U.S. Housing Market Sales of Existing Homes Slow Growth, Price Declines Moderating

Housing-Market / US Housing Jan 21, 2012 - 12:13 PM GMTBy: Asha_Bangalore

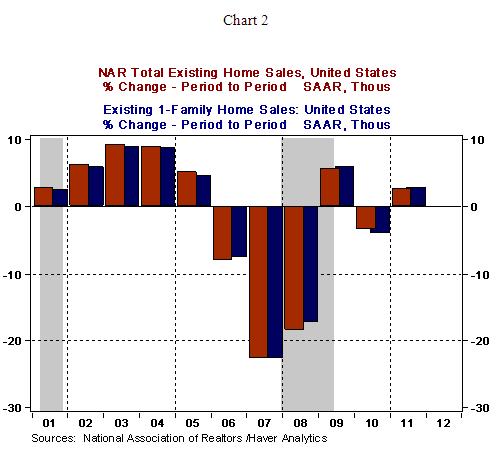

Sales of existing homes rose 4.6% to an annual rate 4.61 million units in December, which takes the annual sales to 4.293 million units. Sales numbers of 2009 and early part of 2010 reflect the impact of the first-time home buyer program. The cycle low for sales of existing homes excluding the swings related to the first-time home buyer program was 3.77 million units for all homes and 3.39 million units for single-family, which occurred in November 2008. With reference to this benchmark, sales of existing single-family homes have moved up 21% in roughly three years.

Sales of existing homes rose 4.6% to an annual rate 4.61 million units in December, which takes the annual sales to 4.293 million units. Sales numbers of 2009 and early part of 2010 reflect the impact of the first-time home buyer program. The cycle low for sales of existing homes excluding the swings related to the first-time home buyer program was 3.77 million units for all homes and 3.39 million units for single-family, which occurred in November 2008. With reference to this benchmark, sales of existing single-family homes have moved up 21% in roughly three years.

The improvement has come entirely in 2011 because the gains and losses of 2009 and 2010 were largely temporary and induced by the first-time home buyer program. Sales of all existing homes moved up 2.5% in 2011 from the prior year, while sales of single-family existing homes advanced 2.7% vs. a 4.1% drop in 2010.

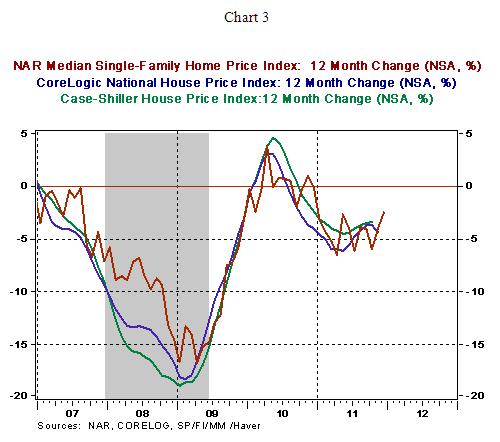

The median price of an existing single-family home rose 2.3% from a month ago to $164,500 in December, while the median price fell 2.5% from a year ago in December. The CoreLogic and Case-Shiller home price indexes (data available for November and October, respectively) and the price numbers from the National Association of Realtors show that home price declines are moderating (see Chart 3).

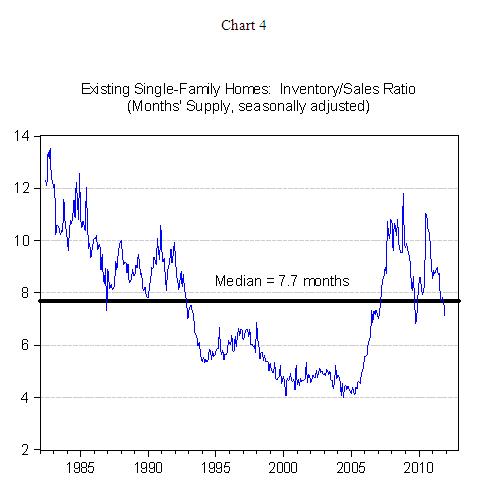

The seasonally adjusted inventory of unsold existing homes dropped to a 7.1-month supply in December from 7.5-month’s supply in the prior month. The supply situation of the last two months is encouraging because it has dropped below the historical median of 7.7 month supply (see Chart 4).

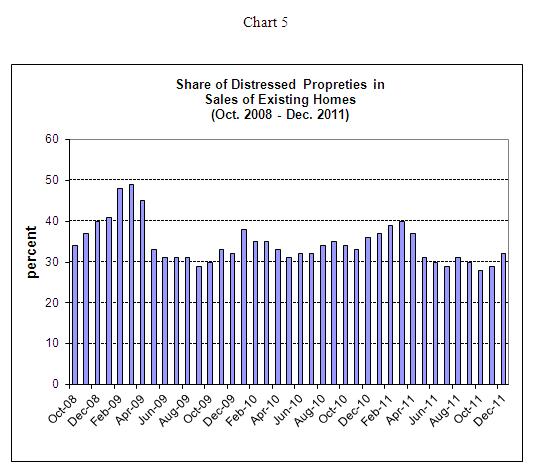

However, the percentage of distressed properties (foreclosures and short sales) made up 32% of total sales, up from 29% in November, is problematic. Distressed properties are persisting at a very high level and the large number of homes with negative equity cast doubt on the duration of the improvement of home prices. Also, the National Association Realtors indicated in today’s report that 33% of realtors indicated contract failures because of declined mortgage applications and failures in loan underwriting stemming from appraised values of homes coming in below the negotiated price. These strong negative undercurrents in the housing market and absence of support from strong labor market conditions will continue to trim home sales in the near term.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.