Gold Rises for Fourth Day - IMF $500 Billion Hopes Create Concerns

Commodities / Gold and Silver 2012 Jan 19, 2012 - 06:46 AM GMTBy: GoldCore

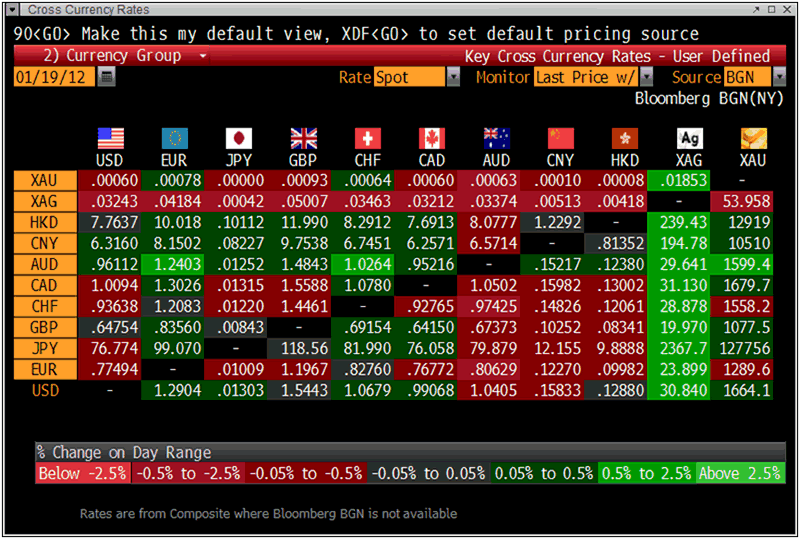

Gold’s London AM fix this morning was USD 1,664.00, GBP 1,076.53, and EUR 1,289.62 per ounce.

Gold’s London AM fix this morning was USD 1,664.00, GBP 1,076.53, and EUR 1,289.62 per ounce.

Yesterday's AM fix was USD 1,657.00, GBP 1,077.09, and EUR 1,290.80 per ounce.

Cross Currency Table - Bloomberg

Spot gold rose on Thursday in Asia and has consolidated on those gains on somewhat subdued trading conditions.

There are hopes that new flows of funding from the International Monetary Fund will help contain the euro zone debt crisis. However, some investors are concerned that the funding is another form of short term debt based panacea and a further currency debasement.

IMF officials from twenty nations are set to hammer out a plan at a meeting in Mexico on Thursday and Friday. Another multibillion or even trillion dollar monetary injection into the global financial system may further boost demand for bullion.

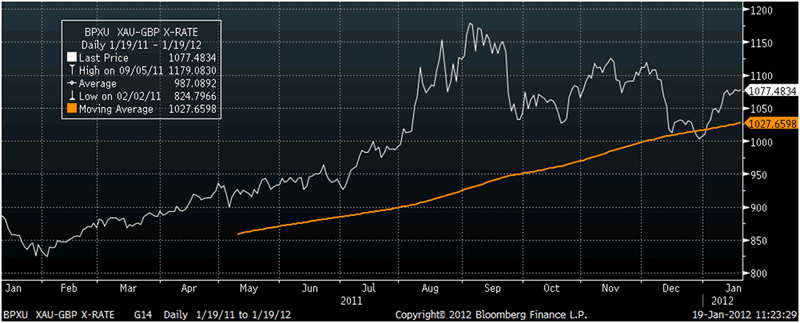

XAU-GBP Exchange Rate - Bloomberg

The duty hike in India has decreased gold prices by 1% in Mumbai as the rupee gained 0.5% against the dollar.

Some jewellers think the recent duty may slow down demand and may result in a decrease in imports from the official channels of about thirty banks. The increased tax may also lead to a tertiary market where people trade amongst themselves and not through dealers.

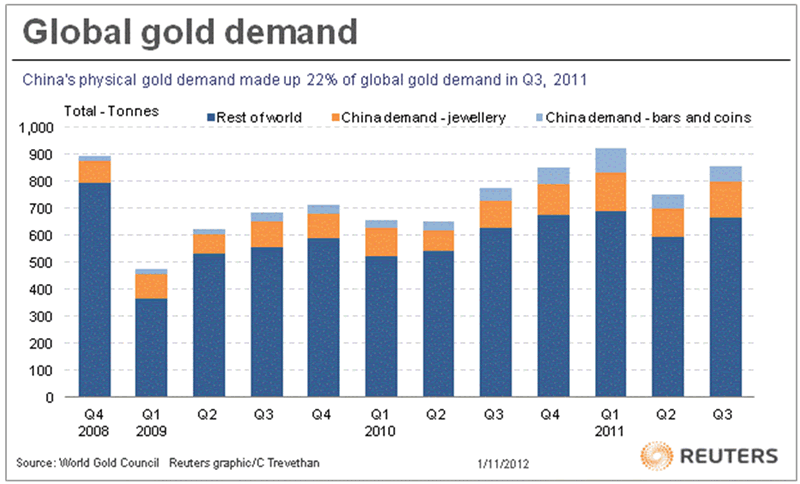

Traders still do not see the hike dampening the demand for the yellow metal. India is the world’s largest importer of gold and its households have the largest holdings of the metal, according to data from the World Gold Council, although Chinese households appear to be catching up in their purchases of gold.

Global Gold Demand by World Gold Council - Reuters

In both China and India, gold is popular for cultural, historical and financial reasons.

Gold is seen as a safe haven that will preserve a family’s wealth over generations. There is more trust in gold bullion than paper assets such bank deposits, stocks and bonds as they have protected Chinese, Indian and people throughout the world from periods of deflation (banks and governments can go bust) stagflation (paper money and bonds lose value), and hyperinflation (paper money and bonds really lose value).

While western countries have not experienced the ravages of high inflation, many African (Zimbabwe recently), Middle Eastern (Iran today) and Asian (Thailand, Vietnam, Indonesia, India and many others) economies have.

It continues to be imprudent to ignore the real risk of today’s inflationary monetary policies by western central banks.

With currency debasement continuing globally, gold remains an essential asset to own

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.