Silver Bearish or Bullish Contrary Unfolding Technical Pictures

Commodities / Gold and Silver 2012 Jan 16, 2012 - 11:34 AM GMTBy: Clive_Maund

The diminution in silver's downside momentum and the massive contradiction between our earlier bearish interpretation of the charts, and the strongly bullish COTs and sentiment indicators forces us today to reconsider the charts and ponder other possibilities, for we cannot afford to be on the wrong side of the trade in this commodity. Fortunately we are still ahead of the curve as silver has yet to "tip its hand", but it doesn't look like it will be long now before it does.

The diminution in silver's downside momentum and the massive contradiction between our earlier bearish interpretation of the charts, and the strongly bullish COTs and sentiment indicators forces us today to reconsider the charts and ponder other possibilities, for we cannot afford to be on the wrong side of the trade in this commodity. Fortunately we are still ahead of the curve as silver has yet to "tip its hand", but it doesn't look like it will be long now before it does.

So today we are going to consider two wildly different scenarios, the bearish one detailed in the last update, which may yet come to pass if deflation gains the upper hand, and the bullish one which will take hold if Europe is saved shortly and we get back to "business as usual", i.e. building the debt and derivative mountains to ever greater heights. Right now everything is hanging in the balance - it could tip either way, but as we will shortly see it would appear that Smart Money is betting on the return to business as usual, and as they make money, by definition, we are perfectly happy doing what they do, if we can figure it out, that is.

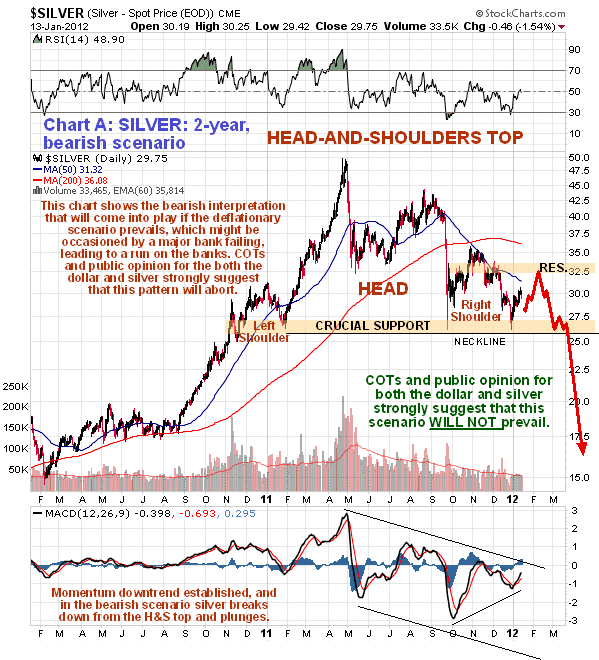

The reason that we were wary, and are still mindful of the position of the exits, is that a large potential Head-and-Shoulders top pattern has formed in silver, as we can see on our 2-year "Scenario 1" chart for silver, which is much the same as the one shown in the last update. The support shown at the bottom of this pattern is clearly of massive importance with the price staging major reversals 3 times at it, so failure of this support, which would signify a breakdown from the H&S top, would be a very bearish development that could be expected to lead to a severe drop. If this scenario eventuates it would signify the onset of a deflationary downwave, such as would be precipitated by the failure of one or more major banks in Europe, leading to a chain reaction and a run on the banks. This is possible, but as mentioned above, it does not appear to be what Big Money is betting on. From a practical standpoint the one key conclusion that we should draw from this chart is that all long positions in silver should be closed out, or at least hedged, in the event of a break below the neckline support of the H&S pattern.

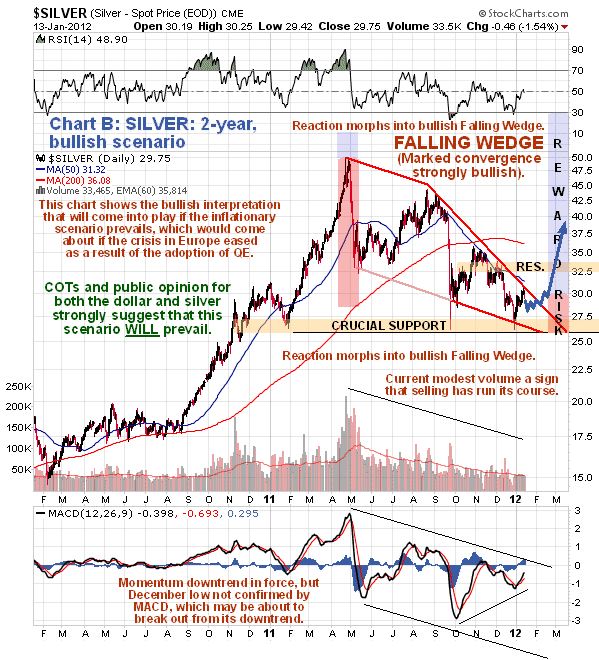

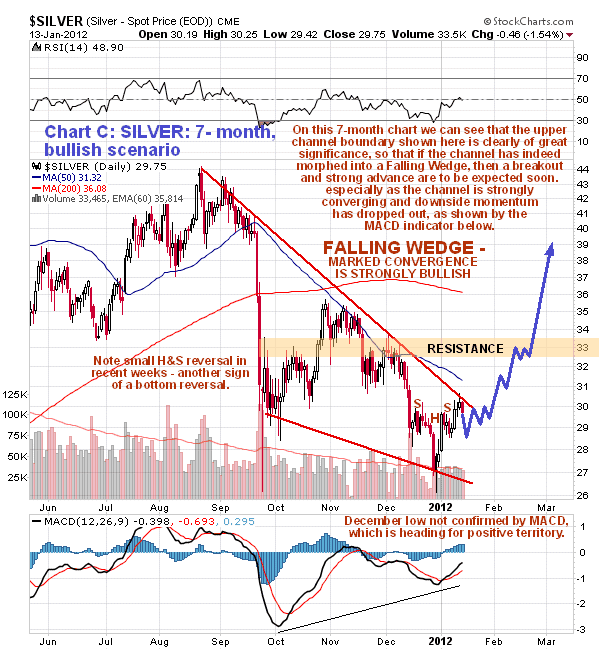

We have until now concentrated on this Head-and-Shoulders thesis and not really considered the possibility that the entire reaction from the April high, which was a downtrend bounded by parallel trend boundaries, is quietly morphing into a strongly bullish Falling Wedge, as shown on our 2-year "Scenario 2" chart below. This became more apparent just last Thursday when the upper boundary of this proposed Wedge shaped channel forced the price to reverse yet again, giving added validity to the steeper downtrend line in force from September. Additional bullish factors associated with this Wedge are the fact that it is fast closing up just above the zone of strong support, plus the fact that volume has died back to a low level compared to most of last year, as remaining fed up silver investors fold their tent and call it a day. This is the stuff of which great rallies are born, particularly when it coincides with very low levels of bullish sentiment and COTs showing record bullish readings.

What is wonderful about the current setup is that it is not necessary to know for sure, or almost sure, what silver's next big move will be, to turn this situation massively to your advantage, because of the current highly advantageous risk/reward setup for traders going long silver here. We know that if silver breaks down below the critical support level shown it's curtains - it will likely plunge, so we also know to get out (or hedge) if that happens and position stops accordingly - not too close though to avoid Big Money shaking you out in an organized raid. On the other hand, after its long and brutal decline from its highs of last April, silver is washed out and oversold, with public interest in it now at a low ebb - sentiment is close to rock bottom and the COT structure is at its most positive for silver pretty much since records began, so if ever there was a time to stick your neck out, this is it. Here's the clincher - because silver is so close to crucial support you can "back up the truck" here knowing that you can get out for a relatively small loss if if it moves against you and breaks down, triggering nearby protective stops.

So by buying here, or soon if it reacts somewhat next week as looks likely, you can position yourself for a potentially humongous uptrend, knowing that you are out for a small loss if it doesn't work. The cherry on the cake will be if we see a minor reaction over the next week or two back towards the support, that would optimize the risk/reward. We should however be careful of trying to cut it too fine, as it would be an awful shame to miss a massive uptrend all because of trying to buy 30 cents cheaper. The way to handle this is to angle for the short-term reaction, but be ready to chase after it in 10 league boots if it instead breaks out above the upper trendline, which is likely to lead to a powerful rally. Whatever, do not forget the stop beneath the support. As with gold, an actual stop level is not given here to avoid Big Money getting hold of the info and running you out of your positions "for a bit of sport" with an intraday plunge that later reverses.

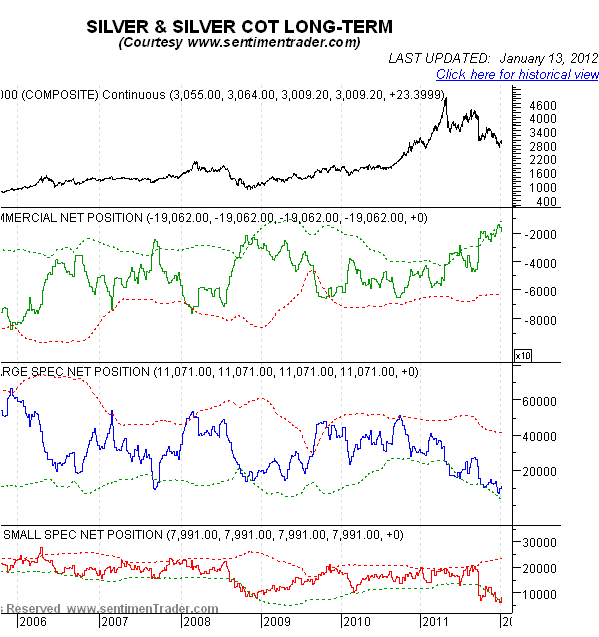

The latest long-term COT chart, courtesy of www.sentimentrader.com, shows that the Commercials' net position is at it most bullish ever. Within this, however, there was a marked increase in their short positions as of last Tuesday, which is a reason why we are expecting a short-term reaction. Large and Small specs have largely lost interest in silver, which is of course very bullish.

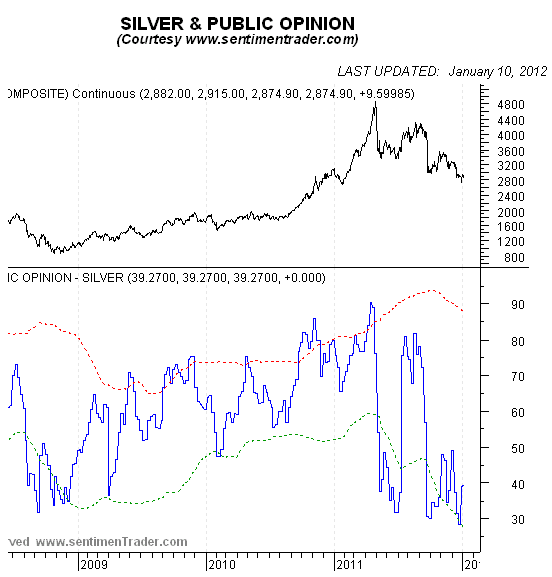

The chart showing public opinion on silver was at its most negative ever about a week ago - even worse than in the darkest days of 2008 - although it recovered somewhat this past week. This is also clearly very bullish, as the last thing you want to see is public enthusiasm for something you are buying - you want that when you come to sell it.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.