Has the Central Fund of Canada Given Us Another Silver Buy Signal?

Commodities / Gold and Silver 2012 Jan 12, 2012 - 08:55 AM GMTBy: Adam_Brochert

I stumbled onto this little gem about a year ago and I think it is about to work its magic again. I am speaking of the ratio of the Central Fund of Canada (CEF) to the price of Gold. Please see the original blog post for an explanation of this CEF:Gold ratio.

I stumbled onto this little gem about a year ago and I think it is about to work its magic again. I am speaking of the ratio of the Central Fund of Canada (CEF) to the price of Gold. Please see the original blog post for an explanation of this CEF:Gold ratio.

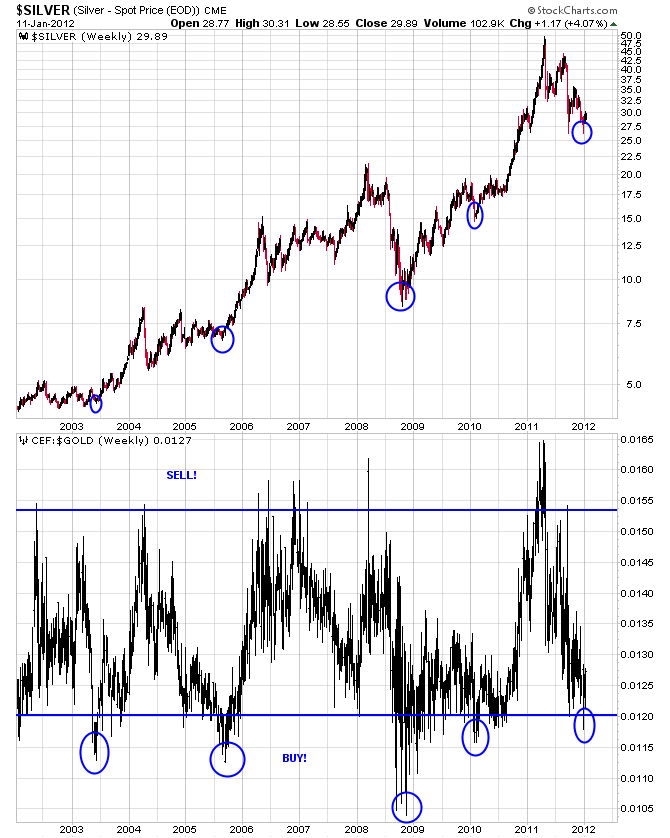

This CEF:Gold ratio barely triggered a buy signal for silver on December 27, 2011. Of course, a "barely triggered" signal may be all we are able to achieve if silver is getting ready to rocket higher after a brutal but fairly typical (for silver) correction from the the spring, 2011 highs. Here's a chart of this ratio thru today's close to show the buy signal for silver (the top plot is the price of silver, while the lower plot is the CEF:$GOLD ratio):

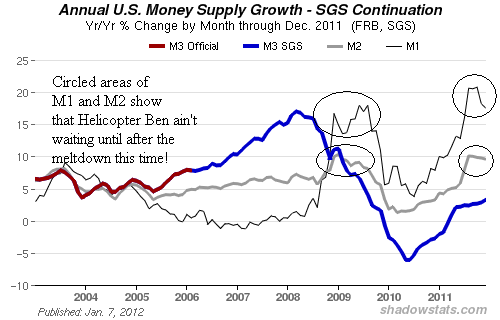

Coupled with horrible sentiment for the restless metal and rampant fears of a deflationary collapse, I think the low is already in for silver. I give you this chart of money supply growth courtesy of shadowstats.com:

This type of monetary madness is what gave rise to silver's last run! We'll have to see what happens, but I think the CEF:Gold ratio will once again prove to be right. I like metal stocks over metal right now and silver over Gold. However, I like anything precious and metal-related at current levels. My subscribers and I are fully invested in order to profit from a further advance in the PM sector, so I am biased. Why don't you join us - a one month trial is only $15.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.