Morphic Fields and Stock Market Cycles

Stock-Markets / Cycles Analysis Jan 17, 2012 - 02:20 AM GMT Dan Brown popularized the Institute of Noetic Sciences (IONS) in the novel The Lost Symbol. IONS is in fact a real research organization. The mission of IONS includes the rather unique goal of supporting individual and collective transformation through consciousness research, with an end toward maximizing human potential. Granted, this is a rather lofty and somewhat subjective sounding agenda and you are likely skeptical of the application of research going on at IONS to the real world.

Dan Brown popularized the Institute of Noetic Sciences (IONS) in the novel The Lost Symbol. IONS is in fact a real research organization. The mission of IONS includes the rather unique goal of supporting individual and collective transformation through consciousness research, with an end toward maximizing human potential. Granted, this is a rather lofty and somewhat subjective sounding agenda and you are likely skeptical of the application of research going on at IONS to the real world.

However, before you dismiss IONS' mission as too nebulous and esoteric to apply to real life, you should be aware that some of the ideas they espouse might actually have an application to global financial market cycles and are worth considering. Some of the research at IONS may have implications for decision making for investors and traders. In particular, their research in the area of morphic fields may be relevant to identifying and understanding social behavior and the lows and highs of financial market cycles.

The idea of morphic fields is largely the product of the research of Rupert Sheldrake, a Cambridge trained Ph.D. biochemist that has discovered self-organizing properties in the field of biochemistry that coordinate, organize and provide the constituent parts to a biochemical process or system. He calls these self-organizing properties morphic fields. These fields are present at each level up the food chain so to speak at the level of cells, tissues, organs and organisms.

After recognizing that morphic fields shape development of organisms, Sheldrake makes a quantum leap and suggests that morphic fields may govern the self-organizing properties of social groups. Sheldrake proposes that at each level a morphic field essentially provides for the instructions for the development and characteristics of a new level or "whole" in a system. What he has concluded is that this morphic field process works all the way up to the level of society, cultures and therefore invariably the structure of the constituent parts of a civilization.

Regarding quantum leaps, in his article entitled Fields of Form, Sheldrake notes that a few physicists are intrigued with the possible connection between morphic fields and quantum fields, including John Bell and David Bohm. Quantum physicists Amit Goswami and Han-Peter Durr have also explored the connections between quantum fields and morphic fields. In the future, connections between quantum fields and morphic fields may be established, but remains unclear at present.

Market analyst PQ Wall was ahead of the crowd when he proposed that market cycles are essentially both quantum fields and morphic fields. His proposition remains to be fully confirmed, but the prospects for this perspective providing clues as to where markets are headed next are promising to date.

Investors and traders will recognize that global market cycles exhibit self-organizing properties and characteristics that may indicate they are exhibiting morphic field activity. The concept of morphic fields directing the development of self-organizing systems has serious implications for anyone that wants to understand what drives trends in the economy and the flows of funds in global markets, producing bull markets and bear markets in stocks, interest rates and bond prices.

Global financial markets clearly play a role in the self-organizing system known as the global economy. You can view financial markets as a sub-system in the global system of international political economy. They are a rather important sub-system. When they are not operating effectively and efficiently, or when fiscal and monetary intervention short-circuits and distorts their self-organizing properties, it can produce major problems and dislocations for society. Civilization itself can even be destabilized. If the feedback loops and messaging signals the system depends on for stability are not reliable, the system can break down.

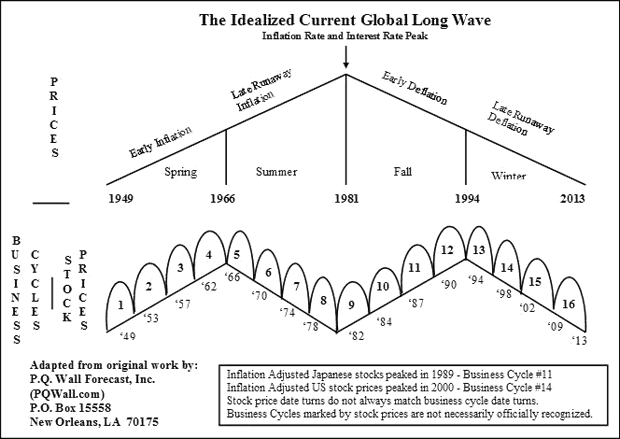

Russian economist Nikolai Kondratieff may have discovered, when he saw a clear pattern in interest rates, prices and production in market economies, is a self-organizing whole or morphic field in the international system. Kondratieff appears to have discovered the essential cycle produced by morphic fields of human action in the international political economy.

The long wave represents a self-organizing system that is the result of morphic fields in human action. Kondratieff appears to have recognized this when he wrote, "The long wave, if existent at all, are a very important and essential factor in economic development, a factor the effects of which can be found in all the principal fields of social and economic life."

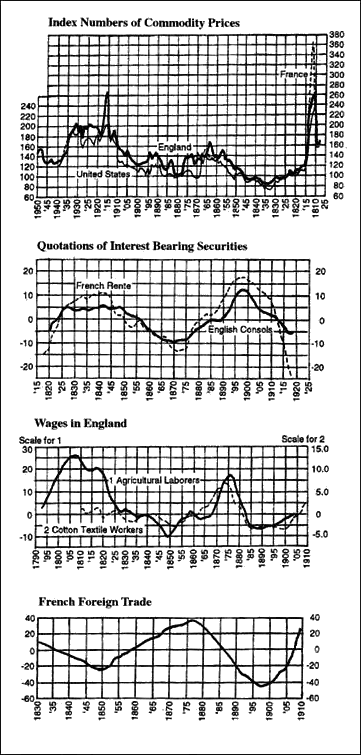

Below are a few of Kondratieff's original research charts. When Kondratieff observed these charts he saw something akin to morphic fields of global economic development in prices, production and interest rates. There are those that think the great cycle or morphic field was a figment of Kondratieff's imagination. Look at Kondratieff's charts. You be the judge. You have powers of observation, reason and deduction. Either the long wave is real or not. If it is real, it does exhibit what appears to be a field of global human activity that by definition involves human consciousness, so maybe IONS is onto something that was first discovered by Kondratieff in economics and markets.

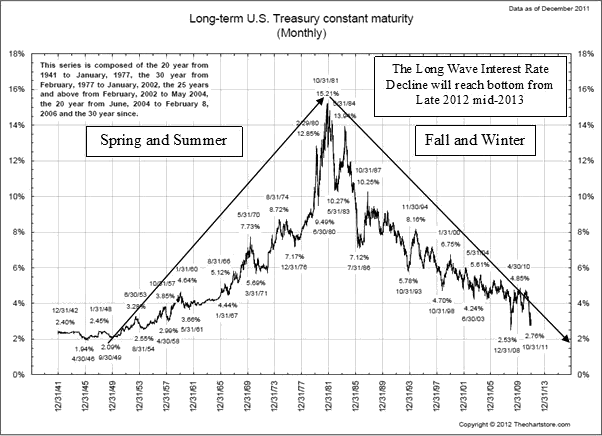

Take a look at the chart below of U.S. interest rates. It sure looks like a repeat from 1949-2012 of the long wave trends in interest rates Kondratieff recognized in his research. It also suggests that the greatest bull market in bond prices may be close to being over sometime from 2012 into 2013.

PQ Wall was a student of Kondratieff long waves and is the first person to apply Sheldrake's work on morphic fields to market cycle analysis. What Wall proposed was that the economic long wave is a whole level in terms of social activity in a morphic field. Far more important for investors and traders, Wall proposed that a long wave is made up of parts, which are in turn lower-level wholes themselves. PQ Wall essentially proposed the basic math of the morphic fields of global financial markets.

The market cycle math is a bit more complex than this, but Wall proposed that if you divide a Kondratieff long wave by 144 it produces the next level of whole in global market activity. These approximate 20-week cycles are the next level of whole below a long wave. In honor of PQ, I rechristened these cycles as Wall cycles in my 1995 book, The K Wave. Wall discovered that a long wave divided by 144 is the next "whole" morphic field that shapes social behavior and therefore is critical to understanding market cycles and their development.

The Wall cycle is made up of constituent parts just like the long wave. Where the long wave has seasons, the Wall cycle has Quarter Wall cycles. The 16 business cycles in the long wave show up as the 8.8-Day cycles in the Wall cycle. What PQ Wall proposed is that the next whole level of morphic field below the global long wave gives the Wall cycle its characteristic properties and coordinates the constituent parts of the cycle. That is why the Wall cycle, just like the long wave, shows up in almost any global market chart. Sometimes they are distorted by fiscal and monetary intervention, but they are always there, lurking right under the surface of human action, morphing from oversold lows to overbought highs and back again, a form of human action and financial market clockwork.

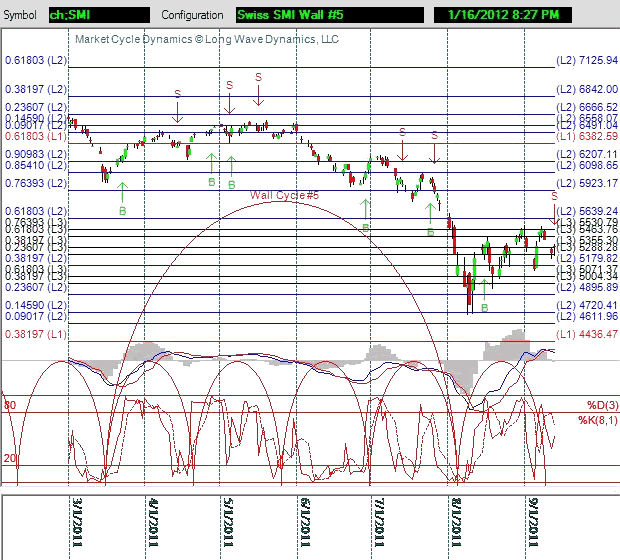

The chart below demonstrates the Swiss Market index in Wall cycle #5 of the current business cycle. The chart used Market Cycle Dynamics software to run an exact ideal 141.9-day Wall cycle from the March 2011 lows and also the Quarter Wall cycles of 35.4-days inside the Wall cycle. The Wall cycle does not always unfold in this close to ideal manner. They sometimes run long or short, but Wall proposed that there are 144 in a global economic long wave cycle. The evidence is mounting that he is correct. A Wall cycle is essentially a miniature long wave and the next level of whole unit in the self-organizing international political economy, and therefore all of human society.

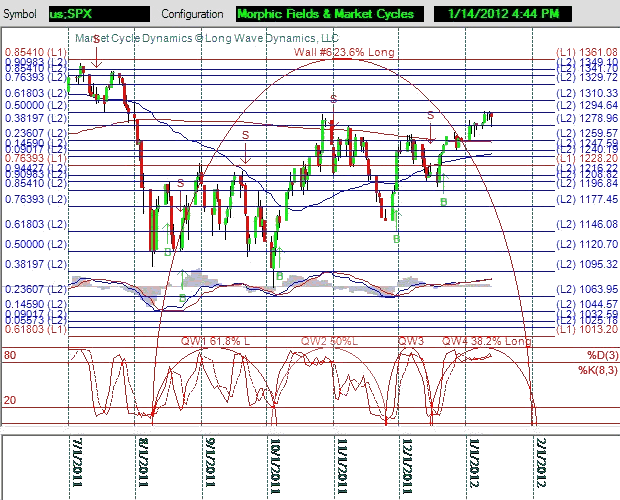

Below is the current Wall cycle chart of the S&P 500. It is demonstrating in price, time and sentiment what appears to be the current next level whole of the 144 morphic fields that make up the current unfolding long wave. Like the Swiss SMI, the S&P 500 Wall cycle low in August was likely the bottom of Wall #5 and the start of Wall #6. The October low is the alternate start date for Wall #6, but the August lows are favorable in many respects. Either way, a Wall #6 cycle low is due shortly. The current Wall cycle is likely running long due to large amounts of deficit fiscal spending and central bank monetary intervention that is attempting to stop the cycles. The intervention only makes the cycles run longer. The morphic fields of market cycles appear to run long and short by degrees of freedom in Fibonacci ratios in time, similar to the forces exhibited by Fibonacci ratios in price action.

It is becoming evident that what happens in Shanghai can have a direct impact on what happens in New York. The threat of a Greek default sends shockwaves through the entire system of the international political economy. When the U.S. Federal Reserve launches QE2 or the ECB injects $645 billion into the financial system, it does have an impact on the cycles, but through all these interventions the self-organizing long wave and its 144 Wall cycles are ebbing and flowing. They may well reflect morphic fields that organize the development of society and produce order out of what often appears to be the chaos of human action.

If the economic long wave is a large morphic field and cycle and very few will ever experience more that one cycle in their lifetime. It can provide some general guidance to investors and traders on the big trends. The Wall cycle on the other hand ebbs and flows with highs and lows several times a year. Each time the Wall cycle hits the cycle lows it provides an opportunity to buy and when it hits a high, it provides an opportunity to sell.

Much remains to be learned about the morphic fields that play a role in guiding and directing the international political economy. If they are guiding the global forces being unleashed in the current Kondratieff long wave winter season, then the crisis now sweeping global markets provides a unique opportunity to study these morphic fields of human action.

Market cycles, from the long wave down to the Wall cycle provide a market cycle driven formula timing plan that identifies opportunities to buy and to sell using price, time and sentiment. Combining Fibonacci in price, market cycles in time, and stochastics for sentiment you can track the morphic field that produce and guide the Wall cycle. The goal at LongWaveDynamics.com is to track the cycles for investors and traders, in order to provide relevant cycle input to help them maximize their potential.

PQ Wall may have been correct, and morphic fields do in fact produce market cycles. The Institute of Noetic Sciences' goal of maximizing our human potential is possible, at least in the area of investing and trading, by applying morphic fields to tracking market cycles. Get prepared, because the current long wave morphic field requires a major global readjustment to correct the cycle excesses in debt, production and prices that is now underway. In addition, the next level of long wave morphic field whole in the current Wall cycle is setting up to deliver an educational fieldtrip for investors and traders.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2012 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.