Are Risk Markets About to Reverse?

Stock-Markets / Financial Markets 2012 Jan 29, 2012 - 03:50 AM GMT A different tone this week, rather than dwell on the US markets as I regularly do, I thought I would expand on some other ideas we are watching that could help decide the US markets direction.

A different tone this week, rather than dwell on the US markets as I regularly do, I thought I would expand on some other ideas we are watching that could help decide the US markets direction.

If you have read my articles for a while you will note I make reference to some forex pairs, which I consider to be vital clues on the direction to where stocks go.

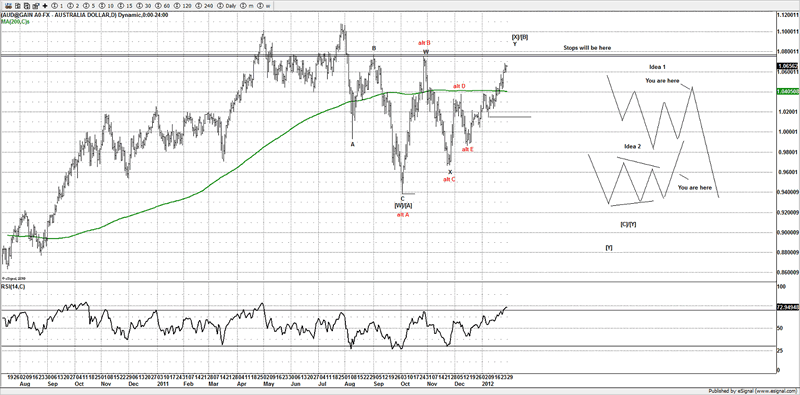

AUD/USD

One such pair is the AUD/USD; I am a fan of watching other markets for clues that are highly correlated with US and European stocks.

The initial idea is still the same as the US markets, as working a wave [X] off the Oct 2011 lows.

Simply put I still consider the move from the Oct 2011 lows in stocks in the US and European markets that of a counter corrective bounce and my idea still is valid to see a retest of those Oct lows again.

By using the AUD/USD pair, I still tend to favor this being a corrective bounce and one that I think will put in a lower high, as we are coming into some target areas of interest.

The objective from here is simple, find a high around 1.0760-1.0800 and reverse, I suspect that if that were to be the case we would see a risk "off" type move and see US and European stocks move lower.

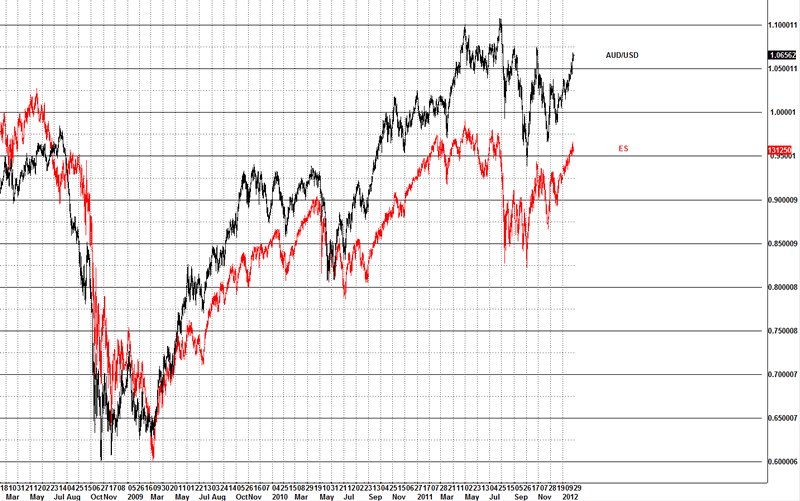

You can see how tightly correlated the SPX (ES is the SPX futures) is to the AUD/USD pair, so we think watching this pair going into next week, could provide us with an edge.

If the alternative idea and that of a triangle thrust is setting up, then I suspect that US stocks will be on their way to push above their 2011 highs, as the AUD/USD is a good proxy for risk appetite, but if there is a bull trap setting up and my original idea of a [X] wave actually does work out, there could be a very aggressive reversal a few days away.

So the 1.0760-1.0800 area on AUD/USD we suspect could be a very key focal area for many markets, especially the ones that are correlated with risk appetite.

The idea is still to find a high up here and reverse aggressively, although the SPX has pushed above my initial target, looking at some other markets, I am going to hold on a little more as US stocks have not exactly been aggressive, and there are some other clues.

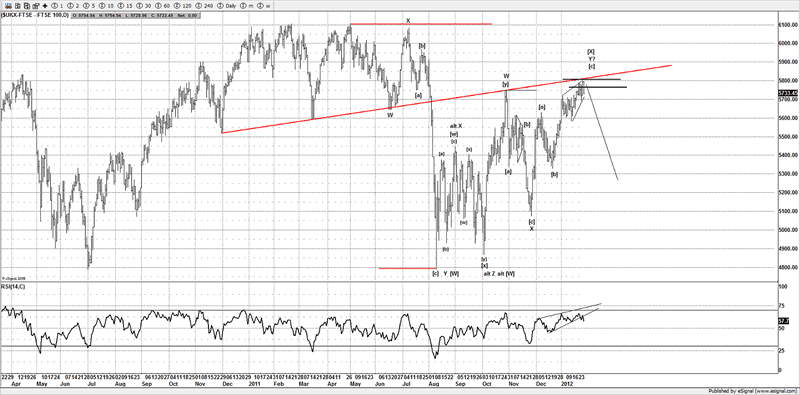

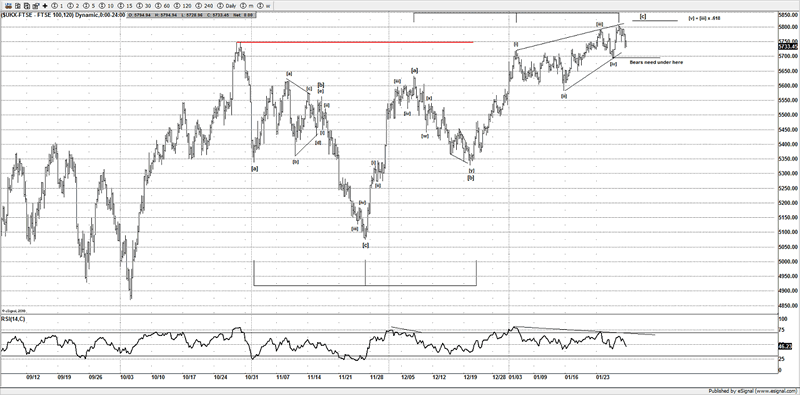

FTSE

Another market that closely tracks the AUD/USD is the FTSE, due to many mining stocks in the FTSE.

So I think it's a good idea to watch the AUD/USD pair as a risk on/off barometer.

Is this market ready to roll over here?

All of all the markets in the US and Europe, I like this setup the best, I think it aligns with most other risk asset markets, and has a clean idea.

Risk is contained to 5900 (that's where the pattern, idea is wrong).

Although so far there is a Fibonacci timing, that has hit the top on this last wave labeled [v] on the ending diagonal (ED).

There is a target of 5820 outstanding should a brief new high be needed. Is the next stop 4800?

Most causal traders will note the bearish formation what is referred to as a bearish wedge, we Elliotticians call it an ending diagonal (ED).

Simply put the idea is that both the AUD/USD and FTSE are setting up for a strong reversal to the downside, that's the currently idea I still like, although it's not as clean as I would have liked to have seen on the US markets, when you look at some other risk asset markets that move in sync with the US markets, I still do think they offer vital clues.

If we are wrong here, we find out shortly and need to revert to an alternative idea, currently I still using the same ideas I have been expecting from the past 6 week, although the markets is really doing its best to swing most traders on side of the trade.

I suspect most will not be expecting a reversal here.

The reward is exceptional, compared to the risk involved.

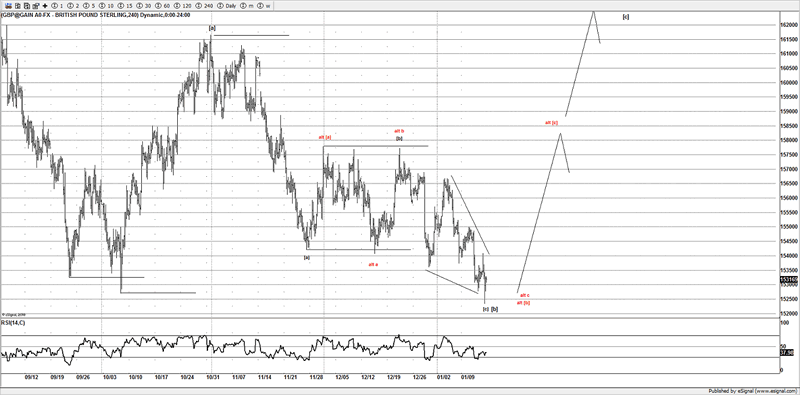

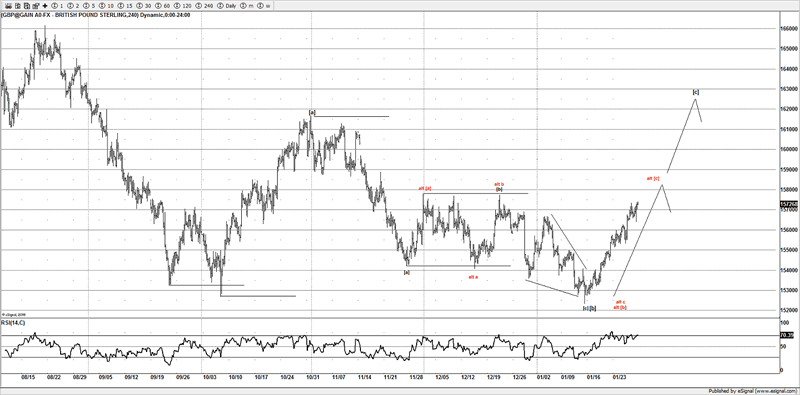

GBP/USD

Talking about most won't be expecting it. Here is an example that I have been following.

Back in the middle of January I posted this to members.

"You can even label it as an ED and about to reverse strongly back above 15350 and onwards to 158+ both these ideas suggests a rally setting up, but a strong move back above 15350 is the 1st step.

Both ideas are suggesting this is a b wave, it's met the criteria for a b wave, as its testing the previous lows, so it will need to see an aggressive reversal."

I was expecting an aggressive rally higher due the conditions and the structure was suggesting it to be the case.

Fast forward to today.

Not many see it coming till it's too late.

We think the GBP/USD pair is setting up for a great reversal and could be a 200-300 pips decline at least or possibly more.

The point I want to make, is that we can all follow a trend and become part of the herd at potential highs or lows, or you can decide if you want to try and capture substantial moves before they happen not after.

So the case of the risk markets still stands, if the idea I have been working pays off, we suspect a great reversal and one that I think will take many off guard.

Now it would be pretty silly of me to suggest that it will happen, as that is not that way the markets work, we like to find low risk setups for high maximum gains.

The 3 markets above offer such setups that we want to participate in, into next week

Are you ready to actually trade setups that make sense? Or continue to get chopped up by this market?

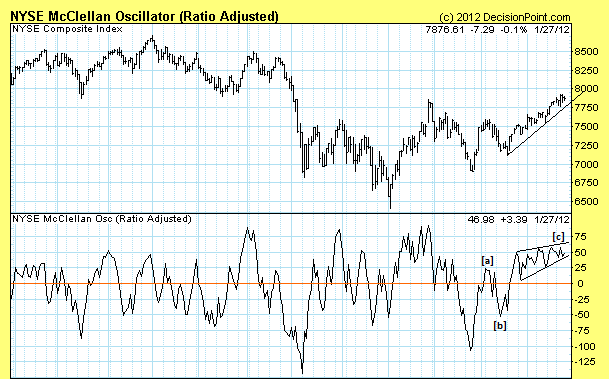

NYME McClellan Osc

The NYSE McOsc has started to really show some negative divergences and I suspect a precursor to the idea that we are looking for, with less and less stocks participating with this current rally, it appears to be the big weighted stocks such as AAPL and IBM that are dragging the markets higher.

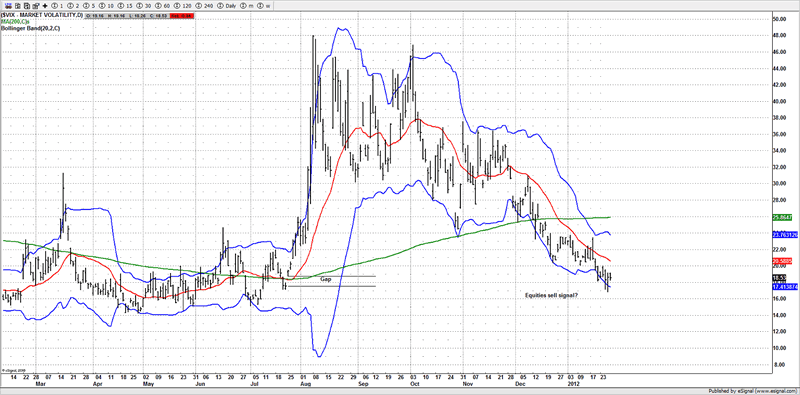

VIX

I am not exactly a fan of using the VIX, although it does have its uses at times, but like all indicators I only use them for back up on my original price action ideas.

For those that have been around the markets a while, probably are aware of the Bollinger band setup.

Simply put once price moves outside the BB then reverts back in, it's either an equities sell or buy trigger, in this case a sell signal.

Over the years it's actually proved to be a very reliable signal for stocks. It's not 100% nothing ever is, but it's got some factual evidence, and we potentially issued an equities sell signal this week just gone.

Conclusion

Not a lot really changed from last week, although the SPX has pushed a bit higher than my original 1300-1320SPX target, but we are closely following some ideas in other risk correlated markets to try and help with our current ideas

Should the markets go on another strong push higher, that will damage our ideas and likely damage the bear case as the highs of 2011 would be threatened, but as we do often, we are willing to buy a low when most are too scared to buy it, as well as look for a high when so many are convinced it will never stop.

As with all ideas there is an element of risk involved, but as long as we control the risk I am sure we will come out laughing last.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2012 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.