has now joined the party and in a very big way.

2012, GREAT WAVES AND THE COMING COLLAPSE

The ending of the Mayan calendar in 2012 is as misunderstood as the interplay between credit and debt and supply and demand; but the coincident collapse of the current economic paradigm and an arcane indicator of change should not be dismissed.

Professor David Hackett Fisher in The Great Wave, Price Revolutions and the Rhythm of History writes that for the last eight hundred years, periods of economic and social stability have been intermittently interrupted by waves of rising prices.

Each of these great waves according to Professor Fisher culminated in the economic and societal collapse of the existing order, bringing to an end the Middle Ages, the Renaissance, the Age of Enlightenment, etc.

During each great wave: …Food and fuel led the upward movement. Manufactured goods and services lagged behind. These patterns indicated that the prime mover was excess aggregate demand, generated by an acceleration of population growth, or by rising living standards, or both.

… Prices went higher, and became increasingly unstable. They began to surge and decline in movements of increasing volatility. Severe price-shocks were felt in commodity movements. The money supply was alternately expanded and contracted.

Financial markets became unstable. Government spending grew faster than revenue, and public debt increased at a rapid rate…Wages, which had at first kept up with prices, now lagged behind.

Returns to labor declined while returns to land and capital increased. The rich grew richer. Inequalities of wealth and income increased. So did hunger, homelessness, crime, violence, drink, drugs, and family disruption.

..Finally, the great wave crested and broke with shattering force in a cultural crisis that included demographic contraction, economic collapse, political revolution, international war and social violence

pp. 237-238, David Hackett Fisher, The Great Wave: Price Revolutions and the Rhythm of History, Oxford University Press, 1996

Great waves take 80 to160 years before they end in the eventual decline and collapse of existing epochs. Today, another great wave is about to crest and break; and the changes could be even more extreme as the amplitude of change is greater than in any previous wave

The current great wave began in 1896. That it could crest and break in 2012 could be a coincidence. Or, it may not.

GOLD AND THE CRACK-UP BOOM

…[during] the crackup boom...the flight into real values begins, and the whole monetary system founders. - von Mises

Von Mises’ predicted flight into real values—gold—is now underway despite the best efforts of today’s kreditmeisters to diminish the allure of the only safe haven left to those fleeing paper money’s now burning mansion.

One of the foremost proponents of the flight to gold is famed stock market analyst, Richard Russell. According to the Hulbert Financial Digest, Russell’s The Dow Theory Letter is tied for top place as a market timer on a risk adjusted basis since 1980.

A leading financial analyst with a stellar reputation timing stock market trends, Russell’s comments regarding today’s stock markets and gold should be seriously considered and, if appropriate, then acted upon.

On December 17, 2011, Richard Russell wrote:

…The talkers on Bloomberg are discussing stocks to buy. They are unswerving bullish. It never occurs to them that hard times lie ahead and that this is not the time to buy stocks…My advice -- sell any stocks you still own -- sell into all rallies, or stay out of stocks completely.

I continue to like gold in all its forms, but I'm afraid that gold mining stocks will tend to go with the general market. Personally, I'm staying with my gold mining stocks until the bitter end. I continue to believe that we'll see a final hysterical blow-off in gold (the metal) that will carry the mining stocks with it.

On December 31, Russell noted 11 consecutive years of gold closing higher confirms that gold is in a record bull market headed towards an even more explosive high:

This year's close for gold marks the 11th year for higher year end gold closing. To my knowledge this is the longest bull market of any kind in history in which each year's close was above the previous year. This fabulous bull market will not end with a whisper and a fizzle. I continue to believe that the upside gold crescendo of this bull market lies ahead. We are watching market history.

The crackup boom will end as von Mises predicts in monetary disarray, i.e. the debasement of currencies and possible hyperinflation where paper money loses all value. Today, money is no longer a store of value. It’s a trap for the unsuspecting that has already been sprung.

The 300 year viral spread of the banker’s fraudulent paper money is best explained by Gresham’s Law wherein bad money drives out good. But the global success of the banker’s debt-based money has led to its own undoing; for when there’s no good money left, only bad remains.

In 1971, after which gold no longer backed the bankers’ now fiat money, the growth of credit and debt became exponential. Today, they are reaching their limits. Tomorrow, those limits will be exceeded.

Yes, Dr. Keynes, Dr. Friedman, Dr. Greenspan, Dr. Bernanke, et. al. while there are no limits to economic hubris, there are limits to monetary imbalances.

Throughout history, time and time again monetary chaos has led to the explosive rise in the price of precious metals. It’s happening again today.

MIDNIGHT AT THE CASINO

If you haven’t yet cashed in your chips, you should. It’s almost midnight and the casino owners are worried. A run on the cashier’s window would show them to be bankrupt; the casino’s only assets being customer IOUs and banks upon banks of increasingly worn chip-making machines.

The management’s recent offer of unlimited chips to the money changers still on the floor was done in the desperate hope it would convince the remaining gamblers of the house’s solvency.

It won’t work. It’s too late. It’s 2012.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.