Global Gold Coin and Bar Demand Surges, Thomson Reuters GFMS Annual Gold Survey

Commodities / Gold and Silver 2012 Jan 17, 2012 - 07:59 AM GMTBy: GoldCore

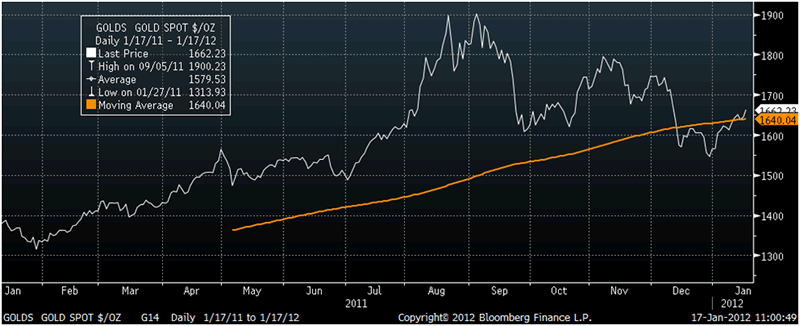

Gold’s London AM fix this morning was USD 1,662.00, GBP 1,080.34, and EUR 1,299.76 per ounce.

Gold’s London AM fix this morning was USD 1,662.00, GBP 1,080.34, and EUR 1,299.76 per ounce.

Yesterday's AM fix was USD 1,642.00, GBP 1,070.27, and EUR 1,281.71 per ounce.

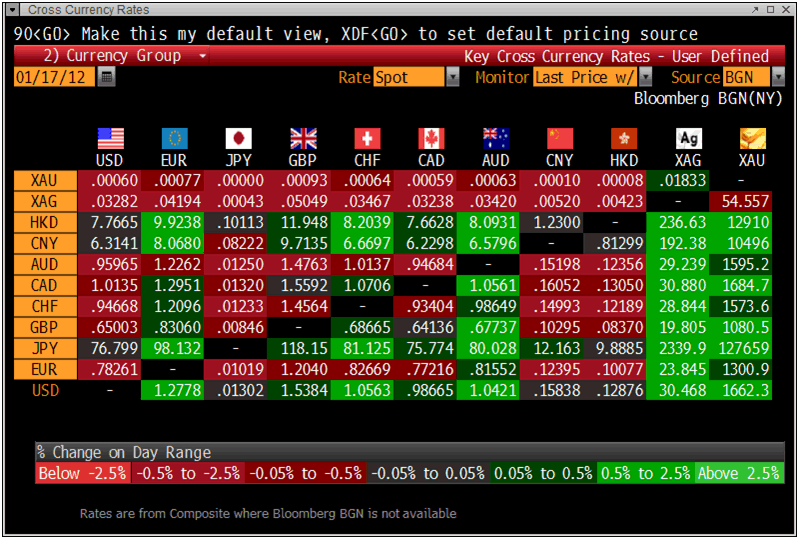

Cross Currency Table – Bloomberg

Spot gold has consolidated gains above the 200 day moving average at $1,640/oz. Gold has climbed 1.5% to a one month high, due to concerns about the Eurozone sovereign debt crisis. Risk appetite has returned lifting markets across the board, after China announced better than expected economic growth in the last quarter of 2011.

Thomson Reuters GFMS annual gold survey released today shows that global investment increased 20% last year to $80 billion, leading to the nominal high last September of $1,920/oz. This is primarily attributed to the physical buying of bullion.

Gold may climb to a new nominal record above $2,000/oz by early next year as concern about currencies and low interest rates encourage investors to seek a protection of wealth, Thomson Reuters GFMS said.

Gold Spot $/oz - Daily 1/17/11-1/17/12 - Bloomberg

Gold coin purchases gained 13% last year and will increase 2.7% in the first half.

Purchases of gold bars increased by 36% to nearly 2,000 (1,194) metric tonnes, concentrated in China, Germany, Switzerland and Austria.

East Asia demand for gold bars rose 53% to 456 metric tonnes.

India rose 9% to 297 metric tonnes and western markets demand for gold bars rose 41% to 335 metric tonnes.

Central banks increased net purchases by a massive fivefold to 430 tons last year, and may buy another 190 tons in the first half, GFMS said.

Combined official holdings stand at 30,788.9 tons, data from the London-based World Gold Council show.

“Attitudes among central banks haven’t really changed,” Thomson Reuters GFMS annual survey said. “There’s still that desire to come into the gold market to diversify some of the assets away from foreign exchange and to boost gold holdings.”

The Thomson Reuters GFMS annual gold survey also predicts that gold will struggle in the first half of the year, increasing in the later half towards $2,000.

It also says the gold bull market is losing steam and predicts an end to the run as economies recover next year and interest rates begin to rise.

These are particularly large assumptions which are unlikely to come to pass. Indeed, rising interest rates will likely be bullish for gold and bearish for risk assets as they were in the 1970’s. It is only towards the end of the interest rate tightening cycle when savers are rewarded with positive real interest rates that gold’s bull market may be threatened – as was seen in late 1979 and 1980.

Separately, Pricewaterhouse Coopers surveyed mining companies and found that 80% of executives expect gold to increase this year to $2,000/oz. Central bank purchases have increased in the last few years and are expected to continue.

The Eurozone debt crisis is certain to continue for the foreseeable future – as no political, economic or monetary magic wand will be found to make it end.

The Thomson Reuters GFMS annual gold survey shows how safe haven demand for gold bullion increased again in 2011 confirming gold is still a safe haven in these uncertain and volatile financial times.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.