Precious Metal Investors Battered by Gold and Whipped By Silver

Commodities / Gold and Silver 2012 Jan 04, 2012 - 08:56 AM GMTBy: William_Bancroft

As we enter the New Year only the firmest of gold and silver investors are holding with serene assurance, as the gold and silver prices have been trending down for a couple of months.

As we enter the New Year only the firmest of gold and silver investors are holding with serene assurance, as the gold and silver prices have been trending down for a couple of months.

Prices have softened again since our latest update on this issue, and thin markets over the festive period allowed relatively low levels of market activity to have an un-naturally significant effect on price direction. These things happen.

Gold has sold off by nearly 13% since it recovered to $1,800/ounce in early November. The mainstream media has been pronouncing the death of the gold bull market, and CNBC even suggested gold be re-rated as a risk asset.

Bumps in the road for gold investors

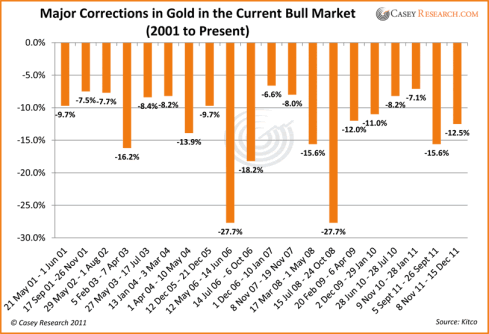

Considered investors should note that such sell offs have been commonplace on this now 12 year gold bull market. The chart below from Casey Research shows exactly this, and puts recent price declines in context.

All these price corrections have occurred in what has proved a very rewarding trend for gold investors.

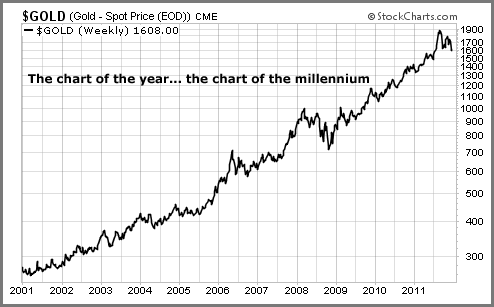

It is no wonder that Brian Hunt refers to a chart of gold’s performance over the past 12 years ‘The Chart of the Millennium’.

Silver price corrections are routine

Silver prices have also disappointed precious metal investors. Gold’s more volatile cousin has lost 20% in value from its own early November recovery to $35/ounce.

Such price drops do get us thinking, an investor can never fall idly in love with a position, but are they again part and parcel of silver investing this last 12 years?

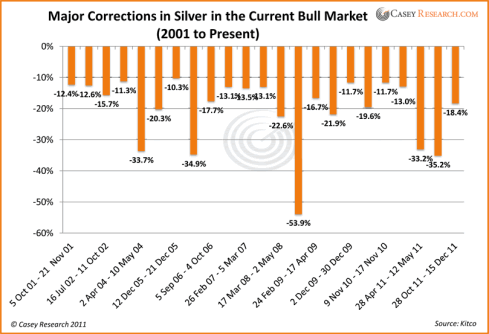

Well, thanks to Jeff Clark and Casey Research, the chart below suggests the affirmative.

Plenty of notable investors have made their voices heard beyond what we continue to urge are continuing bull markets for owners of gold and silver bullion.

The silver price has undergone many corrections en route to gains of over 560% over the last ten years.

The fundamentals driving the precious metals are stronger today than ever. As Jeff Clark reminds us:

“Have the reasons for gold’s bull market changed in any material way such that we should consider exiting? Instead of me providing an answer, ask yourself some basic questions: Is the current support for the US Dollar an honest indication of its health? Are the sovereign debt problems in Europe solved? How will the US repay its $15 trillion debt load without some level of currency dilution? Is there likely to be more money printing in the future, or less? Are real interest rates positive yet? Has gold really lost its safe haven status as a result of one bad week?”

But what does this all mean for our two favourite ways to invest in gold and silver?

Averaging into gold and silver investment

Our favoured means of investing in gold and silver for most people, is for individuals to steadily buy a little each month in what would be called ‘averaging’ into a position.

Dollar cost averaging, or for UK investors, pound cost averaging, has been promoted as the best way of building a position for ages. We find the best advocacy of it by Benjamin Graham and David Dodd, the Godfathers of value investing, in their books ‘Security Analysis’ and ‘The Intelligent Investor’.

All this really means is that you invest a certain amount each month and buy gold and/or silver regardless of the current price.

When the gold price is high you buy less, when it is low you get more for your money. As a result your average cost per unit of gold bullion can be lower. The same applies for silver. Averaging into a position reduces your exposure to price volatility.

This form of investing does require the identification of a trend to invest into, but can be a steady and considered method for the average investor.

Gold and silver investors who are steadily building their positions will find that this recent softness in the gold price and silver price means they are currently getting more bang for their buck. They also benefitted in this way at the very end of 2010 and January 2011.

Keep averaging in and enjoy the current weak prices.

Buying dips in the gold price

More speculative or professional investors might chose not to buy each month but instead to try and buy the sell offs in gold and silver prices as they occur.

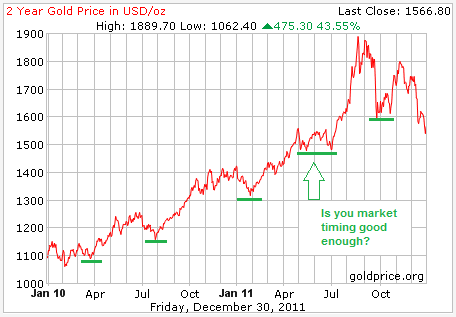

There have indeed been dips to buy, just look at the last two years for gold.

Could you have picked these moments to buy?

Many have tried and failed.

Buying the dips successfully is much easier imagined than done, as this introduces a proprietary trading element to your investing.

If you are a good enough trader to do this consistently the chances are that this is your job and you stand to make a pretty penny.

The danger with trying to trade gold and silver in this way is that you call it wrong when trying to judge when the bottom is in and a good time to buy is there.

Which investment technique works best

We mention a number of notable analysts and traders in our ‘Research & Analysis’ section, but few of even these market heavyweights can consistently buy the dips effectively.

This is why most commentators advocate steadily accumulating gold and silver bullion, in the knowledge that these tangible assets are the ultimate form of money and stand independent of the creaking financial and monetary systems.

Wishing you a successful 2012.

Regards and good investing,

Ready to buy gold and silver? Get started in minutes…

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2011 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.