Revisiting Our Proposal for an Overnight Gold Fund

Commodities / Gold and Silver 2012 Jan 15, 2012 - 10:42 AM GMTBy: Bob_Kirtley

In August 2010 we wrote an article entitled “Proposing An Overnight Gold Fund” in which we explored the potential for launching a fund that held long positions in gold overnight and was short gold during the day. We pointed out that “a hedge fund starting in 2001 with $100m, with the strategy of being long gold from the PM to AM fix, and short gold from the AM to PM fix...would be worth $2.16billion today, before any fees and expenses.” We have been monitoring this trading strategy since then and therefore would like to take this opportunity to update readers on its astonishing progress.

In August 2010 we wrote an article entitled “Proposing An Overnight Gold Fund” in which we explored the potential for launching a fund that held long positions in gold overnight and was short gold during the day. We pointed out that “a hedge fund starting in 2001 with $100m, with the strategy of being long gold from the PM to AM fix, and short gold from the AM to PM fix...would be worth $2.16billion today, before any fees and expenses.” We have been monitoring this trading strategy since then and therefore would like to take this opportunity to update readers on its astonishing progress.

Firstly we will introduce the thinking that led us to investigate this trading strategy. There is much debate within the precious metals industry regarding the alleged suppression, or at least manipulation to an extent, by either central banks or the proprietary trading divisions of large banks, or a combination of the two.

In April 2010 the US Commodity Futures Trading Commission CFTC fined Hedge Fund Moore Capital for manipulation of the New York platinum and palladium futures market, as the firm was found to be “banging the close”, which involves entering orders in a manner designed to inflate the closing price, which other various derivatives contracts could be based on. So that is irrefutable evidence that the precious metals futures market is, at least to some extent, being manipulated. However a large concentration of this debate is based not on platinum and palladium, but on gold and silver, and particularly gold.

There are other theories that could explain this discrepancy that do not involve manipulation. For example one could take the view that Eastern market participants are perhaps more bullish on gold than their Western trading counterparts. Therefore gold is perhaps more likely to rise during Asian trading and fall when the west takes over.

Numerous hypothesises have been put forward as to the motive behind alleged suppression of the gold, ranging from a central bank conspiracy to keep gold prices low, to large trading banks simply exploiting their market dominance for easy profits, or even a combination of the two with the central banks and large bullion trading operations working together in some kind for cartel to keep gold prices low. This article does not intend to discuss the merits of these theories, however plausible or implausible various parties believe them to be. Instead we will focus on finding out if a discrepancy exists and if it does, can one take advantage of it and use it for profitable trading strategies.

We would like to recommend an excellent article by Adrian Douglas, editor of Market Force Analysis and a GATA board member entitled “Gold Market is not “Fixed”, it’s Rigged” which goes into great detail on the statistics behind the difference between how gold trades between the AM and PM fix, and how it trades from the PM to AM fix. The very fact that there appears to be a significance difference sets our alarm bells ringing. Whether gold trades in New York, London, Tokyo or Timbuktu, gold is still gold and so one would expect that it would trade in a similar fashion across these time frames over a long period of time.

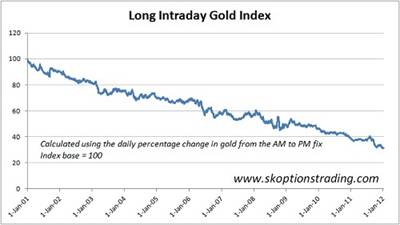

If we take the change in the gold price from the London AM to PM fix (intraday gold) compare it to the change in the gold price from the PM to AM fix (overnight gold), we can see the startling difference between the two periods of trading. We will demonstrate this by showing what would have happened if one had theoretically invested in the intraday gold market from 2001 to present.

Starting in 2001 with an indexed based at 100, the chart below shows what would have happened to that investment of 100 if it had been used to purchase gold at the AM fix and sell gold at the PM fix, replicating the daily percentage performance of gold in the intraday market.

As the chart above shows, the performance is dismal. For example a hypothetical gold investment fund starting with $100m in 2001, and using it to buy gold at the AM fix and sell it at the PM fix would now be left with just $31 million, almost a 70% loss in just under ten years. Over the same time period gold prices have risen over 590%.

From this we can infer that in fact it was possible to make money shorting gold everyday for the last decade or so. If a hedge fund or even an individual trader were to have sold gold at the AM fix and covered that short position at the PM fix, for each day of this terrific bull market run in gold, that fund would have almost tripled their starting capital.

This appears to be a remarkable result, as one would presume that shorting gold everyday during a period where the yellow metal has risen 590% would have devastated any portfolio, not caused a 178.7% increase. Those who do not believe in theories of gold price suppression, often cite the fact that gold prices are at an all time high as a major piece of evidence to discredit any suggestions of price suppression. After all how can the price be being suppressed if prices are sky rocketing?

Well the answer to that question is that if the gold traders at the large banks accused of such manipulation are just trading during the intraday market between the AM to PM fix, they may not be too concerned about how gold trades overnight (provided they are not holding positions overnight of course). What matters is how gold trades during this intraday period, and if more often than not gold is falling during this time, and more often than not the banks are short gold during this period, then they are making money regardless of the overnight price action.

It would appear that subtle manipulation is more likely that blatant price suppression.

So the question on the mind of many gold bulls might be; how do I remove this downward manipulation during the intraday period? Even if I do not believe in manipulation, suppression or any other conspiracy theories, how do I eliminate this statistical fact that gold is under-performing during the intraday period?

The answer is to buy gold at the PM fix and sell it the following day at the AM fix, or more simply put, just be long gold overnight.

The graph above shows how rewarding this strategy would have been, with a return of 1797% in eleven years, a return 3.2 times greater than the 590% that would have been made simply buying gold in 2001 holding until now. With many investors and traders looking for the best way to lever their gold returns, from pouring over drill results to identify the best gold stocks to experimenting with leveraged gold ETFs and ETNs, a more simple solution could be simply to only have long exposure to gold overnight.

For the more cavalier traders, going long gold overnight and then short gold for the intraday period, makes for an even more profitable strategy.

Consider a hedge fund starting in 2001 with $100m, with the strategy of being long gold from the PM to AM fix, and short gold from the AM to PM fix. That hedge fund would be worth $5.26billion today, before any fees and expenses. This should be enough to catch any investor’s attention. Even without shorting gold during the intraday period, limiting exposure to gold to just the overnight period enhances returns enough to justify using this as a basis for a trading strategy.

As stated at the beginning of this article, our focus is not what or who is causing this discrepancy nor any potential motives for such a discrepancy, but what action to take in order to profit from it.

What has surprised us most in our ongoing investigation into this area is that not only is the discrepancy persisting, but it is arguably increasing. When we first wrote about this in August 2010, the annualized return of the Long Overnight/Short Intraday gold index was 37.46% since the start of 2001. However if we measure from now the annualized return since 2001 is 43.24%. the chart below demonstrates this point, with the annualized return of the Long Overnight/Short Intraday gold index standing at roughly 64.4% since 2009.

Another point of interest is when this out-performance is concentrated. The performance around the September 2011 correction is particularly remarkable. Whilst gold prices plummeted, the Long Overnight/Short Intraday gold index increased dramatically, having already been increasing whilst gold rallied over the previous couple of months.

From this we can infer that the majority of gold’s declines in the recent major correction occurred during the intraday trading session, not the overnight trading session.

However in practice we must keep in mind that reversing one’s position each day is not free. One would have to cross the bid/ask spread. Taking a $0.10 spread into account the short intraday and long overnight index would have increased from 100 to 1827.34 since 2001. This increase of 1727.4% outperforms the 593% increase in gold prices over the same period by almost 3 times. If a $0.20 spread is used on a short intraday and long overnight index, there is an increase of 530.4%, which slightly under-performs a buy and hold strategy. Therefore one would need to be able to reverse one’s position at the AM and PM fix for $0.10 spread for the strategy to work in practice.

Nonetheless we still think that this is an important discrepancy that should be taken into account when trading gold. Even if one does not explicitly execute this exact trading strategy, one can still benefit from the trading patterns it is based on. For example if one was nervous about a correction in gold prices but did not want to be short gold, it would perhaps be preferable to close any long position prior to the intraday trading period and reopen them after the PM fix.

In addition to incorporating these patterns into our trading strategy at SK Options Trading, we are also looking into the feasibility of launching some form of investment fund to take advantage of the opportunities discussed in this article. As part of this feasibility study we are looking to gauge investor interest and so would welcome any comments, suggestions or ideas that people may wish to contribute, simply email info@skoptionstrading.com.

Regarding www.skoptionstrading.com. We currently have a number of open trades at the moment however, we do not update the charts until the trade is closed and the cash is back in our account.

Also many thanks to those of you who have already joined us and for the very kind words that you sent us regarding the service so far, we hope that we can continue to put a smile on your faces.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 2007

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.