Gold Confiscation, a Reality? Part 2

Commodities / Gold and Silver 2012 Jan 10, 2012 - 12:48 PM GMT Currency Debasement and Price Stability Risks

Currency Debasement and Price Stability Risks

Despite the small moves in exchange rates between the U.S. dollar and the euro, confidence and trust has been debased. Looking forward to 2012, we see that deflation is becoming a rising danger. After the decay in 2011 that has hammered confidence in the euro, the need to issue more and more 'new' money is growing. The Eurozone is moving into recession (if it is not already in one). The Eurozone is more than likely to lose one or more of its weaker members -this will be good for the euro itself though--so liquidity shortages may force more money supply growth already exceptionally high in many countries.

Despite the 40-year long campaign to prevent gold from returning to any active role in the developed world's monetary system, gold remains the only universally-accepted currency whose supply cannot be increased by policy-makers. The equivalent of money issuance for gold is new mine production, which has been on a relatively flat trend for the past ten years.

Shortage of Gold in Monetary System Relative to Amount of Money

In a recent report, the World Gold Council examined the quantitative relationship between money supply and gold. Data showed that a 1% change in US money supply growth six months prior has an impact of 0.9% on the price of gold, on average. Meanwhile a 1% change in money supply in India and Europe six months prior affects the price of gold by 0.7% and 0.5% respectively.

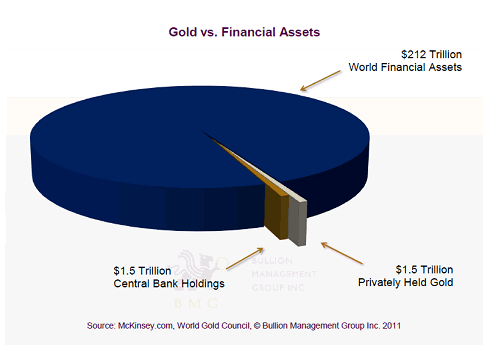

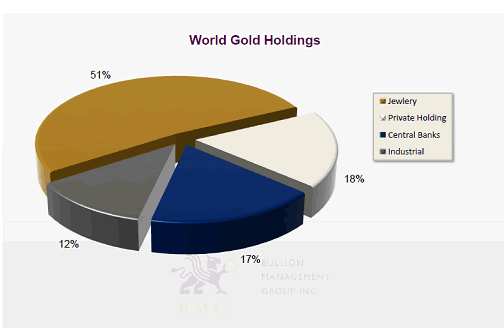

So gold, whether accepted or recognized by 'official' bodies, has a role in money, and this role is growing as the real value of currencies declines in terms of trust and confidence. For gold to do an effective job of restoring confidence and trust, its value has to relate to the global supply of money (i.e. financial assets). Take a look at the first pie chart (thanks to BMG/WGC and McKinsey) showing the value of gold verses the world's financial assets. We leave it to you to estimate the growth of the gold price so that the value of gold closely relates to the value of global financial assets.

A multiplication of 10 to the gold price would fall short of this figure!

Percentage of Gold in Reserves

So often the percentage of gold in reserves is used as a measure of how much gold should there be in the reserves. But in the context of the amount of money there is out there, this number is meaningless. We looked at the traditional use of gold in reserves and found the measure was 3-months worth of international trade, as though this is all it would take to resolve any crisis. Where on earth was that formula concocted from?

If we look back to the days when the developed world accumulated the reserves they're now thought to have and the amount of money on issue, a more pertinent number would be the percentage of money, gold, at current prices, represents in reserves. The two, relevant points in this valuation of gold would be when gold was a basis of the world's monetary system (before the Second World War) and then in the 1960's under the Bretton Woods system, just before it was effectively torpedoed.

It quickly becomes clear that this percentage has been dropping heavily as total money has expanded. For gold to function, as it used to, something has to change. Either the amount of gold in foreign exchange reserves has to increase, or the price of gold in each currency has to rise to compensate for the increase in total money, or a combination of both. Even with a massive hike in the price of gold, two problems will still persist:

- There is not enough gold in 'official' national reserves the world over.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.